- France

- /

- Capital Markets

- /

- ENXTPA:VIL

Undiscovered Gems In France Top Three Stocks For September 2024

Reviewed by Simply Wall St

In recent weeks, the French market has mirrored global trends with notable declines, as evidenced by the CAC 40 Index dropping 3.65% amid renewed fears about economic growth. Despite this backdrop, opportunities remain for discerning investors to uncover promising small-cap stocks that may offer resilience and potential in a fluctuating market. Identifying a good stock often involves looking at companies with strong fundamentals, innovative business models, and solid management teams—qualities that can help them navigate economic uncertainties and capitalize on future growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.66% | 19.86% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Financière Moncey Société anonyme (ENXTPA:FMONC)

Simply Wall St Value Rating: ★★★★★★

Overview: Financière Moncey Société anonyme operates as a holding company that manages a portfolio of investments in France, with a market cap of €1.53 billion.

Operations: Financière Moncey Société anonyme generates revenue primarily through its portfolio of investments. The company has a market cap of €1.53 billion.

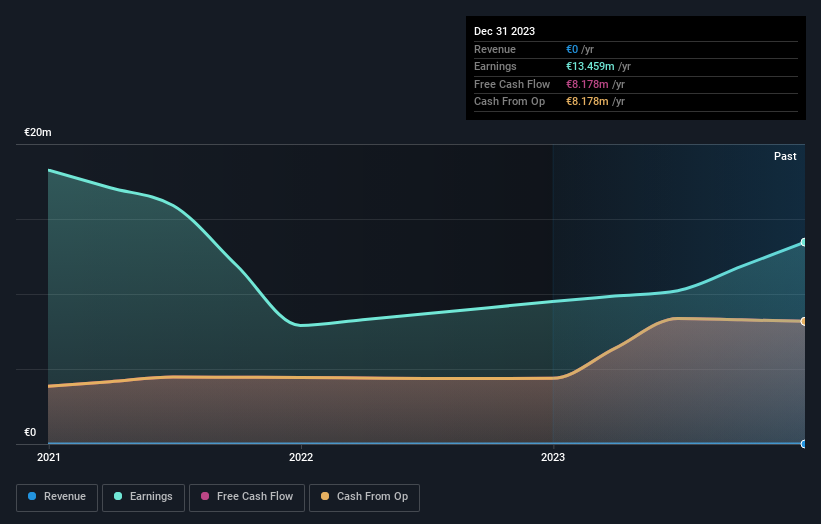

Financière Moncey Société anonyme has shown robust performance with earnings growth of 41.7% over the past year, outpacing the Diversified Financial industry’s -1.4%. The company is debt-free, a significant improvement from five years ago when its debt to equity ratio was 0.02%. Despite generating less than US$1m in revenue (€0), it boasts high-quality earnings and positive free cash flow, making it a compelling prospect among France's undiscovered gems.

NRJ Group (ENXTPA:NRG)

Simply Wall St Value Rating: ★★★★★★

Overview: NRJ Group SA is a private media company that operates as a publisher, producer, and broadcaster in France and internationally with a market cap of €599.07 million.

Operations: The company's primary revenue streams are derived from its Radio segment (€243.01 million), Television segment (€78.63 million), and Circulation segment (€77.62 million).

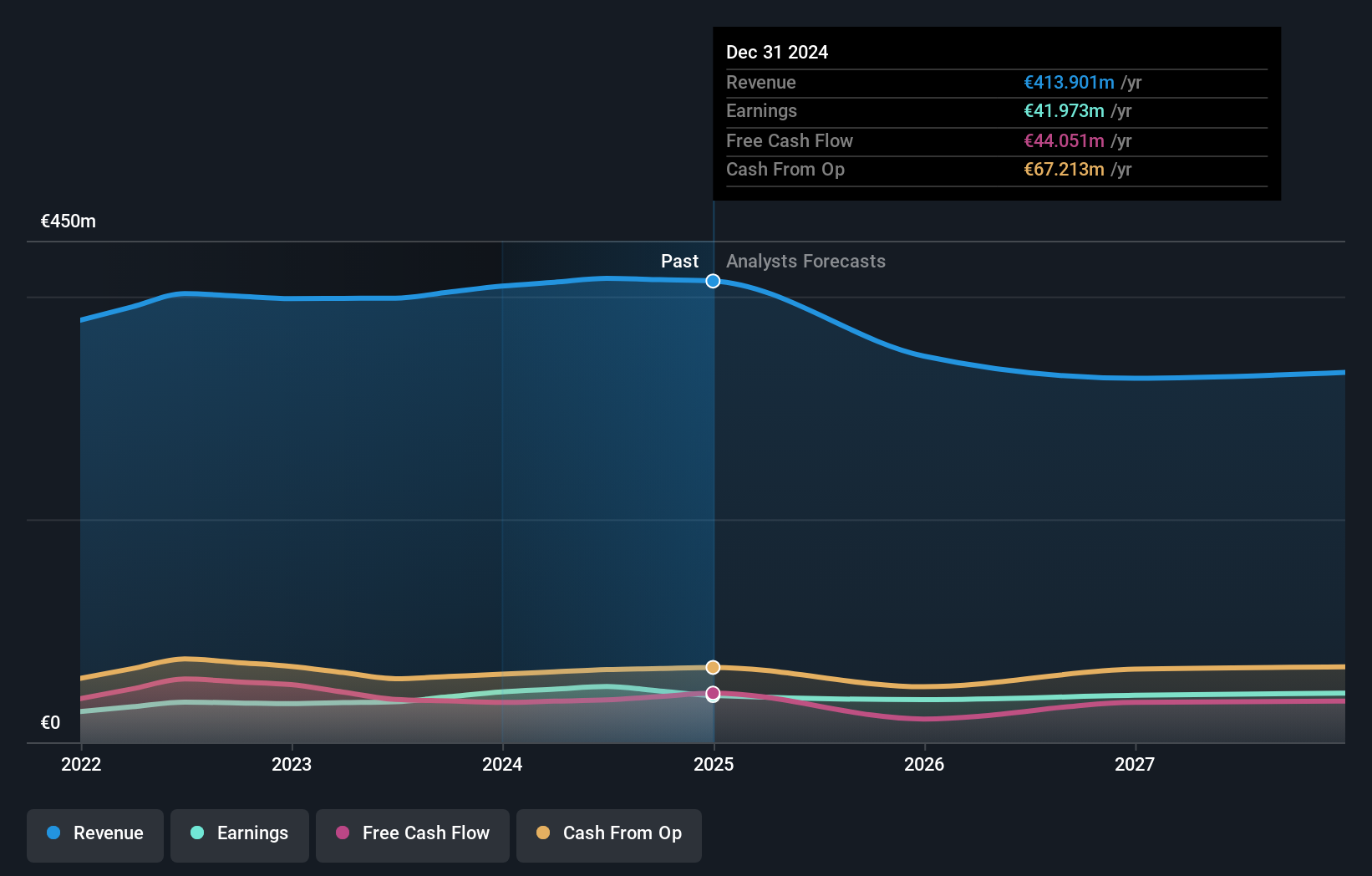

NRJ Group, a smaller player in the French media landscape, has shown impressive performance recently. Earnings grew by 37.2% over the past year, outpacing the industry average of 23.1%. The company reported half-year sales of €199.38 million as of June 2024, up from €192.44 million last year, with net income rising to €20.02 million from €15.2 million previously. Trading at 38% below its estimated fair value and having reduced its debt-to-equity ratio from 3:1 to zero over five years, NRJ appears financially robust and undervalued in the market.

- Navigate through the intricacies of NRJ Group with our comprehensive health report here.

Gain insights into NRJ Group's historical performance by reviewing our past performance report.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market cap of €662.60 million.

Operations: VIEL & Cie, société anonyme generates revenue primarily through interdealer broking, online trading, and private banking services. The company reported a market cap of €662.60 million.

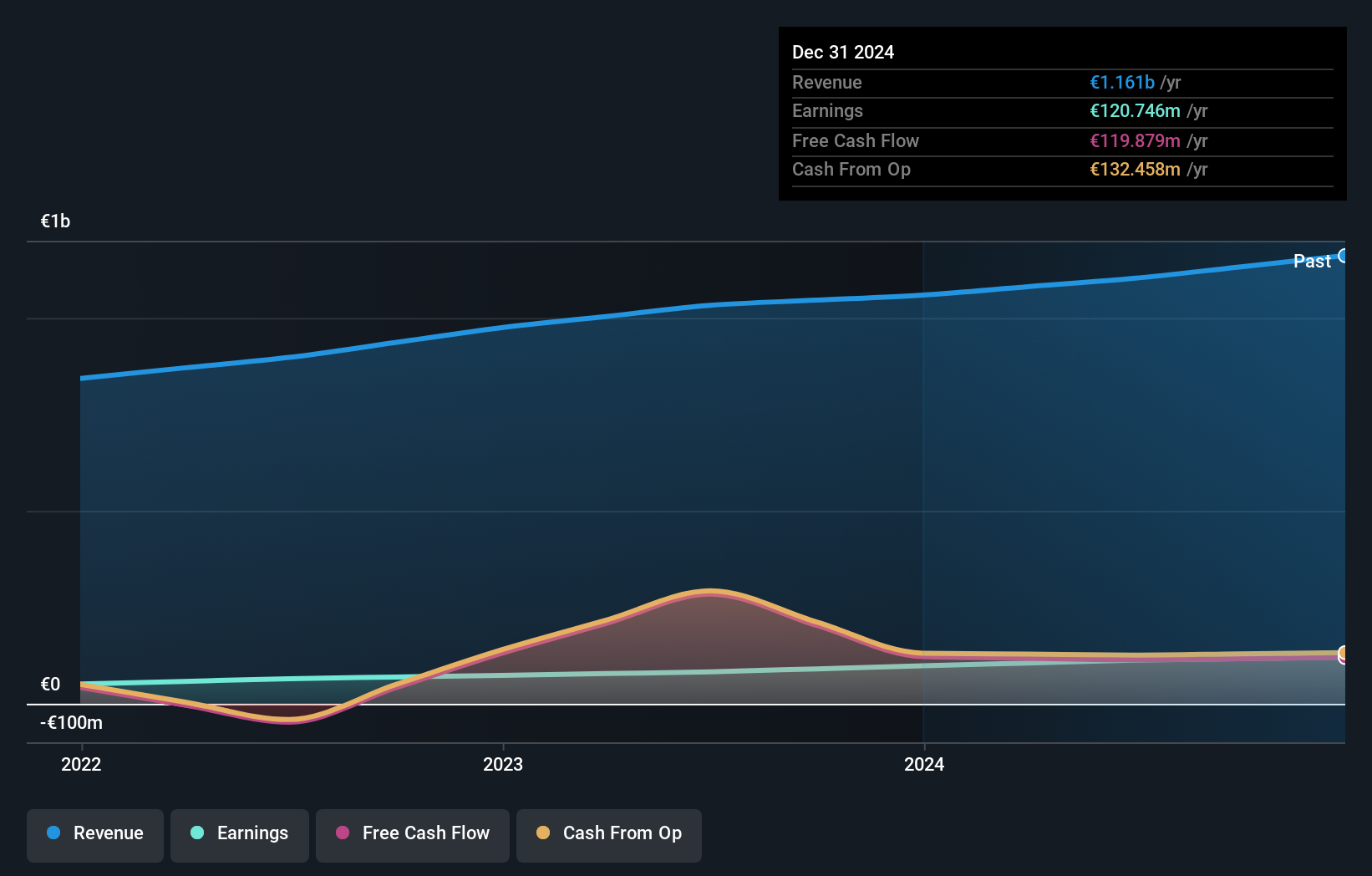

VIEL & Cie, société anonyme reported half-year revenue of €598.8 million, up from €555.8 million last year, with net income rising to €65.4 million from €50.9 million. The company's earnings growth of 36.3% outpaced the Capital Markets industry average of 30.7%. Its debt to equity ratio has improved significantly over five years, dropping from 85.1% to 63.2%. Trading at a substantial discount of 44.6% below estimated fair value, VIEL offers high-quality earnings and positive free cash flow.

Summing It All Up

- Access the full spectrum of 35 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Outstanding track record with excellent balance sheet and pays a dividend.