- France

- /

- Electrical

- /

- ENXTPA:SU

Schneider Electric (ENXTPA:SU): Evaluating Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Schneider Electric (ENXTPA:SU) has seen some movement recently, catching the attention of investors interested in how its fundamentals stack up amid shifting market sentiment. The stock's performance over the past month offers insights that are worth a closer look.

See our latest analysis for Schneider Electric.

After a brief run-up earlier this year, Schneider Electric’s share price has come under pressure in recent weeks, dipping 6.2% over the last 7 days and down nearly 6% for the month. While momentum has softened in the short term, the three-year total shareholder return of over 71% highlights what steady compounding can deliver in this sector.

If Schneider’s shifting momentum has you thinking more broadly, now is the perfect opportunity to discover fast growing stocks with high insider ownership

But after impressive longer-term returns, the real question for investors now is whether today’s dip signals an undervalued entry point or if Schneider Electric’s recent price already reflects all its potential upside.

Most Popular Narrative: 12.7% Undervalued

With the most followed narrative setting a fair value notably above Schneider Electric’s recent close, market watchers are closely examining the company’s future growth picture right now.

The company’s transition toward software and recurring digital services (notably EcoStruxure, AVEVA SaaS, and EcoCare), now representing 60% of revenues and growing at double-digit rates, should drive higher margins and recurring earnings. There is further upside potential as AVEVA's SaaS conversion completes by 2027.

How do recurring digital revenues and margin upgrades play into this price target? The calculus behind this fair value draws on bold profitability forecasts and high conviction about the scale of Schneider’s future earnings. But the lynchpin number is hidden just beneath the surface. Unlock the specific formula powering this bullish case and see what the market might be missing.

Result: Fair Value of €264.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued margin pressure from changing product mix or persistent challenges in key regions could quickly cool the current bullish case for Schneider Electric.

Find out about the key risks to this Schneider Electric narrative.

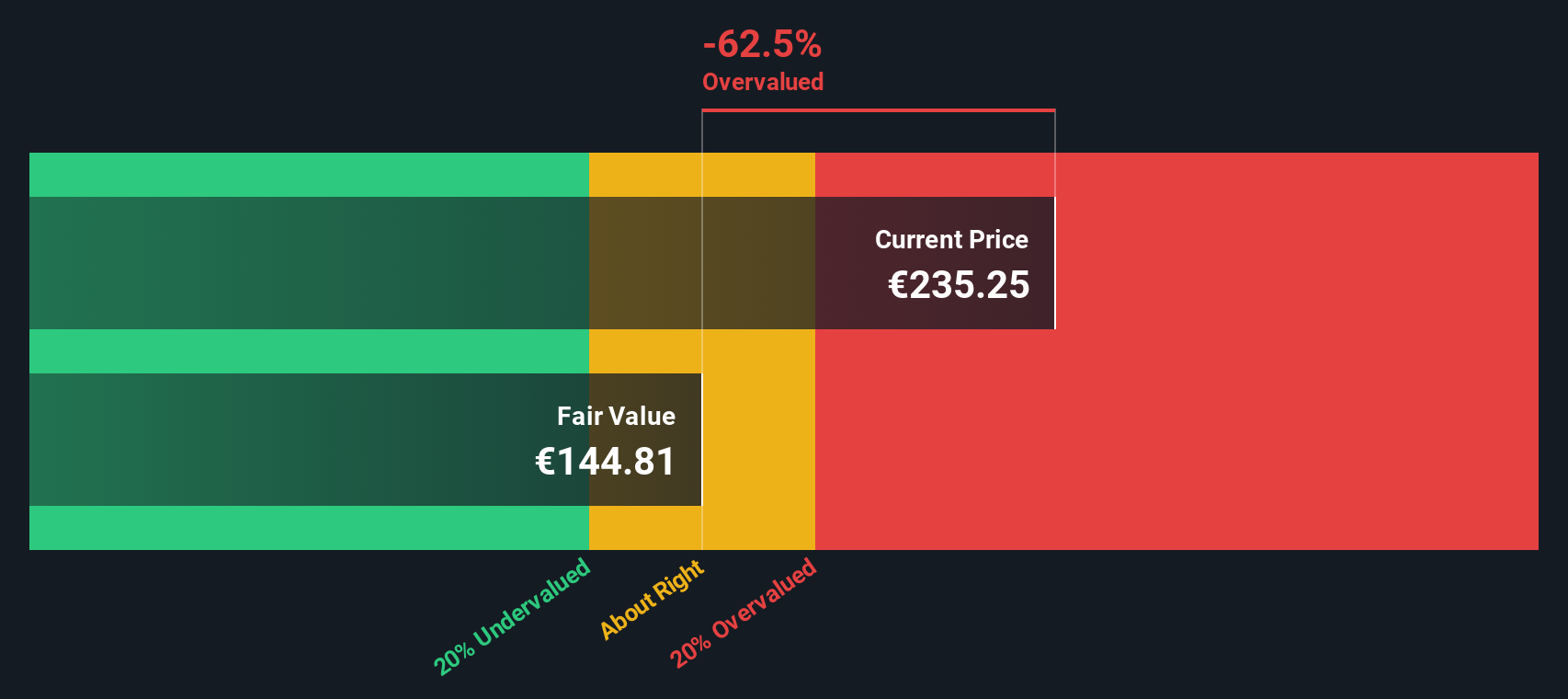

Another View: Our DCF Model Suggests a Different Story

While analysts currently see Schneider Electric as fairly valued or even with upside, our SWS DCF model paints a more cautious picture. According to this approach, the shares trade well above their estimated intrinsic value. This suggests the market might be factoring in more optimistic future growth than the model allows. Could future execution change that outlook, or is the stock’s price running ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider Electric Narrative

If you have a different perspective, or want to dig into the numbers firsthand, it's simple to generate a personal narrative in just a few minutes. Do it your way

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to spot new opportunities before the crowd, these investment shortcuts can help you filter winners that match your style and goals.

- Start earning more from your portfolio by checking out these 16 dividend stocks with yields > 3%, which offers solid yields above the market average.

- Target the future of medicine with these 32 healthcare AI stocks, giving you direct access to companies harnessing AI to reshape healthcare.

- Capitalize on hidden value by selecting these 874 undervalued stocks based on cash flows to pinpoint top stocks trading beneath their true potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SU

Schneider Electric

Engages in the energy management and industrial automation businesses worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives