- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

3 Companies On Euronext Paris That May Be Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have buoyed major stock indexes, France's CAC 40 Index has seen modest gains, reflecting a cautiously optimistic outlook in the region. In this environment of potential monetary easing and lower inflation expectations, investors may find opportunities in stocks that are currently priced below their intrinsic value estimates, offering a chance to potentially capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €29.10 | €57.31 | 49.2% |

| Vivendi (ENXTPA:VIV) | €10.48 | €18.02 | 41.9% |

| Lectra (ENXTPA:LSS) | €26.50 | €52.79 | 49.8% |

| EKINOPS (ENXTPA:EKI) | €4.18 | €7.01 | 40.4% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.06 | €5.09 | 39.8% |

| Solutions 30 (ENXTPA:S30) | €1.155 | €2.30 | 49.8% |

| Vogo (ENXTPA:ALVGO) | €3.20 | €6.25 | 48.8% |

| Exail Technologies (ENXTPA:EXA) | €18.08 | €29.96 | 39.7% |

| Prodways Group (ENXTPA:PWG) | €0.52 | €0.8 | 34.8% |

| OVH Groupe (ENXTPA:OVH) | €7.375 | €12.29 | 40% |

Let's review some notable picks from our screened stocks.

Planisware SAS (ENXTPA:PLNW)

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations in Europe, the Americas, the Asia-Pacific, and internationally, and has a market cap of €1.84 billion.

Operations: The company generates its revenue from the Software & Programming segment, amounting to €170.48 million.

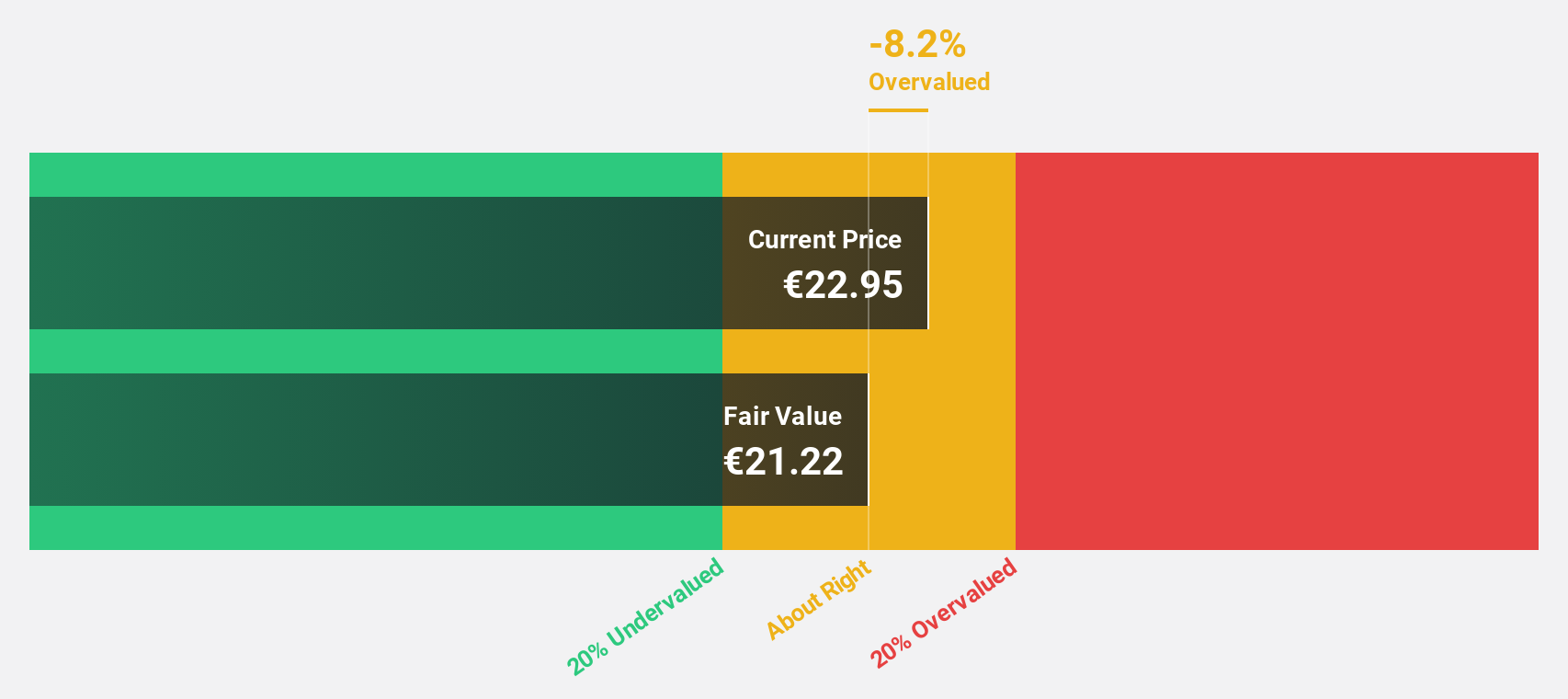

Estimated Discount To Fair Value: 16.1%

Planisware SAS is currently trading 16.1% below its estimated fair value of €31.36, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income to €15.98 million for H1 2024, the company's earnings are forecast to grow at 19.7% annually, outpacing the French market's growth rate of 12.2%. Revenue growth is also strong at an expected 16.5% per year, further supporting its valuation appeal.

- Our earnings growth report unveils the potential for significant increases in Planisware SAS' future results.

- Click to explore a detailed breakdown of our findings in Planisware SAS' balance sheet health report.

Safran (ENXTPA:SAF)

Overview: Safran SA, along with its subsidiaries, operates in the aerospace and defense sectors globally and has a market cap of €89.75 billion.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

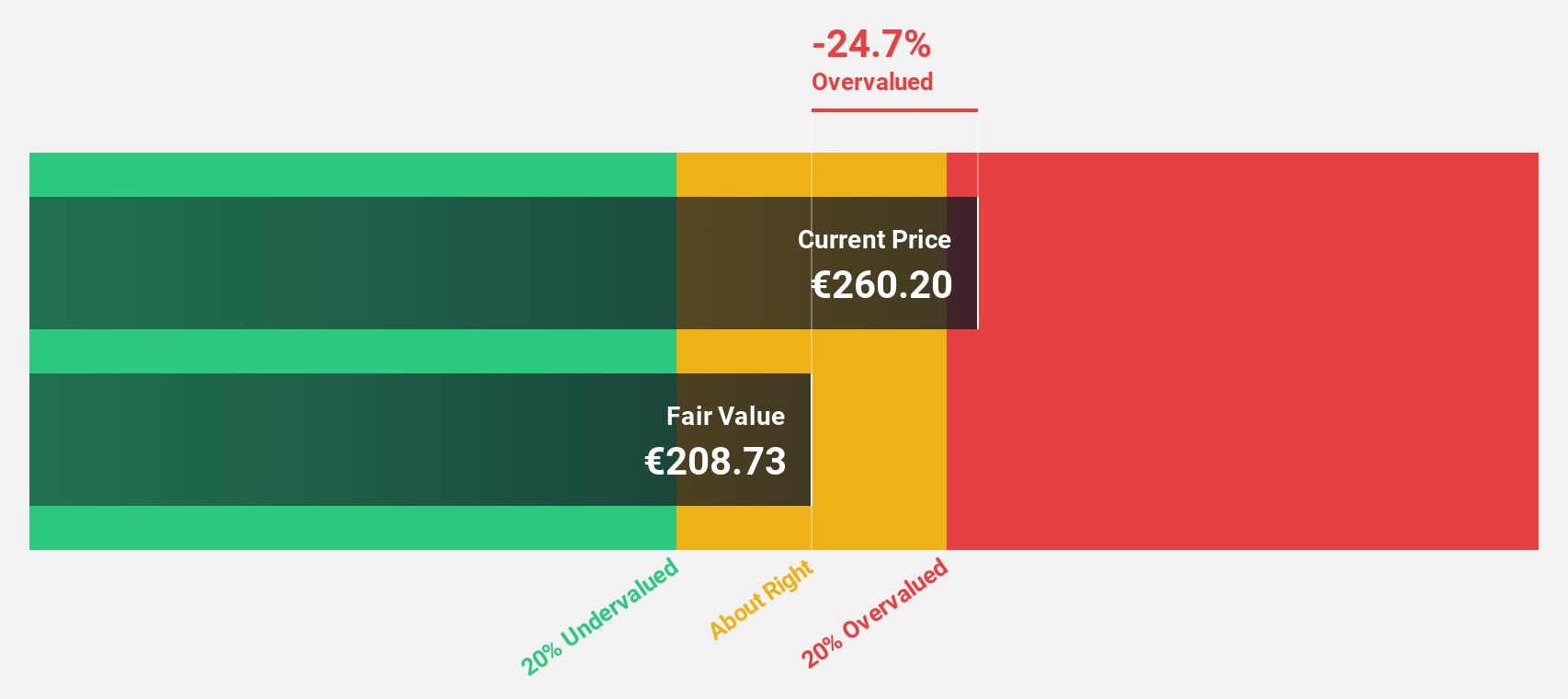

Estimated Discount To Fair Value: 24.6%

Safran is trading 24.6% below its estimated fair value of €283.28, highlighting potential undervaluation based on cash flows. Despite a sharp decline in net income to €57 million for H1 2024, earnings are forecast to grow at 19.5% annually, surpassing the French market's growth rate of 12.2%. While revenue is expected to increase by 10.3% per year, profit margins have decreased significantly from last year’s levels, affecting overall profitability metrics.

- Our comprehensive growth report raises the possibility that Safran is poised for substantial financial growth.

- Navigate through the intricacies of Safran with our comprehensive financial health report here.

Tikehau Capital (ENXTPA:TKO)

Overview: Tikehau Capital is a private equity and venture capital firm offering a comprehensive suite of financing products such as senior secured loans, equity, and mezzanine financing, with a market cap of approximately €3.91 billion.

Operations: The company's revenue is derived from Investment Activities, generating €173.11 million, and Asset Management Activities, contributing €322.94 million.

Estimated Discount To Fair Value: 27.6%

Tikehau Capital is trading 27.6% below its estimated fair value of €31.41, indicating potential undervaluation based on cash flows. Despite a decrease in net income to €57.55 million for H1 2024, earnings are projected to grow significantly at 42.2% annually, outpacing the French market's growth rate of 12.2%. However, the dividend yield of 3.3% is not well covered by free cash flows, and debt coverage by operating cash flow remains weak.

- The growth report we've compiled suggests that Tikehau Capital's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Tikehau Capital.

Make It Happen

- Gain an insight into the universe of 22 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

Excellent balance sheet with reasonable growth potential.