- France

- /

- Oil and Gas

- /

- ENXTPA:ES

Undiscovered Gems In France To Explore This October 2024

Reviewed by Simply Wall St

As the European markets experience a rebound, with France's CAC 40 Index climbing significantly amid hopes for interest rate cuts and China's economic stimulus measures, investors are increasingly focusing on opportunities within the region. In this context of renewed optimism, identifying promising small-cap stocks in France can offer potential growth avenues as these companies often benefit from local economic shifts and emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| ADLPartner | 120.47% | 9.86% | 16.17% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Fiducial Real Estate | 33.77% | 1.63% | 3.30% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. engages in the refining, distribution, and marketing of refined petroleum products both in France and internationally, with a market cap of approximately €1.67 billion.

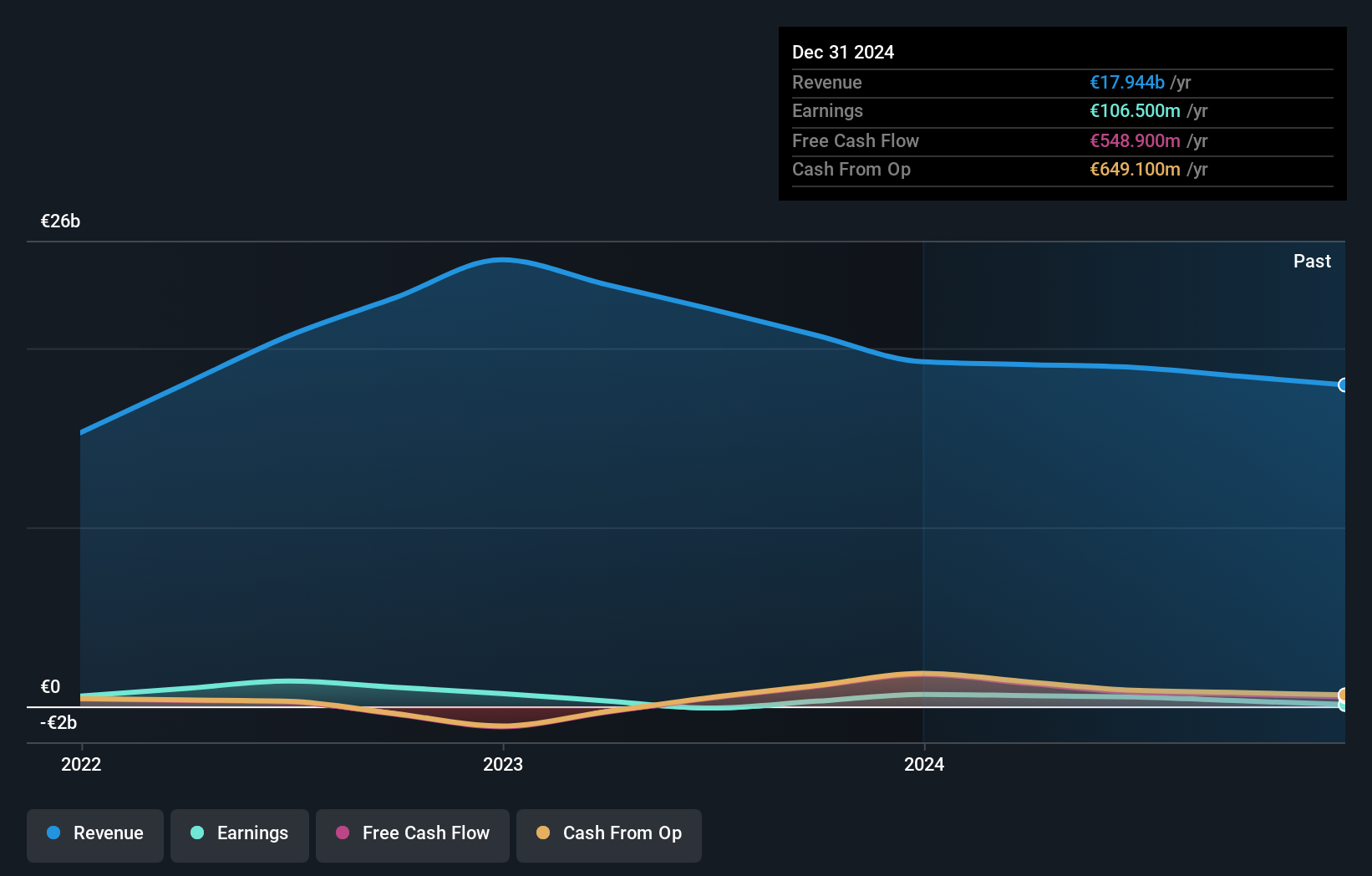

Operations: Esso S.A.F. generates revenue primarily from its refining and distribution activities, amounting to €18.93 billion.

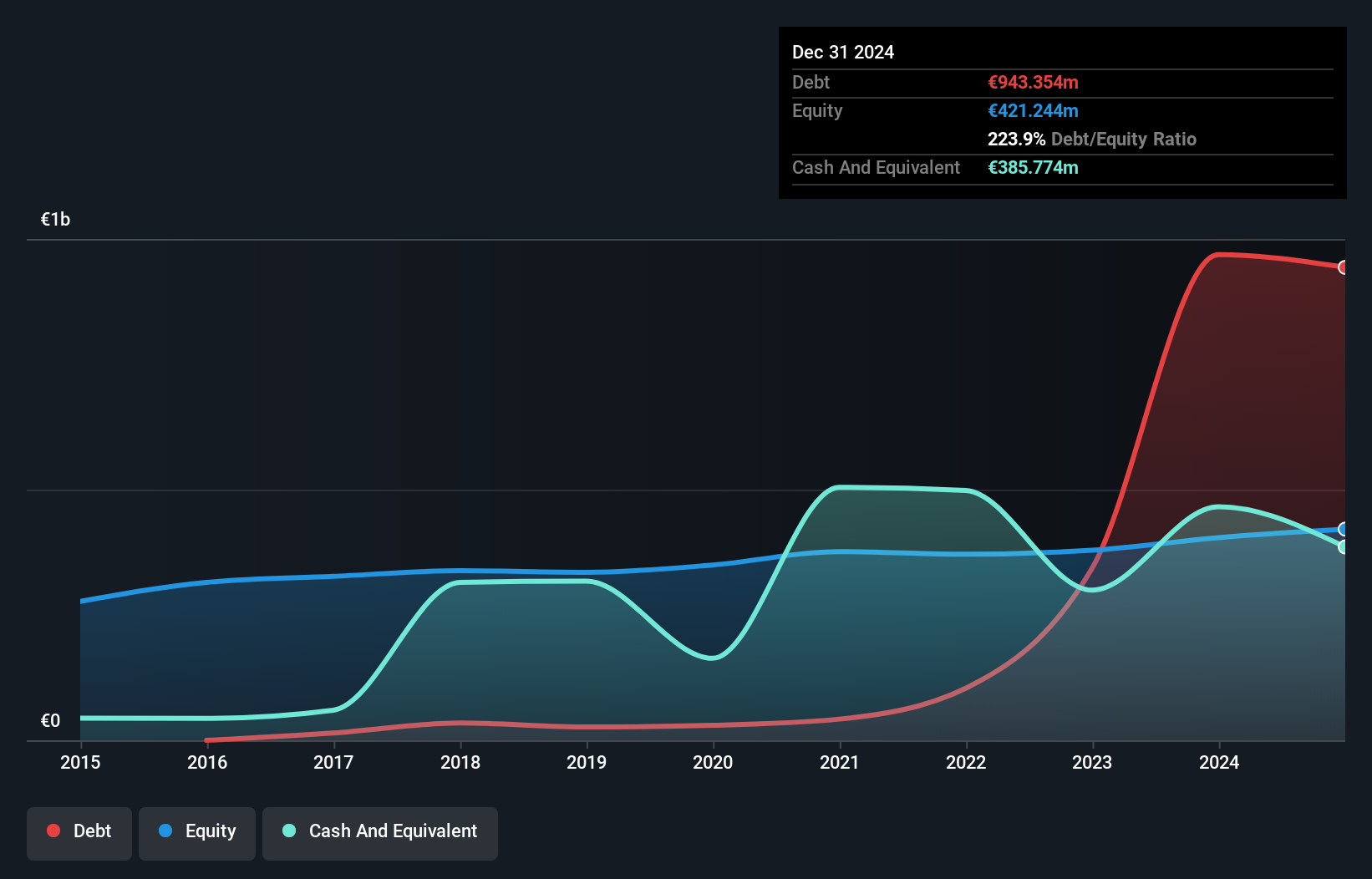

EssoF, a notable player in the oil and gas sector, has seen its debt to equity ratio decrease significantly from 5.8 to 1.2 over five years, indicating improved financial health. Despite recent earnings showing a net income of €116 million compared to last year's €265.6 million, the company trades at nearly 97% below estimated fair value, suggesting potential undervaluation. With free cash flow turning positive and interest payments well-covered by profits, EssoF's financial positioning seems robust despite volatility in share price recently observed.

- Take a closer look at EssoF's potential here in our health report.

Assess EssoF's past performance with our detailed historical performance reports.

Marie Brizard Wine & Spirits (ENXTPA:MBWS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marie Brizard Wine & Spirits SA is involved in the production, marketing, and sale of wines and spirits across France, Europe, Africa, the Americas, and the Asia Pacific with a market capitalization of €437.42 million.

Operations: Marie Brizard Wine & Spirits generates revenue through the production and sale of wines and spirits across various regions, including France, Europe, Africa, the Americas, and the Asia Pacific. The company's financial performance is impacted by its cost structure associated with these operations.

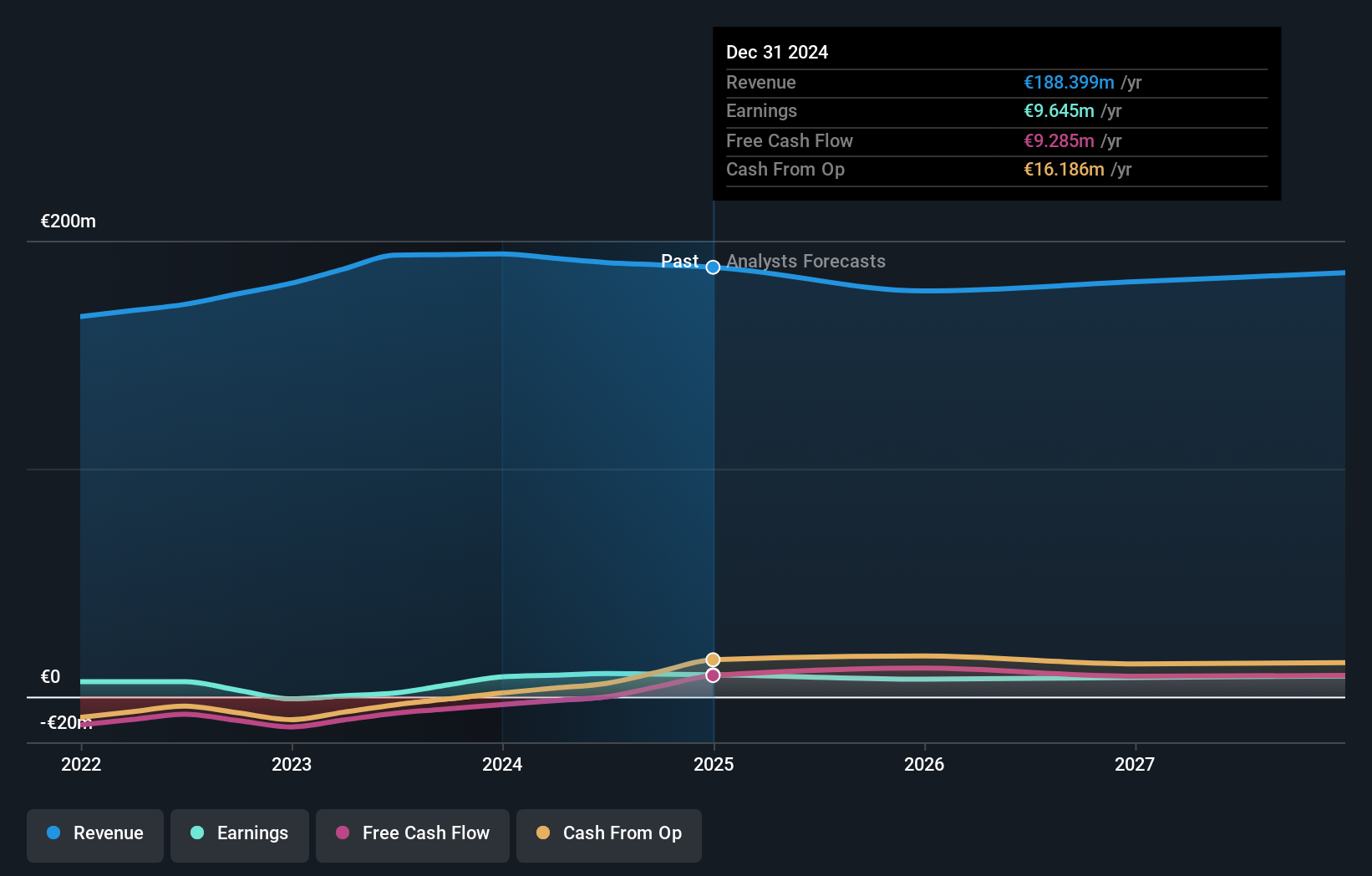

Marie Brizard Wine & Spirits, a smaller player in the beverage industry, has shown impressive earnings growth of 516.7% over the past year, significantly outpacing the industry average of -31.5%. The company's debt to equity ratio has improved remarkably from 65.6% to 3.4% over five years, indicating stronger financial health. However, recent results for the half-year ending June 2024 show sales at €115 million and net income at €6.52 million, reflecting slight declines in revenue compared to last year but an increase in profitability.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Value Rating: ★★★★★☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, offers banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally, with a market cap of €710.52 million.

Operations: CFM Indosuez generates revenue primarily through its Wealth Management segment, which contributes €196.38 million. The company's financial performance can be analyzed by observing trends in its profit margins over time.

With total assets of €7.7B and equity of €404.3M, CFM Indosuez Wealth Management stands out with its robust financial health. The bank's non-performing loans are at a low 0.8%, while 85% of liabilities come from low-risk funding sources like customer deposits, enhancing stability. Notably, earnings surged by 40% last year, outpacing the industry average of 1%. With a price-to-earnings ratio of 11.7x below the market average, it offers potential value for investors seeking growth in France's banking sector.

Seize The Opportunity

- Unlock more gems! Our Euronext Paris Undiscovered Gems With Strong Fundamentals screener has unearthed 35 more companies for you to explore.Click here to unveil our expertly curated list of 38 Euronext Paris Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EssoF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ES

EssoF

Esso S.A.F. refines, distributes, and markets refined petroleum products in France and internationally.

Flawless balance sheet and good value.