Pernod Ricard (ENXTPA:RI): Assessing Value After Recent Underperformance

Reviewed by Simply Wall St

Pernod Ricard (ENXTPA:RI): Is The Market Missing Something?

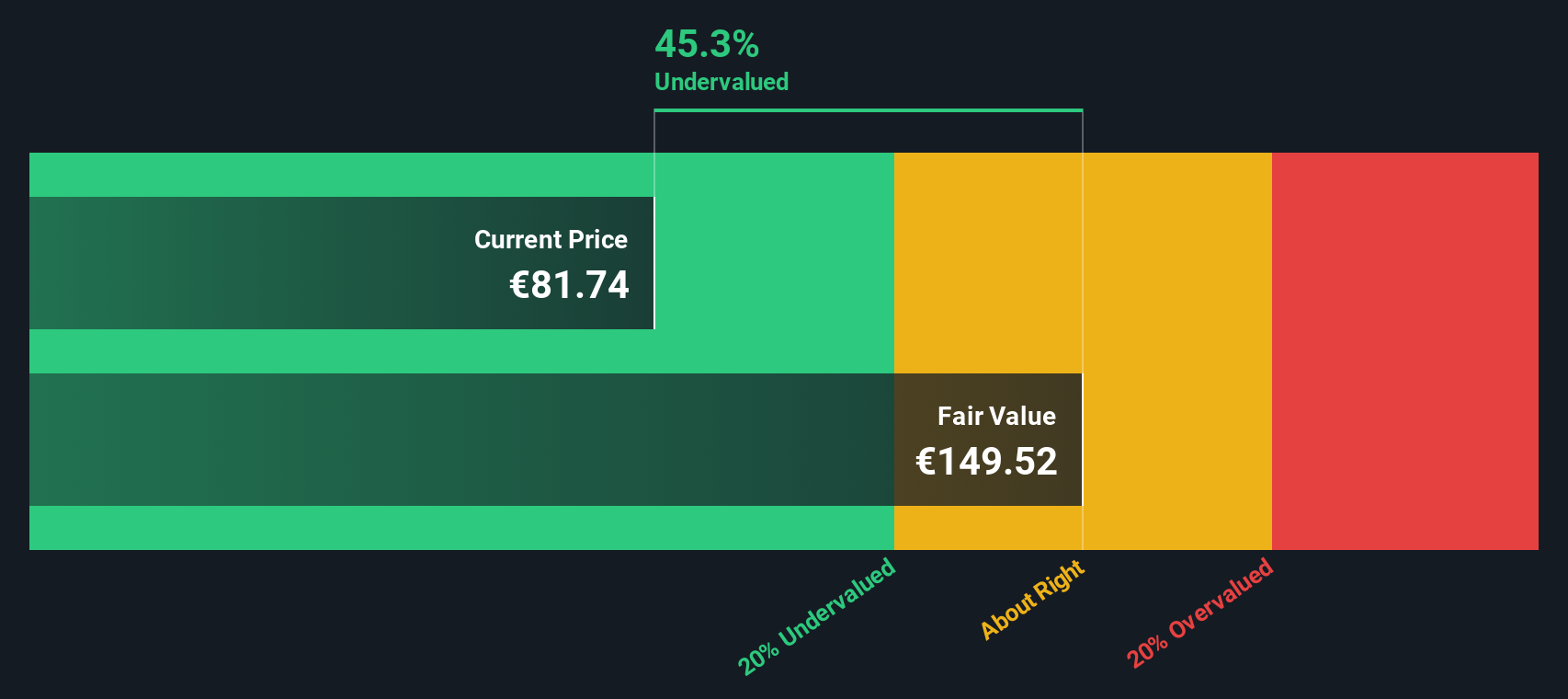

Pernod Ricard (ENXTPA:RI) shares have lagged this year, closing at €95.08 most recently, even as the company posted modest annual revenue and net income growth. That might leave investors wondering whether the current share price is reflecting temporary setbacks or signaling deeper concerns for the spirits giant. When a household name in global beverages drifts lower, it can ignite lively debate among market watchers who are looking for stability or hidden value.

Throughout the past year, Pernod Ricard stock has struggled and underperformed with a nearly 20% drop. Short-term moves have been mixed, with a slight decline over the past month but a 4% gain in the past three months. While sales and earnings have inched upward, the broader momentum remains weak compared to prior years. Investors are still digesting the impacts of recent business trends amid evolving global consumer demand for premium spirits.

With the stock’s sell-off and muted growth, is Pernod Ricard a value play waiting to be discovered, or is the market simply pricing in a slower road ahead?

Most Popular Narrative: 13.9% Undervalued

According to the most widely followed narrative, Pernod Ricard shares are currently trading below their estimated fair value, suggesting the market may be overly pessimistic about future prospects.

A new phase of operational efficiency is underway, with a targeted €1 billion in further cost savings by 2029 and an already completed €900 million program. This is expected to support ongoing organic margin expansion and improved free cash flow conversion (targeting approximately 80 percent), enhancing earnings resilience despite short-term headwinds.

What is really behind this undervalued rating? The narrative leans heavily on upgraded profitability, cost-efficiency, and financial discipline. These fundamentals could set the stage for a valuation reset. There is one pivotal financial projection that holds everything together. Curious what that is? The full narrative reveals the figure driving these expectations.

Result: Fair Value of €110.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key markets like the U.S. or escalating regulatory action could easily challenge this optimistic outlook and stall Pernod Ricard’s rebound.

Find out about the key risks to this Pernod Ricard narrative.Another View: DCF Model Check

While analyst price targets suggest Pernod Ricard shares are undervalued, our SWS DCF model tells a similar story by using future cash flows to estimate value. But does relying on long-term forecasts tell the whole truth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pernod Ricard for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pernod Ricard Narrative

If you have a different take or want to dig into the data yourself, it only takes a few minutes to craft your own narrative and conclusions. Do it your way.

A great starting point for your Pernod Ricard research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your portfolio miss out on the strongest opportunities this year. Expand your horizons and catch trends before the crowd with our handpicked stock ideas below.

- Boost your search for income potential by scanning high-yield opportunities among dividend stocks with yields over 3% through dividend stocks with yields > 3%.

- Seize tomorrow’s tech wave by targeting leaders at the forefront of artificial intelligence advancements with AI penny stocks.

- Find value gems that the market has overlooked and put your money behind stocks trading below their cash flow potential with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:RI

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives