While shareholders of Tecnotree Oyj (HEL:TEM1V) are in the black over 5 years, those who bought a week ago aren't so fortunate

Tecnotree Oyj (HEL:TEM1V) shareholders might understandably be very concerned that the share price has dropped 39% in the last quarter. But over five years returns have been remarkably great. To be precise, the stock price is 454% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 56% decline over the last twelve months.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Tecnotree Oyj

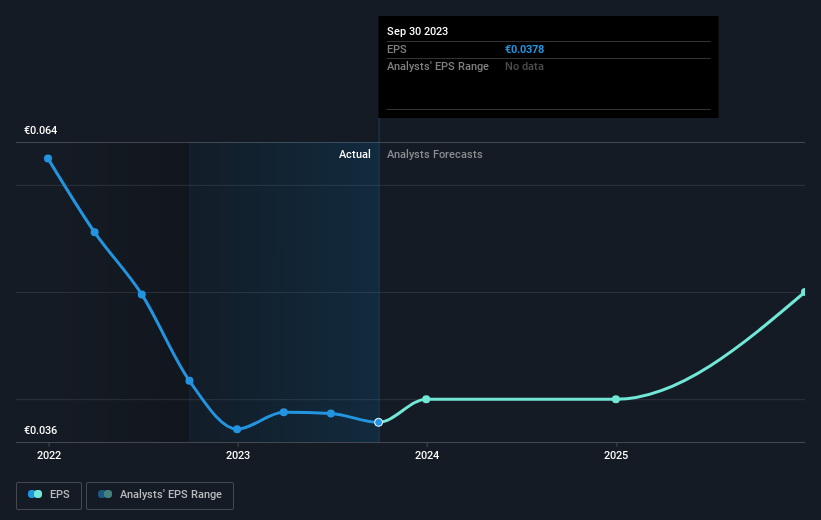

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Tecnotree Oyj moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Tecnotree Oyj's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 11% in the twelve months, Tecnotree Oyj shareholders did even worse, losing 56%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 41% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Tecnotree Oyj better, we need to consider many other factors. Even so, be aware that Tecnotree Oyj is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Tecnotree Oyj is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tecnotree Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TEM1V

Tecnotree Oyj

Supplies telecommunication IT solutions for charging, billing, customer care, and messaging and content services in Europe, the Americas, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.