Unveiling These 3 Undiscovered Gems in France for Savvy Investors

Reviewed by Simply Wall St

The French stock market has recently seen a boost, with the CAC 40 Index gaining 1.71% amid growing hopes for interest rate cuts by both the Fed and the ECB. This positive sentiment, coupled with an uptick in eurozone business activity driven by the Paris Olympics, sets a favorable backdrop for exploring smaller, lesser-known companies that could offer unique investment opportunities. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial. Here are three undiscovered gems in France that might pique your interest.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher operating in France, the rest of Europe, the Americas, and the Asia Pacific with a market cap of €668.07 million.

Operations: Axway Software SA generates revenue through four primary segments: License (€8.46 million), Maintenance (€77.04 million), Subscription (€201.19 million), and Services excluding Subscription (€35.49 million). The largest revenue stream is from Subscriptions, followed by Maintenance services.

Axway Software, a small player in the software industry, has shown notable progress recently. The company's debt to equity ratio increased from 12.5% to 24.6% over five years, yet its net debt to equity ratio stands at a satisfactory 19.9%. Despite shareholder dilution in the past year, Axway became profitable this year with high-quality earnings and an EBIT interest coverage of 10.1x. Its price-to-earnings ratio of 19.1x is competitive against the industry average of 32.6x, indicating good value potential for investors.

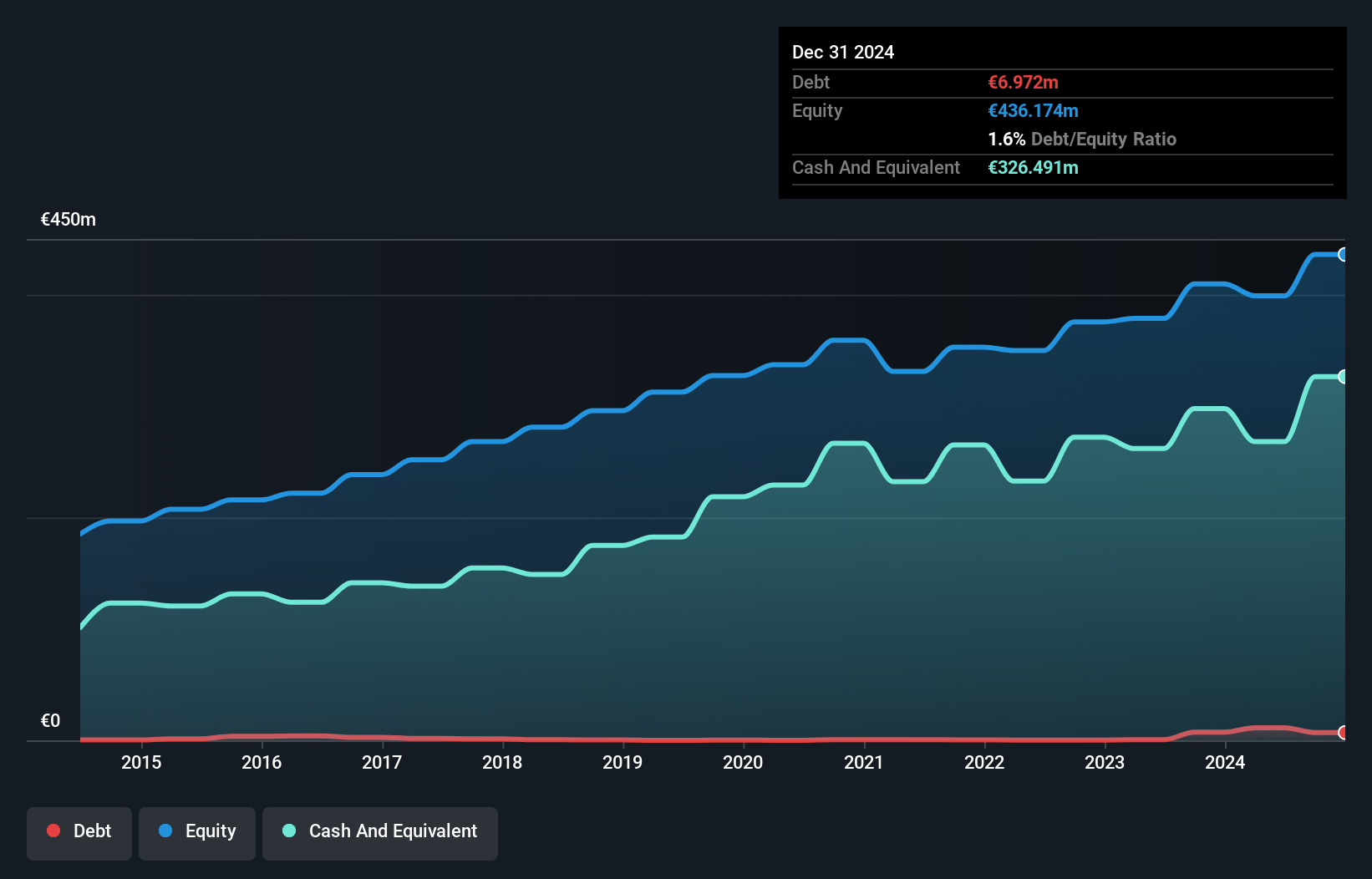

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Value Rating: ★★★★★☆

Overview: CFM Indosuez Wealth Management SA, with a market cap of €630.30 million, provides banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally through its subsidiaries.

Operations: CFM Indosuez Wealth Management SA generates €196.38 million in revenue from its Wealth Management segment.

CFM Indosuez Wealth Management boasts total assets of €7.7B and equity of €404.3M, with deposits at €6.2B and loans totaling €3.2B. The company repurchased shares in 2024, reflecting confidence in its valuation. Earnings growth reached 40% over the past year, outpacing the industry average of -11%. With a price-to-earnings ratio of 10x compared to the French market's 15x, it offers good value. Bad loans are appropriately managed at 0.8%, supported by a low-risk funding structure primarily from customer deposits (85%).

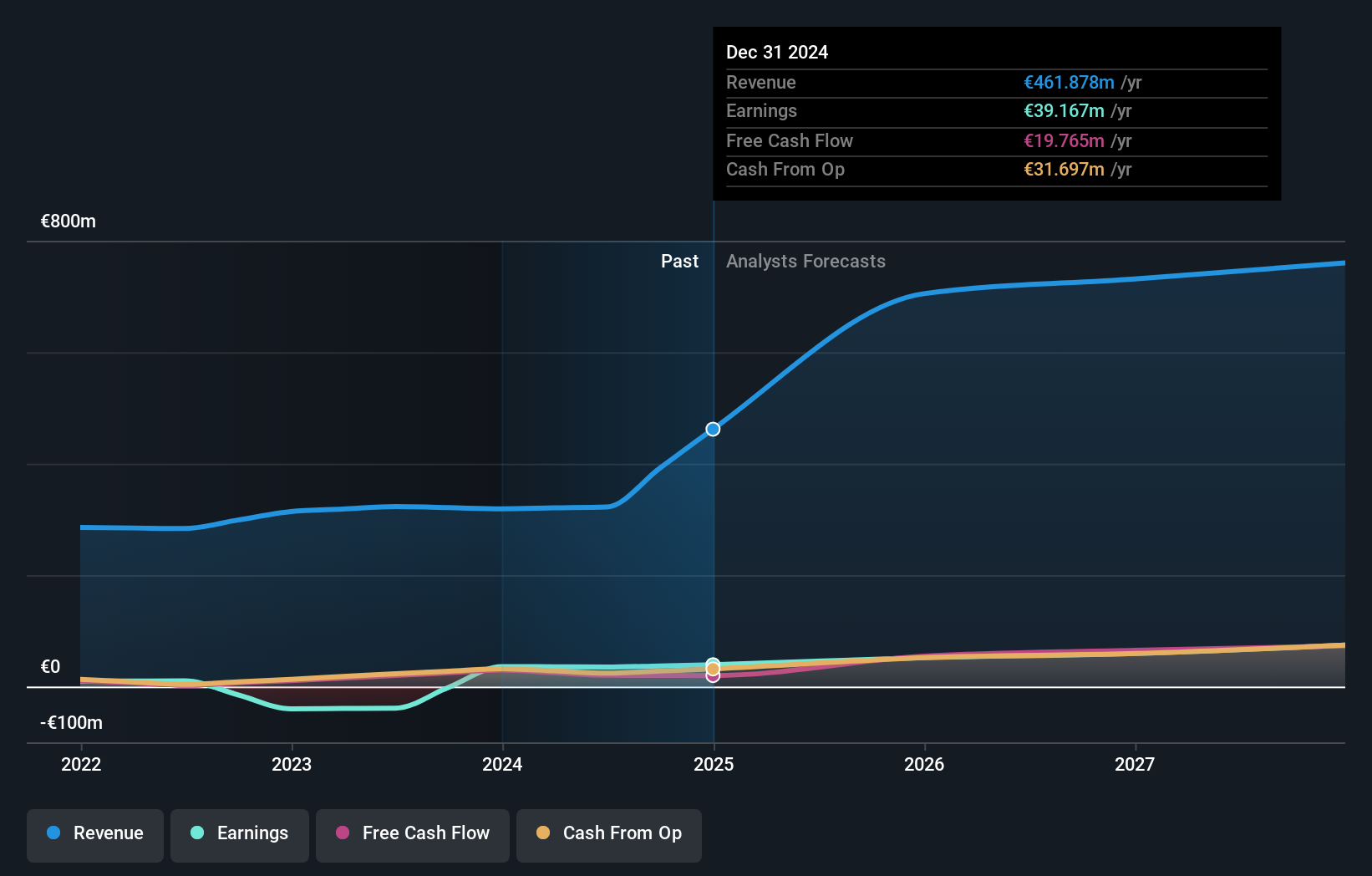

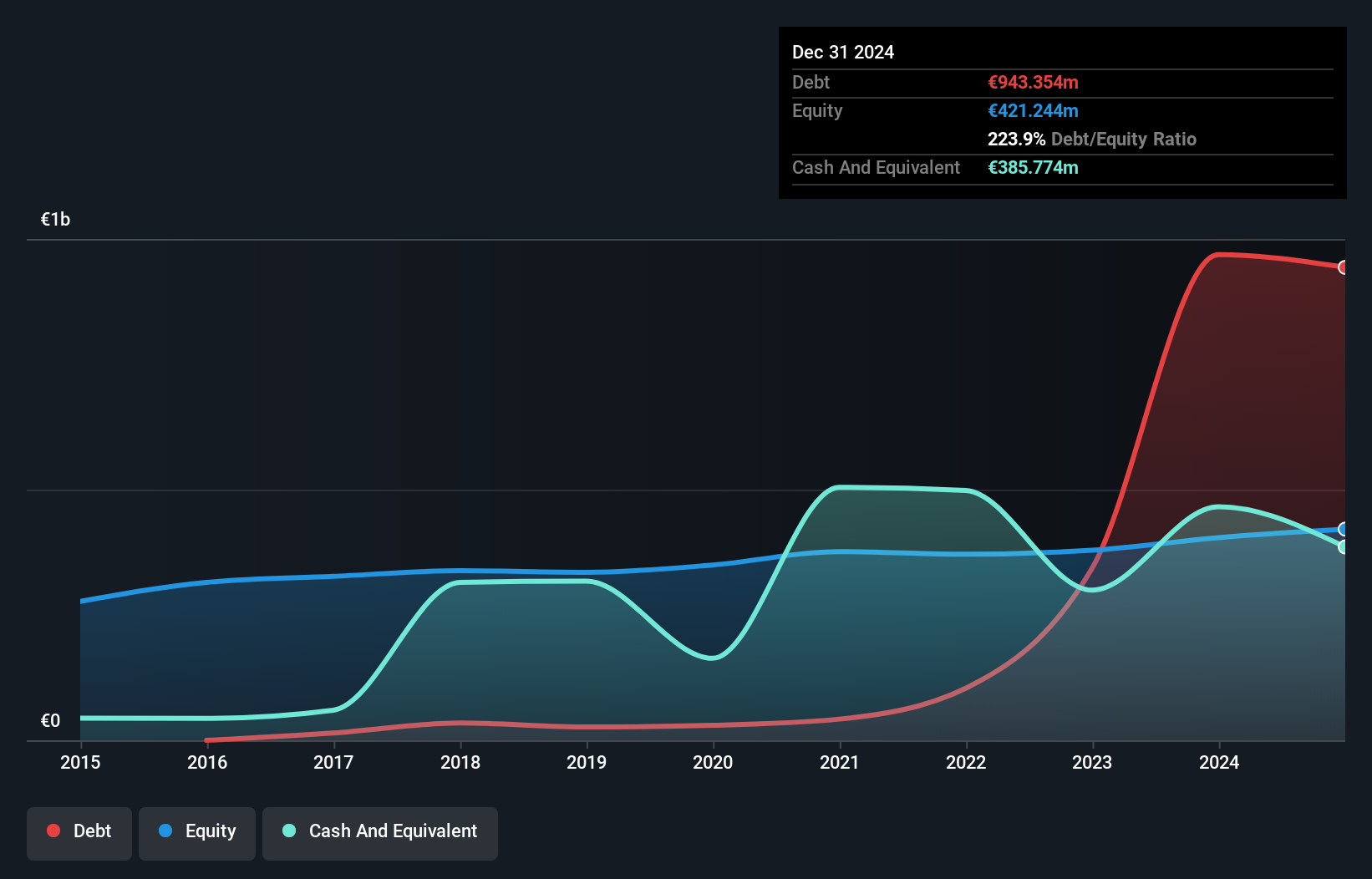

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of approximately €1.09 billion.

Operations: Neurones generates revenue primarily from three segments: Infrastructure Services (€468.49 million), Application Services (€219.47 million), and Consulting (€53.21 million).

Neurones has shown robust performance, with earnings growth of 11.7% over the past year, outpacing the IT industry's -9.9%. Trading at 11.4% below its estimated fair value, it presents a compelling investment case. The company's debt to equity ratio has increased from 0.1 to 1.8 over five years but remains manageable as it earns more interest than it pays and maintains high-quality earnings. Neurones' profitability ensures that cash runway is not a concern for future operations.

- Click here and access our complete health analysis report to understand the dynamics of Neurones.

Understand Neurones' track record by examining our Past report.

Next Steps

- Gain an insight into the universe of 36 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neurones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NRO

Neurones

An information technology (IT) services company, provides infrastructure, application, and consulting services in France and internationally.

Excellent balance sheet established dividend payer.