- Germany

- /

- Capital Markets

- /

- XTRA:BWB

Undiscovered European Gems To Explore In November 2025

Reviewed by Simply Wall St

As European markets navigate concerns over artificial intelligence-related stock valuations, the pan-European STOXX Europe 600 Index has seen a decline, reflecting broader market sentiment. Amid this backdrop, investors are increasingly on the lookout for stocks with strong fundamentals and growth potential that may not be immediately apparent in headline-grabbing sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

LU-VE (BIT:LUVE)

Simply Wall St Value Rating: ★★★★★☆

Overview: LU-VE S.p.A. is involved in the production and marketing of heat exchangers and air-cooled equipment both in Italy and internationally, with a market capitalization of approximately €813.86 million.

Operations: LU-VE generates revenue primarily from two segments: Components (€280.80 million) and Cooling Systems (€298.06 million).

LU-VE, a nimble player in the European market, showcases resilience with a net debt to equity ratio of 28.7%, deemed satisfactory. Over five years, it reduced its debt ratio from 204.3% to 154.7%, indicating prudent financial management. Despite sales dipping slightly to €294.71 million for the first half of 2025 compared to €296.38 million last year, LU-VE's earnings growth outpaced the industry at 1% versus -2.3%. The company enjoys high-quality earnings and forecasts a promising annual growth rate of 19%. This blend of financial health and strategic positioning makes LU-VE an intriguing prospect in its sector.

- Click here to discover the nuances of LU-VE with our detailed analytical health report.

Examine LU-VE's past performance report to understand how it has performed in the past.

Raisio (HLSE:RAIVV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Raisio plc, with a market cap of €405.30 million, is involved in the production and sale of food and food ingredients across Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Operations: Raisio plc generates revenue primarily from producing and selling food and food ingredients in select European countries. The company's market capitalization stands at €405.30 million.

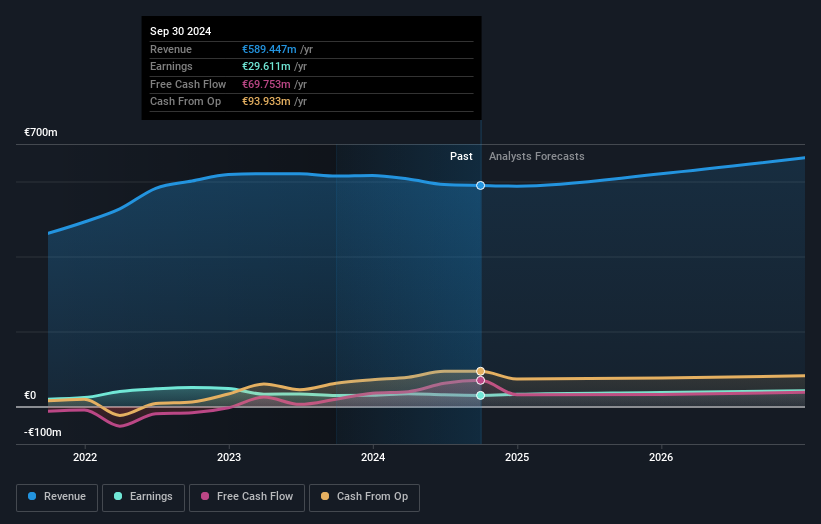

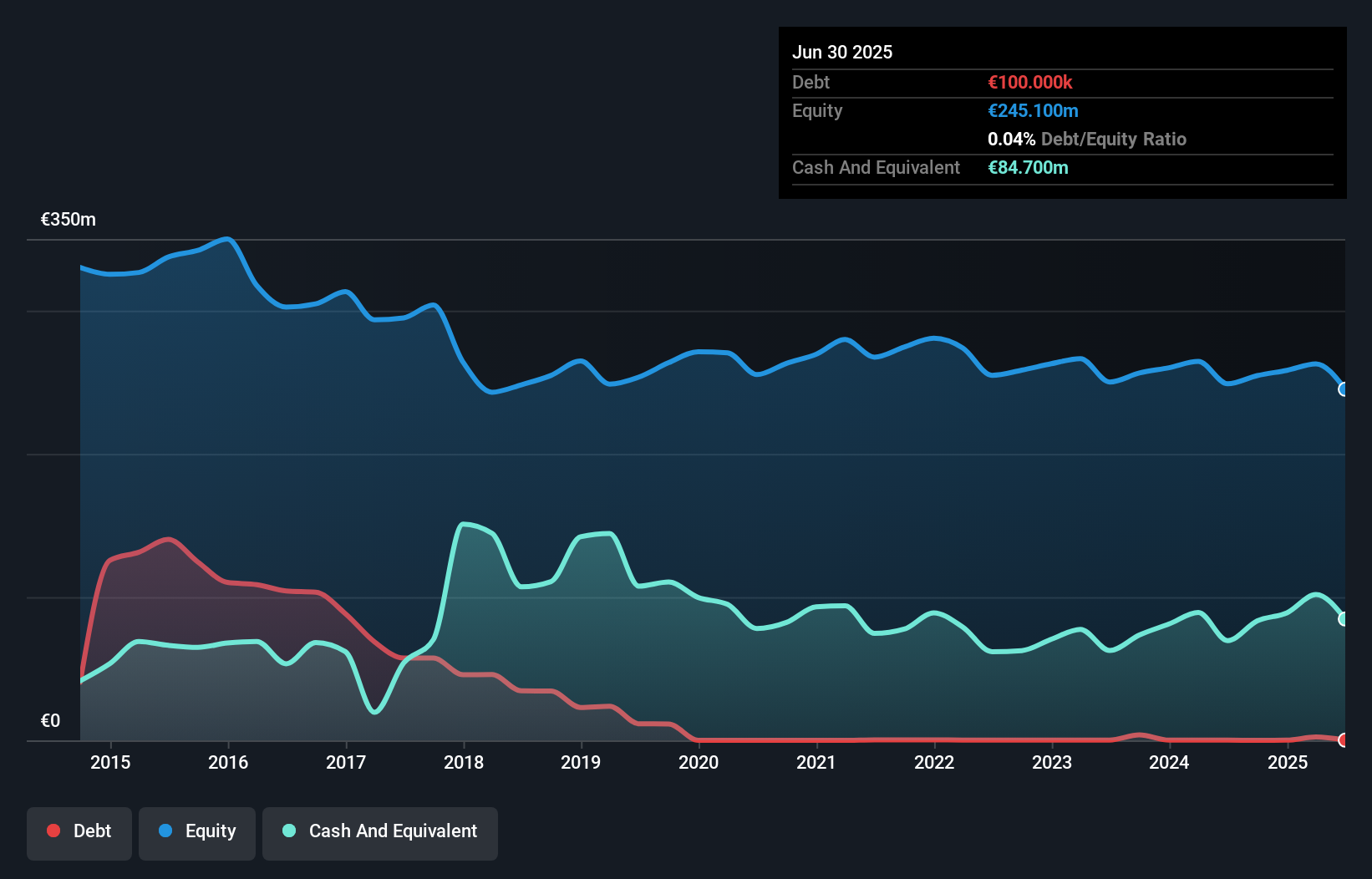

Raisio, a notable player in the food industry, is trading at 23.5% below its estimated fair value, which suggests potential for value investors. The company has demonstrated high-quality earnings and achieved a modest earnings growth of 0.5% over the past year, outpacing the broader food industry's -2.4%. Raisio's financial health appears robust with more cash than total debt and positive free cash flow standing at EUR 34.4 million as of September 2024. Recent executive changes include Anni Palmio's appointment as M&A Director to bolster strategic acquisitions, reflecting Raisio’s commitment to growth through strategic initiatives despite being dropped from an index recently.

- Navigate through the intricacies of Raisio with our comprehensive health report here.

Review our historical performance report to gain insights into Raisio's's past performance.

Baader Bank (XTRA:BWB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Baader Bank Aktiengesellschaft offers investment and banking services across Europe, with a market cap of €317.18 million.

Operations: Baader Bank generates revenue primarily through its investment and banking services across Europe. The company has a market capitalization of €317.18 million, reflecting its presence in the financial sector.

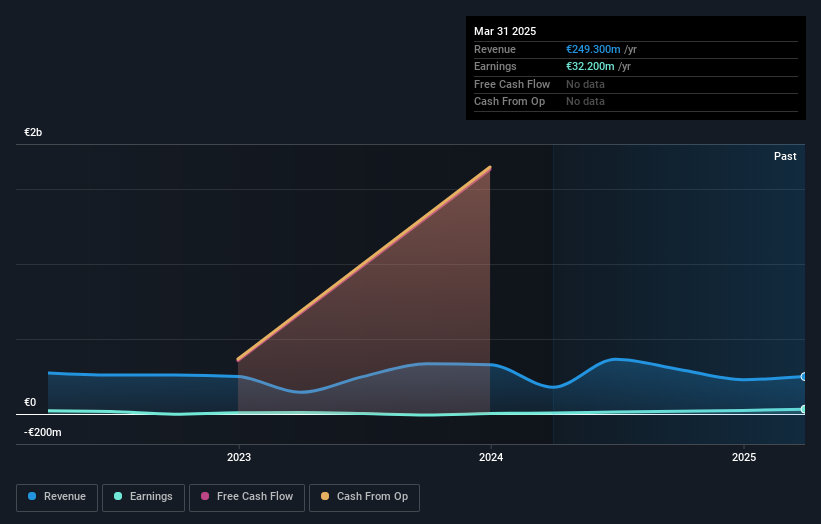

Baader Bank, a nimble player in the European financial landscape, has demonstrated robust earnings growth of 268% over the past year, outpacing its industry peers significantly. The bank's price-to-earnings ratio stands at 6.6x, notably below the German market average of 17.6x, suggesting potential value for investors. Despite a challenging five-year period with earnings declining by an average of 24% annually, Baader Bank's strategic alliances with AlphaValue and Erste Group are poised to enhance its research capabilities and investor reach across Europe and beyond. Additionally, its debt-to-equity ratio improved from 58% to 42%, indicating prudent financial management.

- Dive into the specifics of Baader Bank here with our thorough health report.

Gain insights into Baader Bank's past trends and performance with our Past report.

Next Steps

- Click this link to deep-dive into the 326 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Baader Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BWB

Solid track record with excellent balance sheet.

Market Insights

Community Narratives