- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

Euronext Paris Stocks Estimated To Be Trading Below Fair Value In August 2024

Reviewed by Simply Wall St

As the European economy continues to gain momentum, particularly with a boost from Paris, the French stock market has shown promising signs of growth. Amidst this positive environment, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential market inefficiencies. In this article, we will explore three Euronext Paris stocks that are estimated to be trading below their fair value in August 2024.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SPIE (ENXTPA:SPIE) | €34.50 | €49.80 | 30.7% |

| NSE (ENXTPA:ALNSE) | €29.00 | €57.70 | 49.7% |

| Vivendi (ENXTPA:VIV) | €9.89 | €18.02 | 45.1% |

| MEMSCAP (ENXTPA:MEMS) | €6.34 | €9.47 | 33.1% |

| Lectra (ENXTPA:LSS) | €27.50 | €51.92 | 47% |

| Safran (ENXTPA:SAF) | €197.10 | €303.72 | 35.1% |

| Guillemot (ENXTPA:GUI) | €5.58 | €9.01 | 38.1% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.04 | €5.09 | 40.3% |

| EKINOPS (ENXTPA:EKI) | €3.475 | €5.50 | 36.8% |

| OVH Groupe (ENXTPA:OVH) | €6.12 | €8.82 | 30.6% |

Let's uncover some gems from our specialized screener.

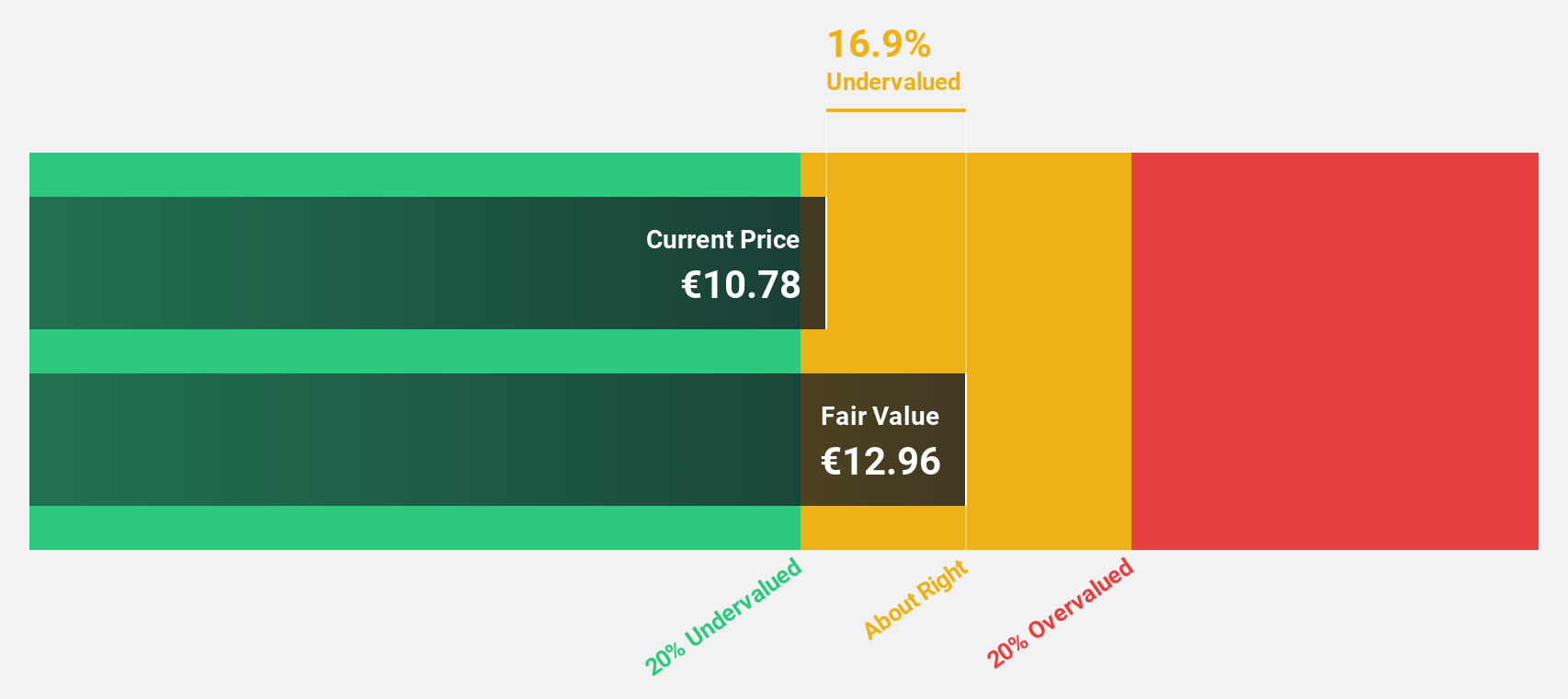

Antin Infrastructure Partners SAS (ENXTPA:ANTIN)

Overview: Antin Infrastructure Partners SAS is a private equity firm that focuses on infrastructure investments and has a market capitalization of approximately €2.24 billion.

Operations: The firm's revenue from asset management amounts to €282.87 million.

Estimated Discount To Fair Value: 28.5%

Antin Infrastructure Partners SAS is trading at €12.48, significantly below its estimated fair value of €17.46, making it undervalued based on cash flows. Analysts forecast earnings to grow at 25.16% annually, outpacing the French market's 12.3%. Despite recent profitability and a high Return on Equity projection of 38.2%, the dividend yield of 5.13% is not well-covered by earnings or free cash flows, and shareholders have faced dilution over the past year.

- In light of our recent growth report, it seems possible that Antin Infrastructure Partners SAS' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Antin Infrastructure Partners SAS.

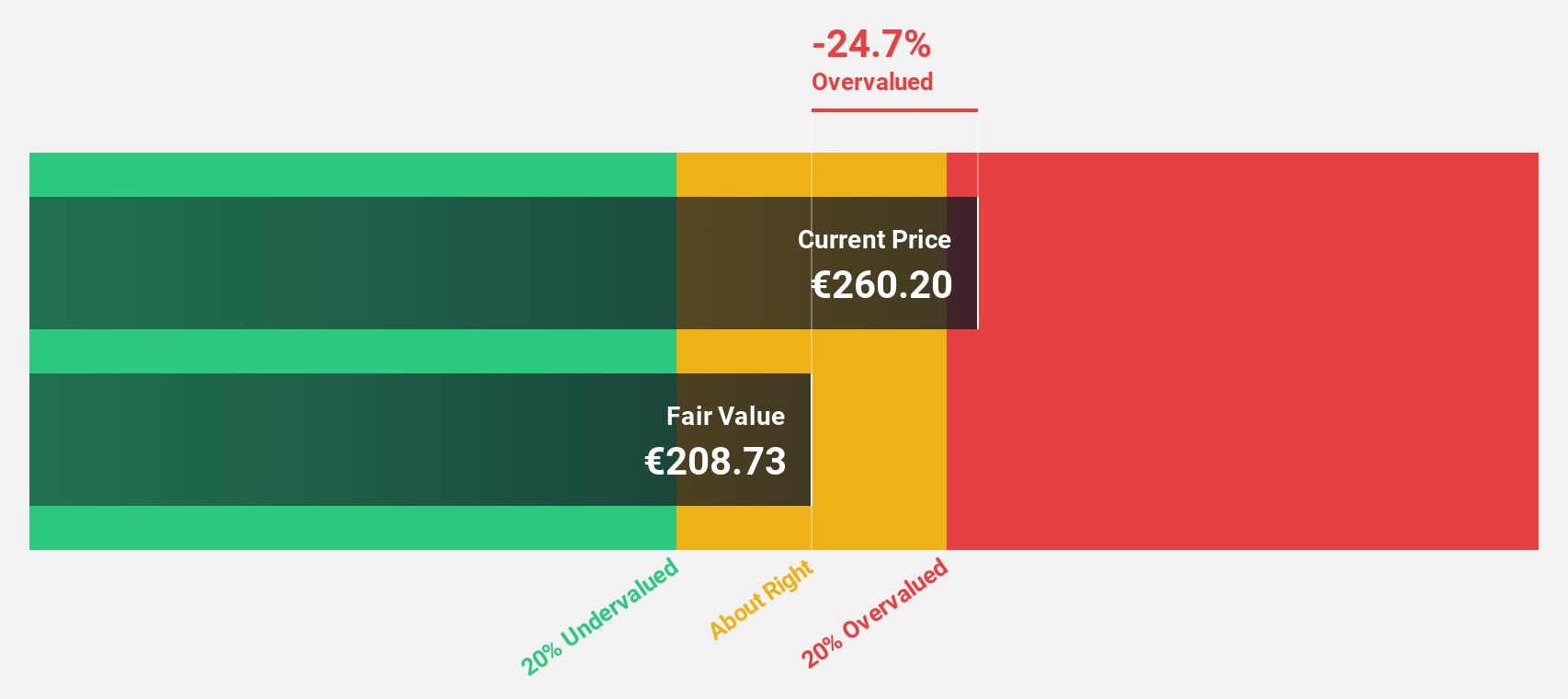

Safran (ENXTPA:SAF)

Overview: Safran SA, with a market cap of €82.86 billion, operates globally in the aerospace and defense sectors through its subsidiaries.

Operations: Safran's revenue segments include Aircraft Interiors (€2.73 billion), Aerospace Propulsion (€12.66 billion), and Aeronautical Equipment, Defense, and Aerosystems (€9.91 billion).

Estimated Discount To Fair Value: 35.1%

Safran is trading at €197.1, significantly below its estimated fair value of €303.72, indicating it is undervalued based on cash flows. Analysts forecast earnings to grow 21.09% annually, outpacing the French market's 12.3%. Recent half-year results showed a substantial drop in net income to €57 million from €1.86 billion a year ago, despite revenue growth to €13.41 billion from €11.36 billion. The company expects full-year revenue around €27.4 billion and plans to acquire Preligens SAS for AI capabilities enhancement.

- Insights from our recent growth report point to a promising forecast for Safran's business outlook.

- Dive into the specifics of Safran here with our thorough financial health report.

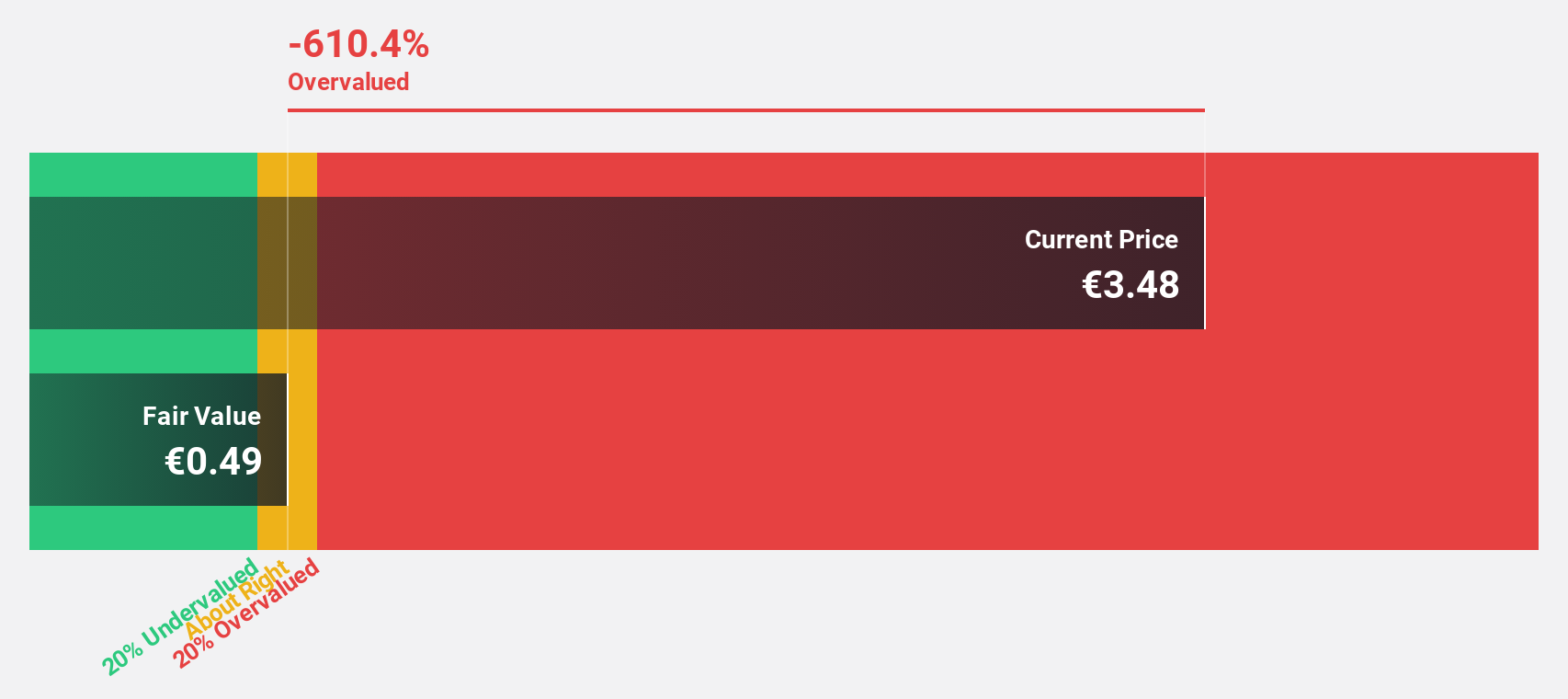

Vivendi (ENXTPA:VIV)

Overview: Vivendi SE is an entertainment, media, and communication company operating globally with a market cap of approximately €9.97 billion.

Operations: Vivendi SE generates revenue from various segments including Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), Gameloft (€304 million), Prisma Media (€303 million), Vivendi Village (€151 million), New Initiatives (€176 million), and Segment Adjustment (€4.86 billion).

Estimated Discount To Fair Value: 45.1%

Vivendi SE is trading at €9.89, well below its estimated fair value of €18.02, indicating it is undervalued based on cash flows. Despite a recent drop in net income to €159 million from €174 million year-on-year, the company reported significant revenue growth to €9.05 billion from €4.70 billion. Analysts forecast earnings growth of 30.6% per year, outpacing the French market's 12.3%. The company also repurchased shares worth €184 million and settled long-standing litigation risks without admitting fault or liability.

- Our earnings growth report unveils the potential for significant increases in Vivendi's future results.

- Take a closer look at Vivendi's balance sheet health here in our report.

Turning Ideas Into Actions

- Embark on your investment journey to our 17 Undervalued Euronext Paris Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

High growth potential with excellent balance sheet.