Tarkett (ENXTPA:TKTT): Assessing Valuation Prospects After Strong 59% Year-to-Date Share Price Return

Reviewed by Simply Wall St

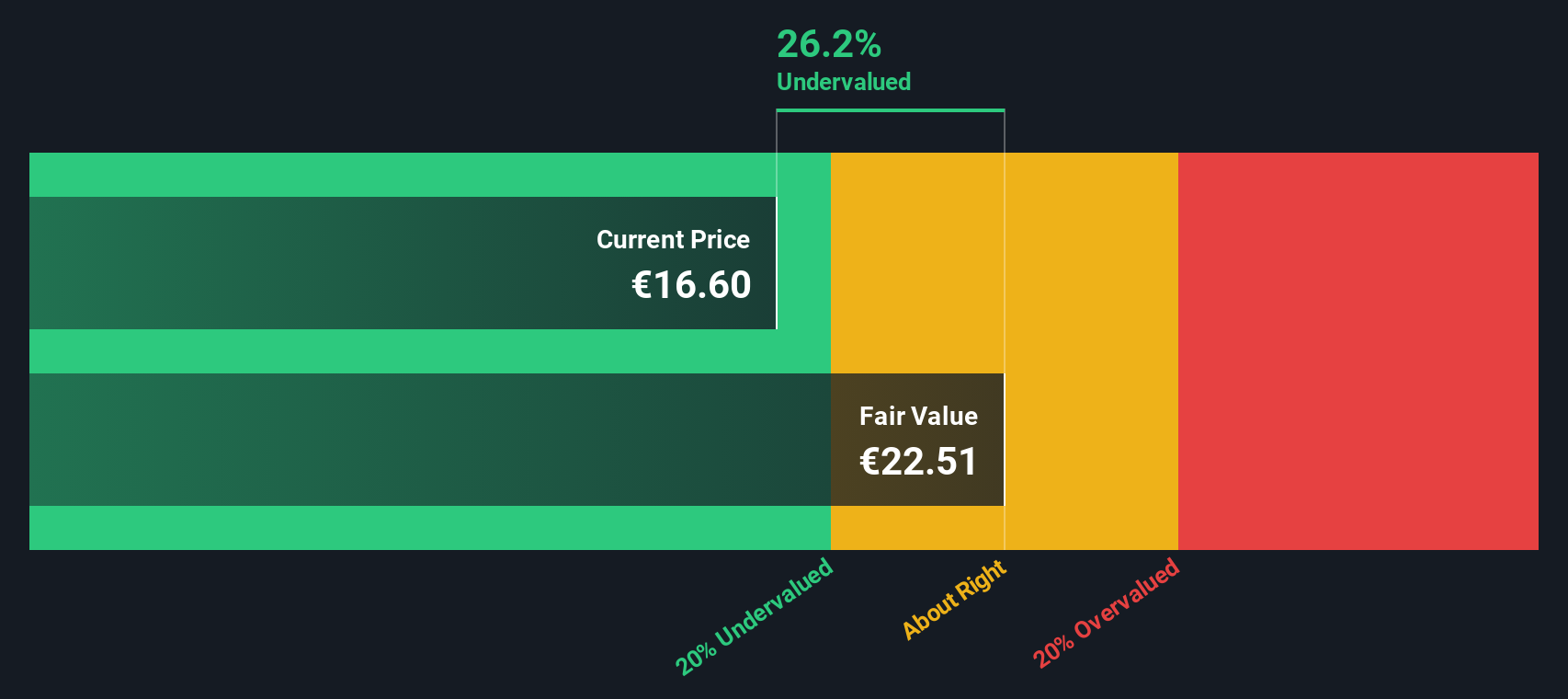

Tarkett (ENXTPA:TKTT) shares have held steady recently, with the price hovering around €16.60. Over the past month, the stock has been flat, while its year-to-date return stands at an impressive 59%.

See our latest analysis for Tarkett.

Tarkett’s year-to-date share price return of nearly 59% signals that momentum is holding strong, even as the stock cools off after a big run. The 53% total return over the past year shows investors who held on have been well rewarded, with the longer-term numbers still trending positively. This suggests that current prices may reflect renewed enthusiasm or a shift in market expectations around Tarkett’s growth potential.

If you’re keeping an eye on which stocks are drawing interest lately, this could be a perfect time to broaden your radar and discover fast growing stocks with high insider ownership

With shares consolidating recent gains, investors might be wondering whether Tarkett’s strong returns are signaling an undervalued opportunity, or if the current price already factors in all future growth potential. Is there more upside to come?

Price-to-Sales of 0.3x: Is it justified?

Tarkett trades at a price-to-sales (P/S) ratio of just 0.3x, well below both its direct peers and the broader European building industry average. At the last close of €16.60, this low multiple implies the market may be discounting Tarkett’s unprofitable status or a lack of future growth expectations. However, the share price performance tells a different story.

The price-to-sales ratio measures how much investors are willing to pay per euro of sales. For companies like Tarkett that are currently unprofitable, P/S becomes especially important because earnings-based multiples are not meaningful. A low P/S can reveal potential undervaluation if the company improves margins or returns to profitability.

Compared to its European industry average P/S of 0.8x and a peer average of 0.5x, Tarkett stands out as a statistical bargain. This gap could close quickly if the company’s financial results improve or investor sentiment shifts. The P/S could move towards more typical sector levels if growth or profitability recovers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 0.3x (UNDERVALUED)

However, Tarkett’s recent unprofitability and the lack of visible revenue growth could challenge continued momentum if fundamentals do not improve soon.

Find out about the key risks to this Tarkett narrative.

Another View: SWS DCF Model Weighs In

While the price-to-sales ratio suggests Tarkett is undervalued, our DCF model estimates the fair value to be €22.10, which is roughly 25% above the current share price. This model considers future cash flows instead of sales multiples. Could the gap signal hidden upside, or does it reflect real business concerns?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tarkett for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tarkett Narrative

If you prefer to dig deeper yourself or see the story differently, you can quickly shape your own narrative and analysis in just a few minutes with Do it your way.

A great starting point for your Tarkett research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step confidently into new opportunities. These handpicked screens will help you spot strong potential before others catch on. Don’t let the next big winner pass you by.

- Unlock the power of high-yielding income streams and see which companies are raising the bar with these 16 dividend stocks with yields > 3%.

- Start building your future on solid ground by targeting value opportunities others might miss with these 870 undervalued stocks based on cash flows.

- Ride the next tech wave and catch early-mover advantages by checking out these 24 AI penny stocks shaping the world of tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tarkett might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:TKTT

Tarkett

Provides flooring and sports surface solutions to businesses and residential end users in Europe, the Middle East, Africa, North America, the Commonwealth of Independent States, the Asia Pacific, and Latin America.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives