- France

- /

- Energy Services

- /

- ENXTPA:VK

The 7.5% return this week takes Vallourec's (EPA:VK) shareholders three-year gains to 96%

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. For example, the Vallourec S.A. (EPA:VK) share price is up 96% in the last three years, clearly besting the market return of around 4.7% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 15%.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Vallourec

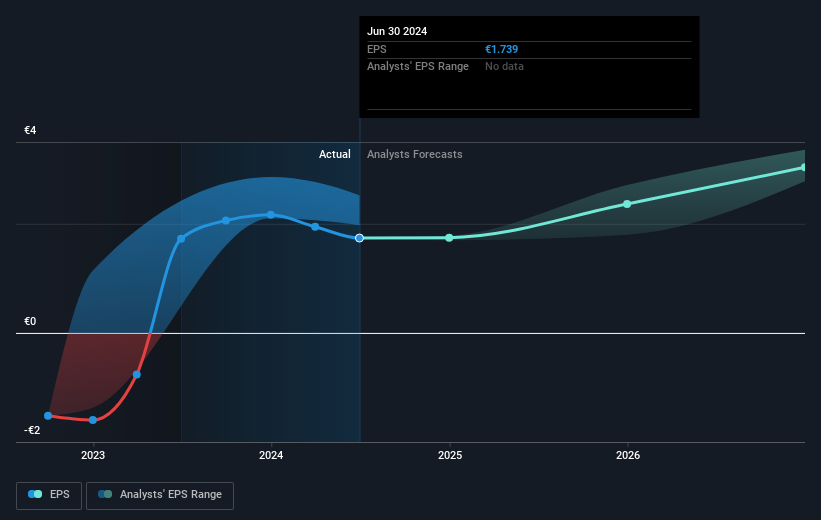

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Vallourec moved from a loss to profitability. So we would expect a higher share price over the period.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Vallourec has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Vallourec stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Vallourec shareholders have received a total shareholder return of 15% over the last year. That certainly beats the loss of about 10% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Before forming an opinion on Vallourec you might want to consider these 3 valuation metrics.

Of course Vallourec may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VK

Vallourec

Through its subsidiaries, provides tubular solutions for the oil and gas, industry, and energy markets in Europe, North America, South America, Asia, the Middle East, and internationally.

Very undervalued with flawless balance sheet.