- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

Exail Technologies (ENXTPA:EXA): Valuation Insights After Addition to the Euronext 150 Index

Reviewed by Simply Wall St

Exail Technologies (ENXTPA:EXA) just secured a spot on the Euronext 150 Index. This move tends to draw wider attention from investors and can amplify future trading activity around the company’s shares.

See our latest analysis for Exail Technologies.

After a meteoric run this year, with a share price return year-to-date of 311.3% and an impressive five-year total shareholder return of nearly 697%, Exail Technologies has seen some short-term volatility, with recent declines hinting at shifting investor sentiment following its index debut.

If this surge in visibility got you thinking bigger, take a moment to broaden your horizons and discover fast growing stocks with high insider ownership

But with shares up dramatically and new index-driven attention, investors now face a key question: Is Exail Technologies trading below its real potential, or has the market already factored in all the future growth?

Price-to-Sales of 2.8x: Is it justified?

Exail Technologies is currently valued at a Price-to-Sales (P/S) ratio of 2.8x, notably above the fair P/S ratio estimate of 1.7x and its last closing price of €74.7. This suggests the market is pricing Exail Technologies at a premium compared to what would be considered fair value based on its sales.

The Price-to-Sales ratio measures how much investors are willing to pay for each euro of sales. For companies in high-growth sectors that may not yet be highly profitable, like Aerospace & Defense, investors often watch this metric closely, especially for rapid revenue-growth stories where earnings are only just starting to ramp up.

Exail Technologies’ P/S ratio exceeds that of the wider European Aerospace & Defense industry, which averages 2.3x. It also sits considerably higher than its estimated fair ratio of 1.7x, a level that models suggest reflects a baseline the market could move closer to over time if growth expectations moderate.

Explore the SWS fair ratio for Exail Technologies

Result: Price-to-Sales of 2.8x (OVERVALUED)

However, sharp recent pullbacks and revenue growth trailing expectations serve as reminders that investor sentiment and performance can change quickly.

Find out about the key risks to this Exail Technologies narrative.

Another View: What Does Our DCF Model Say?

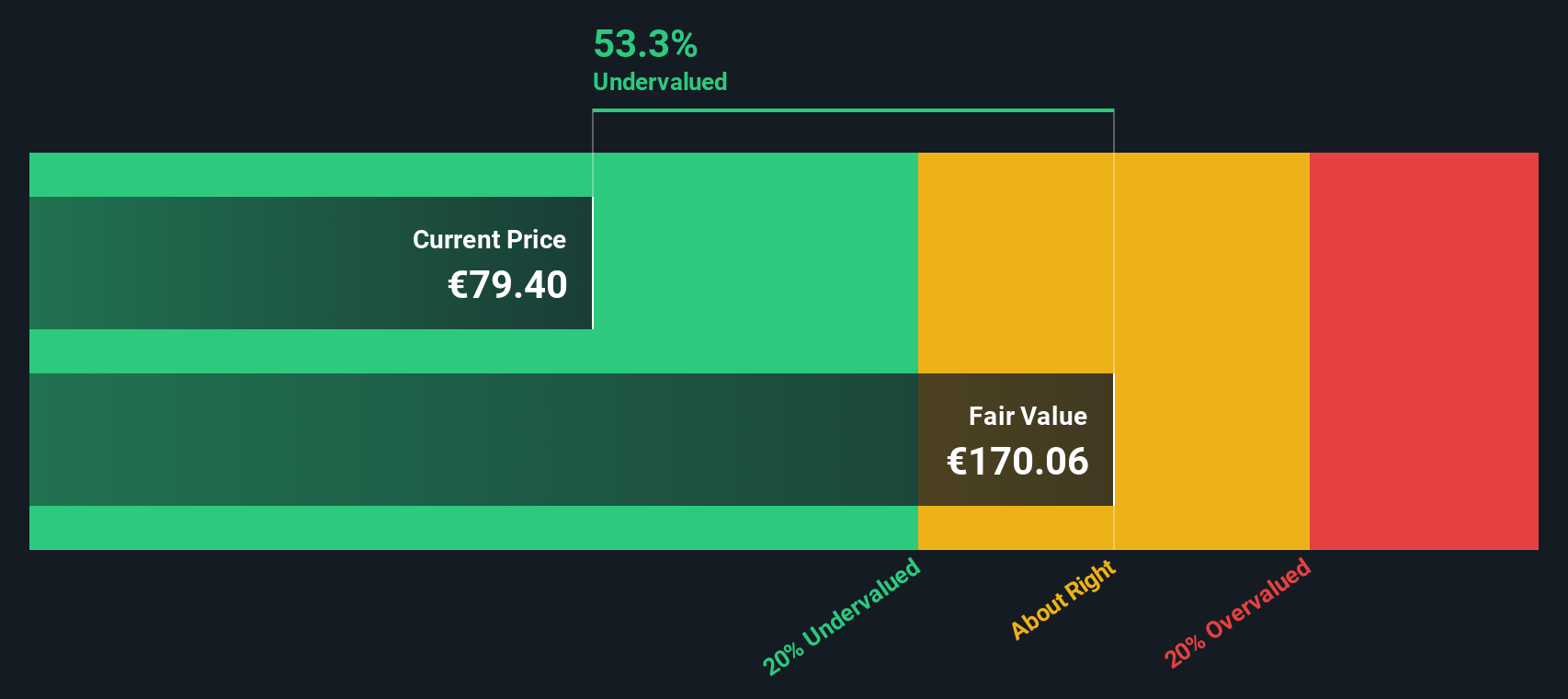

While Exail Technologies appears expensive based on its Price-to-Sales ratio, our DCF model offers a different perspective. According to this approach, the shares are trading at a steep discount, around 55% below our estimated fair value of €168.25. Is the market overlooking something fundamental here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Exail Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Exail Technologies Narrative

If you want to see things from a fresh angle or back up your own view with the data, you can dive in and create your own story in just a few minutes. Do it your way

A great starting point for your Exail Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Confident investors never wait for the next big opportunity to pass them by. More growth stories, income plays, and emerging trends are just a click away below.

- Capture portfolio gains by targeting high-yield payouts from these 15 dividend stocks with yields > 3% and see your income potential exceed market averages.

- Ride the surge of artificial intelligence by tapping into these 25 AI penny stocks positioned to benefit from breakthroughs transforming industries worldwide.

- Seize the edge with these 855 undervalued stocks based on cash flows that may be flying under the radar but have fundamentals that support strong future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives