What Do The Returns On Capital At Hermès International Société en commandite par actions (EPA:RMS) Tell Us?

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So while Hermès International Société en commandite par actions (EPA:RMS) has a high ROCE right now, lets see what we can decipher from how returns are changing.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Hermès International Société en commandite par actions is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.22 = €1.7b ÷ (€9.7b - €1.7b) (Based on the trailing twelve months to June 2020).

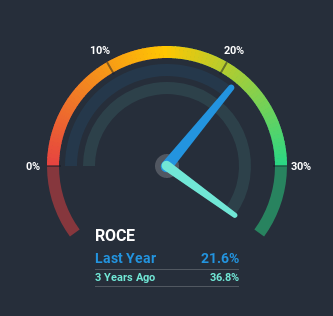

Thus, Hermès International Société en commandite par actions has an ROCE of 22%. In absolute terms that's a great return and it's even better than the Luxury industry average of 12%.

Check out our latest analysis for Hermès International Société en commandite par actions

In the above chart we have measured Hermès International Société en commandite par actions' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Hermès International Société en commandite par actions.

So How Is Hermès International Société en commandite par actions' ROCE Trending?

When we looked at the ROCE trend at Hermès International Société en commandite par actions, we didn't gain much confidence. Historically returns on capital were even higher at 41%, but they have dropped over the last five years. However it looks like Hermès International Société en commandite par actions might be reinvesting for long term growth because while capital employed has increased, the company's sales haven't changed much in the last 12 months. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

In Conclusion...

In summary, Hermès International Société en commandite par actions is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Yet to long term shareholders the stock has gifted them an incredible 196% return in the last five years, so the market appears to be rosy about its future. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you're still interested in Hermès International Société en commandite par actions it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

If you’re looking to trade Hermès International Société en commandite par actions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hermès International Société en commandite par actions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:RMS

Hermès International Société en commandite par actions

Engages in the production, wholesale, and retail of various goods.

Flawless balance sheet with solid track record.