- France

- /

- Aerospace & Defense

- /

- ENXTPA:AM

If EPS Growth Is Important To You, Dassault Aviation société anonyme (EPA:AM) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Dassault Aviation société anonyme (EPA:AM), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Dassault Aviation société anonyme

How Fast Is Dassault Aviation société anonyme Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Dassault Aviation société anonyme's EPS has grown 20% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Dassault Aviation société anonyme's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Despite consistency in EBIT margins year on year, Dassault Aviation société anonyme has actually recorded a dip in revenue. While this may raise concerns, investors should investigate the reasoning behind this.

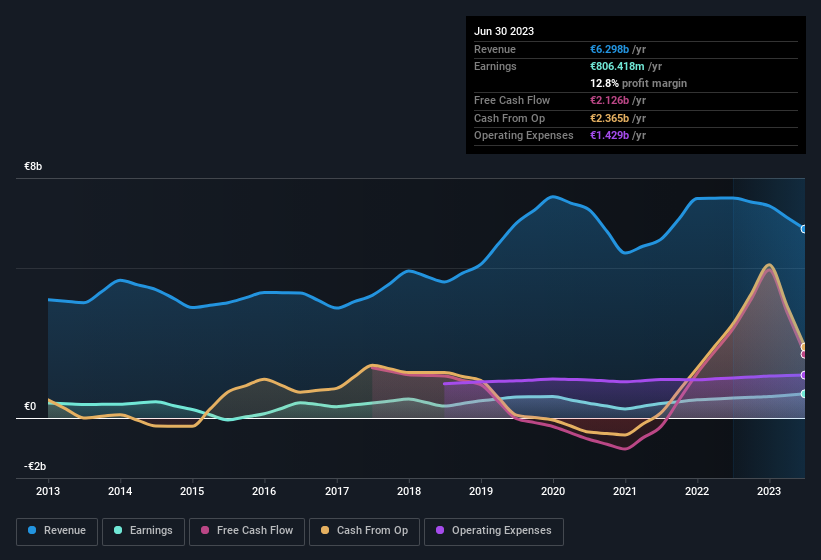

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Dassault Aviation société anonyme's future EPS 100% free.

Are Dassault Aviation société anonyme Insiders Aligned With All Shareholders?

Since Dassault Aviation société anonyme has a market capitalisation of €14b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. As a matter of fact, their holding is valued at €23m. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.2%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Dassault Aviation société anonyme Worth Keeping An Eye On?

For growth investors, Dassault Aviation société anonyme's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Dassault Aviation société anonyme's continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Dassault Aviation société anonyme is trading on a high P/E or a low P/E, relative to its industry.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:AM

Dassault Aviation société anonyme

Designs and manufactures military aircraft, business jets, and space systems in France, the Americas, and internationally.

Flawless balance sheet and fair value.