- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Undiscovered Gems In France To Watch This August 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, the French market has also seen its share of volatility, with the CAC 40 Index dropping 3.54% amid concerns about growth and inflation. Despite these challenges, opportunities still exist for discerning investors, particularly in the realm of small-cap stocks that may be overlooked by broader market movements. In this environment, a good stock often exhibits strong fundamentals and resilience to economic fluctuations—traits that can be especially valuable when navigating uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.60% | 11.16% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Société Industrielle et Financière de l'Artois Société anonyme (ENXTPA:ARTO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Société Industrielle et Financière de l'Artois Société anonyme designs, manufactures, markets, and sells terminals, bollards, access control, and automatic identification systems with a market cap of €1.41 billion.

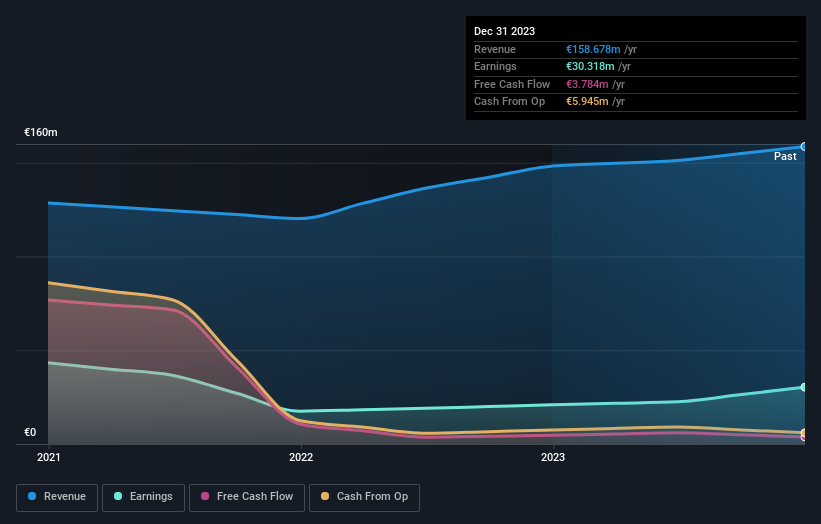

Operations: The company generated €158.68 million in revenue from its industry segment. Its net profit margin stands at 12.5%, reflecting the profitability after accounting for all expenses and taxes.

Société Industrielle et Financière de l'Artois has shown impressive financial health, with earnings growing 8.3% annually over the past five years and a debt-to-equity ratio decreasing from 4.4 to 2.9 in the same period. Despite this, its recent earnings growth of 45.1% did not surpass the tech industry's performance. The company is profitable and free cash flow positive, indicating strong operational efficiency and financial stability amid industry challenges.

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme (ticker: ENXTPA:ELEC) engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €763.54 million.

Operations: The company generates revenue primarily from the production and distribution of electricity and gas (€1.40 billion) and electricity distribution (€288.95 million).

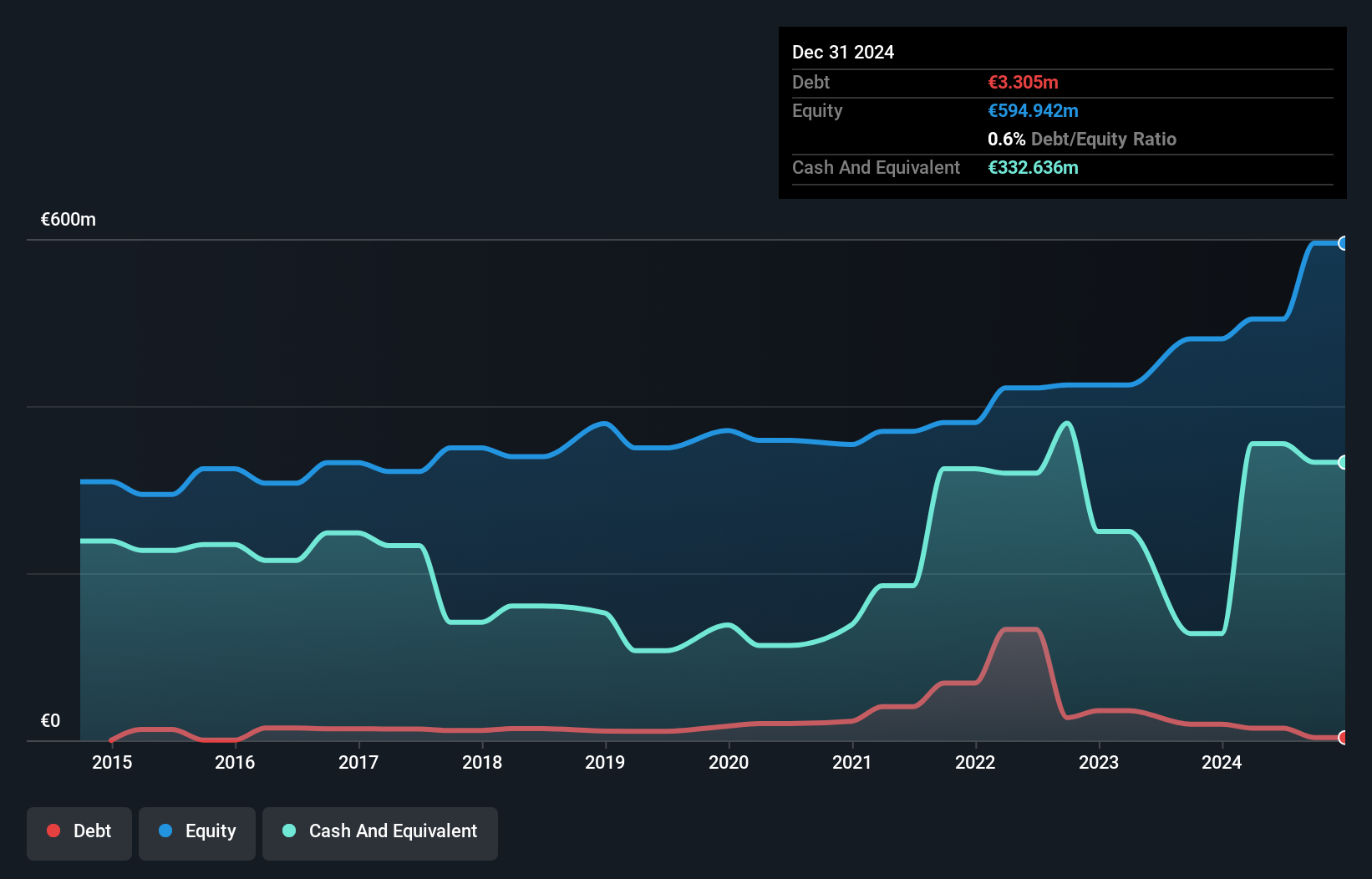

Électricite de Strasbourg Société Anonyme, a small cap in the electric utilities sector, has shown impressive performance with earnings growth of 69.9% over the past year, outpacing the industry average of 7.6%. Trading at 53.2% below its estimated fair value and reducing its debt to equity ratio from 2.9 to 2.2 over five years, it demonstrates strong financial health. Additionally, high levels of non-cash earnings indicate quality past earnings and robust interest coverage ensures financial stability.

Financière Moncey Société anonyme (ENXTPA:FMONC)

Simply Wall St Value Rating: ★★★★★★

Overview: Financière Moncey Société anonyme operates as a holding company managing a portfolio of investments in France, with a market cap of €1.46 billion.

Operations: Financière Moncey Société anonyme generates its revenue through managing a diversified portfolio of investments in France. The company has a market cap of €1.46 billion.

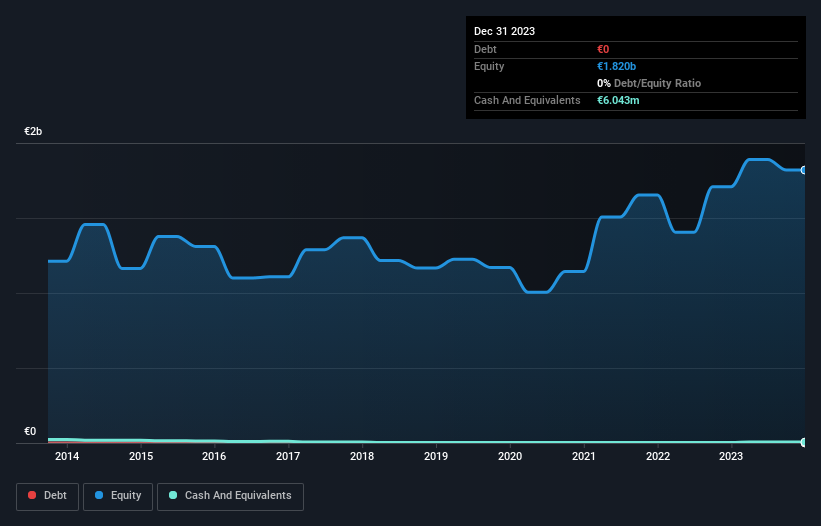

Financière Moncey Société anonyme, a small financial entity in France, has shown impressive earnings growth of 41.7% over the past year, outpacing its industry peers. With no debt on its balance sheet compared to a debt-to-equity ratio of 0.02% five years ago, it stands out for its financial prudence. The company also reported levered free cash flow of US$8.18M as of December 2023 and remains profitable with high-quality earnings despite generating less than US$1M in revenue annually (€0).

Next Steps

- Investigate our full lineup of 34 Euronext Paris Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.