The Metsä Board Oyj (HEL:METSB) Share Price Is Up 34% And Shareholders Are Holding On

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, long term Metsä Board Oyj (HEL:METSB) shareholders have enjoyed a 34% share price rise over the last half decade, well in excess of the market return of around 27% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 25% in the last year , including dividends .

View 1 warning sign we detected for Metsä Board Oyj

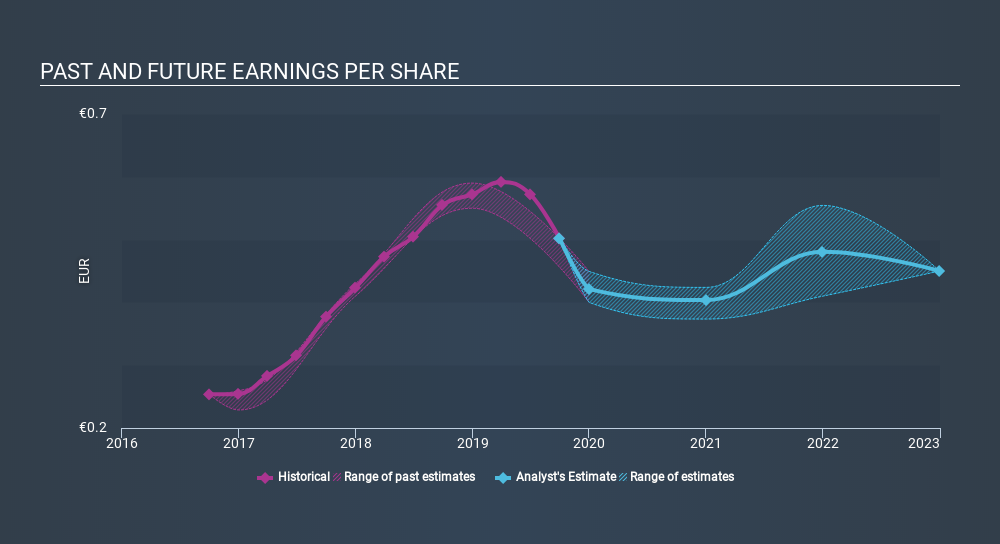

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over half a decade, Metsä Board Oyj managed to grow its earnings per share at 11% a year. The EPS growth is more impressive than the yearly share price gain of 6.0% over the same period. So one could conclude that the broader market has become more cautious towards the stock.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

While the share price will often move with EPS, other factors can also play a role. For example, we've discovered 1 warning sign for Metsä Board Oyj which any shareholder or potential investor should be aware of.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Metsä Board Oyj's TSR for the last 5 years was 61%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Metsä Board Oyj shareholders have received a total shareholder return of 25% over the last year. Of course, that includes the dividend. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before forming an opinion on Metsä Board Oyj you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:METSB

Metsä Board Oyj

Engages in the folding boxboard, fresh fibre linerboard, and market pulp businesses in Finland and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives