- France

- /

- Auto Components

- /

- ENXTPA:FR

Valeo (ENXTPA:FR) Valuation in Focus After Liquid Cooling Partnership With 2CRSi Expands Diversification

Reviewed by Simply Wall St

Valeo (ENXTPA:FR) just teamed up with 2CRSi to co-develop innovative liquid cooling systems for edge data centers. This partnership signals Valeo's latest step beyond automotive and targets the sustainable tech needs of decentralized computing.

See our latest analysis for Valeo.

Valeo’s latest foray into edge data center technology comes as its share price rallies, with a 31.4% year-to-date return and a standout 24.8% gain over the last month. Despite these sharp moves, long-term total shareholder returns remain well underwater. However, recent momentum suggests that investors are warming to Valeo’s diversification efforts.

If Valeo’s pivot into high-tech cooling systems got your attention, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership.

But with shares rallying hard and valuation metrics sitting near historic averages, investors may wonder whether Valeo’s current price represents a bargain for new entrants or if the market is already factoring in expectations for future growth.

Most Popular Narrative: 5% Overvalued

Valeo’s last close price of €12.38 stands above the narrative’s fair value estimate of €11.79, hinting at some optimism built into the current price. This narrative presents a framework where near-term investor enthusiasm may outpace analyst consensus, setting the scene for debate on the sustainability of recent gains.

Bullish analysts have raised their price targets in response to strong quarterly results. This reflects growing confidence in Valeo's execution and earnings trajectory.

Want to uncover what’s really fueling analyst expectations? The most influential projection here relies on assumptions about explosive profit momentum and shifting market multiples. See which financial forecasts the narrative bets on.

Result: Fair Value of €11.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, order cancellations in key segments and persistent debt levels could undermine the optimistic outlook if these issues are not managed effectively.

Find out about the key risks to this Valeo narrative.

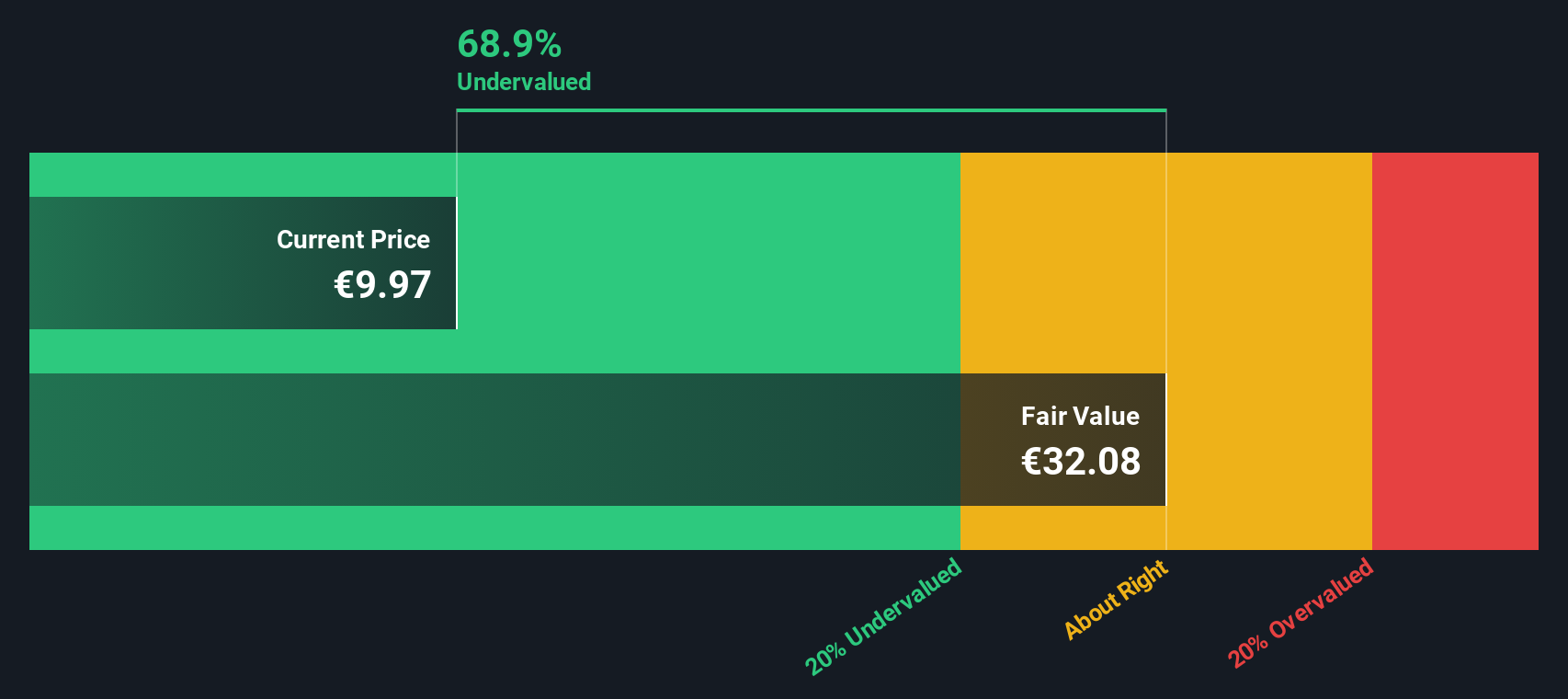

Another View: Discounted Cash Flow Signals Opportunity

While the analyst consensus points to Valeo being slightly overvalued, our DCF model presents a much more optimistic scenario. By estimating future cash flows, it values the company at €25.41 per share, which is well above current levels. Does this signal a hidden value for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Valeo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Valeo Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own take on Valeo in under three minutes. Do it your way.

A great starting point for your Valeo research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your chance to uncover investment opportunities before the crowd does. Unlock a world of unique stocks with tailored screeners designed for market outperformance.

- Tap into early-stage growth by checking out these 3564 penny stocks with strong financials, which are positioned for breakout performance as market leaders of tomorrow.

- Cement your edge in the innovation race by targeting these 26 AI penny stocks, focusing on companies that capitalize on artificial intelligence breakthroughs and shape new industry frontiers.

- Secure stronger yield potential with these 15 dividend stocks with yields > 3% to find resilient companies delivering superior dividends above market averages in uncertain times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives