Danone (ENXTPA:BN) Valuation: Assessing Fair Value After Recent Share Price Gains

Reviewed by Simply Wall St

Danone (ENXTPA:BN) shares have edged up around 1% in the past day, building on a nearly 8% rise over the past month. Investors appear to be weighing steady gains against broader sector trends, with recent price action reflecting a calm and measured outlook.

See our latest analysis for Danone.

After a simmering stretch, Danone's recent share price gains are adding to a strong year-to-date run, with momentum now picking up pace. The stock has notched a 21% share price return since January, and its one-year total shareholder return stands even taller at nearly 23%, hinting that investors are reassessing growth prospects and risk appetite as confidence builds in the company’s direction.

If Danone’s steady advance has you watching the broader market, this could be the right moment to discover fast growing stocks with high insider ownership.

With Danone’s strong run leaving shares near their analyst price targets, the question now is whether the market is underestimating future potential or if expectations are fully reflected in today’s price, leaving little room for upside.

Most Popular Narrative: Fairly Valued

With Danone’s shares closing at €78.20 and the narrative fair value pegged at €76.88, the market price now closely mirrors the consensus analyst outlook. This alignment highlights the company's latest performance and the major themes influencing sentiment.

Strategic investments and recent acquisitions (Kate Farms, The Akkermansia Company) strengthen Danone's leadership in plant-based, gut health, and medical nutrition. These moves reinforce differentiation and support both premiumization (higher revenue per unit sold) and improved long-term margin potential.

How do bold bets on specialty nutrition and global expansion fuel this price target? Find out which surprising financial expectations and future profit multiples underpin the narrative’s “fairly valued” stance. The numbers behind this calculation may challenge what you thought you knew about Danone’s growth runway.

Result: Fair Value of €76.88 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing struggles in U.S. dairy and potential integration challenges from recent acquisitions could quickly temper current optimism if progress stalls.

Find out about the key risks to this Danone narrative.

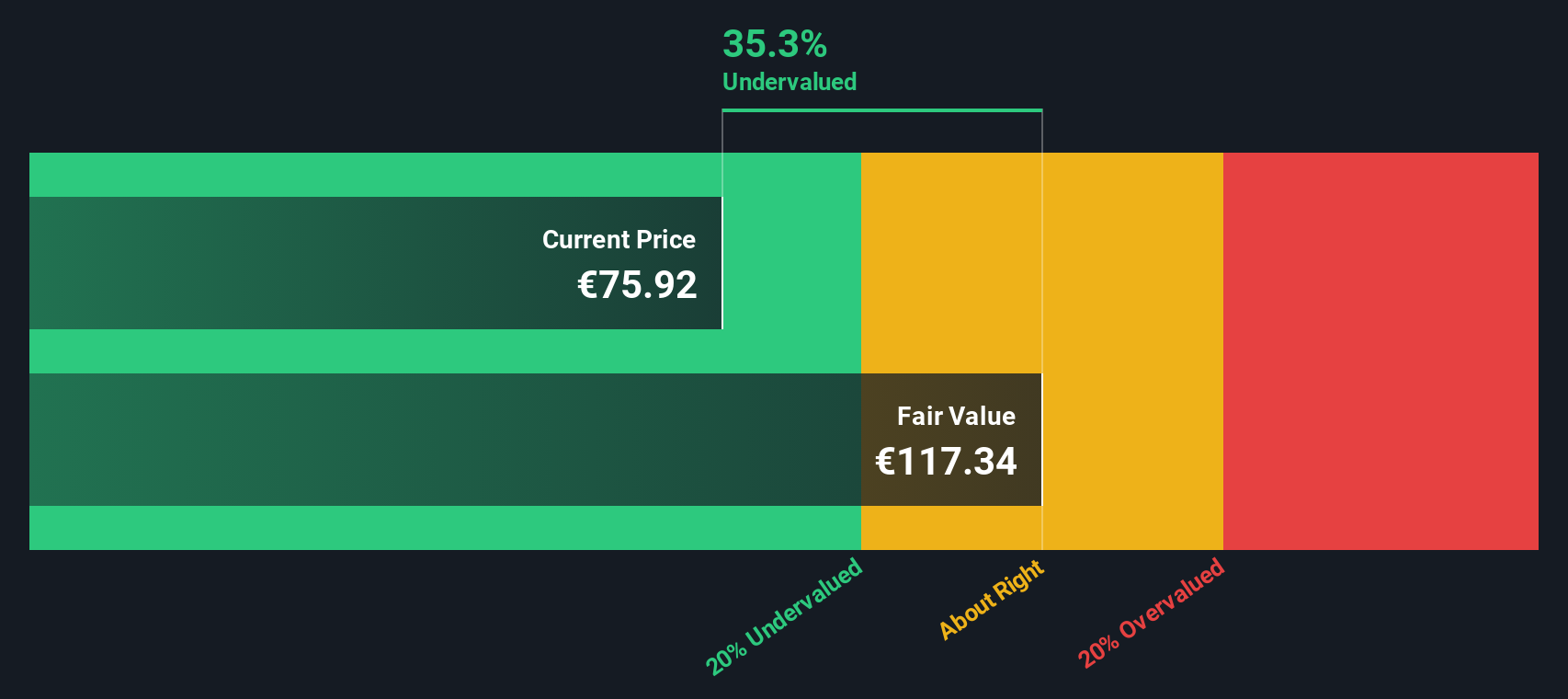

Another View: Discounted Cash Flow Estimate

Looking at Danone through the lens of the SWS DCF model, the picture is quite different. The model values the company at €121.59 per share, which is far above its current price. This suggests the market might be overlooking the potential for long-term cash flow growth. Does this signal a hidden opportunity, or is the DCF being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Danone for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Danone Narrative

If you see the story differently, or want to reach your own conclusions, you can chart your own narrative in just a few minutes by using Do it your way.

A great starting point for your Danone research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always one step ahead, so now is the time to check out other opportunities built around future trends and untapped market potential. Don’t miss your chance to act before the crowd.

- Unlock consistent income streams when you scan these 16 dividend stocks with yields > 3%, offering reliable yields above 3% for your portfolio.

- Seize early-mover advantages with these 24 AI penny stocks, powering the next generation of artificial intelligence breakthroughs.

- Ride market shifts by targeting these 870 undervalued stocks based on cash flows, which are primed for growth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BN

Danone

Operates in the food and beverage industry in Europe, Ukraine, North America, China, North Asia, the Oceania, Latin America, rest of Asia, Africa, Turkey, the Middle East, and the Commonwealth of Independent States.

Established dividend payer with proven track record.

Market Insights

Community Narratives