- France

- /

- Auto Components

- /

- ENXTPA:FR

A Fresh Look at Valeo (ENXTPA:FR) Valuation After This Year’s Quiet Share Price Momentum

Reviewed by Simply Wall St

Most Popular Narrative: 8.4% Undervalued

The most widely followed narrative sees Valeo as undervalued, pointing to significant potential for future returns based on business transformation and improving profitability.

Valeo's strategic focus on electrification, ADAS, software development, and smart lighting positions the company to capture growing market demand and potentially drive future revenue growth. Their competitive positioning in these segments is strong.

Curious what’s behind this high conviction in Valeo’s future? The analyst narrative leans on ambitious targets for profitability, margin recovery and efficiency. Want to uncover the bold assumptions and headline-grabbing forecasts that support this fair value? The real drivers of this valuation might surprise you.

Result: Fair Value of €11.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, Valeo faces threats such as order cancellations in electrification and ongoing challenges in its high-voltage powertrain business, which could cloud future gains.

Find out about the key risks to this Valeo narrative.Another View: What Do Other Valuation Methods Say?

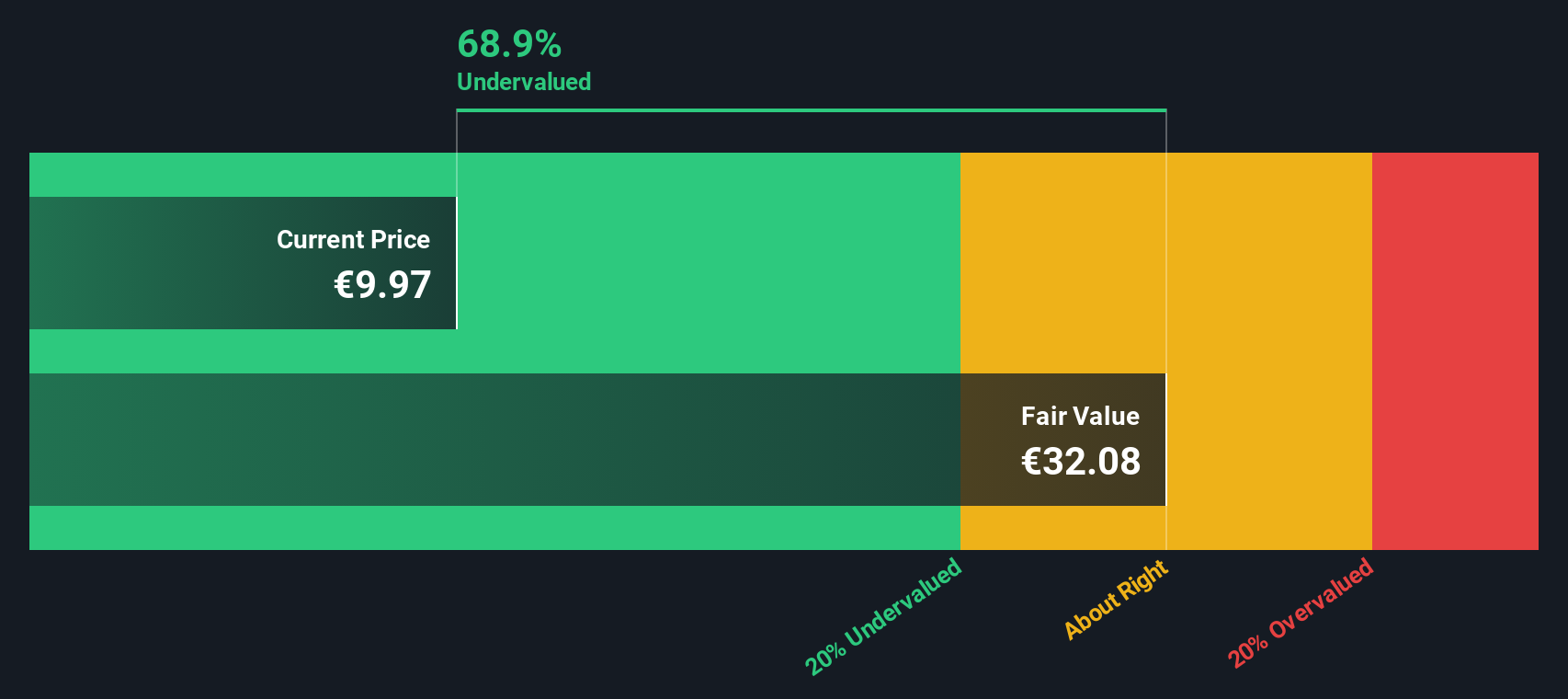

Looking through a different lens, our DCF model also looks at Valeo and suggests the shares are trading below their estimated value. But can two methods agree for the right reasons? Which clues should we trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valeo Narrative

If you see the story unfolding differently, or want a hands-on approach to your own research, it only takes a couple of minutes to build your own view. Do it your way

A great starting point for your Valeo research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Supercharge your strategy by uncovering stocks spotted by our best screeners, tailored to help you get ahead of the market.

- Uncover growth potential by targeting companies in artificial intelligence when you use our AI penny stocks insight tool.

- Strengthen your portfolio with stable income by tapping into our collection of dividend stocks with yields > 3%.

- Seek out tomorrow’s bargains before the crowd and reveal hidden gems with our undervalued stocks based on cash flows screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:FR

Valeo

A technology company, designs, produces, and sells products and systems for the automotive markets in France, other European countries, Africa, North America, South America, and Asia.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives