- Finland

- /

- Food and Staples Retail

- /

- HLSE:KESKOB

Does Kesko's Lowered 2025 Outlook Challenge the Bull Case for HLSE:KESKOB?

Reviewed by Sasha Jovanovic

- Kesko Oyj recently announced its third-quarter 2025 results, showing sales of €3,227.3 million and net income of €139.1 million, alongside a lowered full-year 2025 profit guidance due to slower-than-expected recovery in building and technical trade.

- Despite the revised outlook for 2025, the company forecasts improved profitability across all divisions in 2026, reflecting management’s confidence in a broad-based business rebound.

- With cautious 2025 guidance and a more optimistic 2026 forecast, we'll explore how expectations for segment recovery shape Kesko’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Kesko Oyj's Investment Narrative?

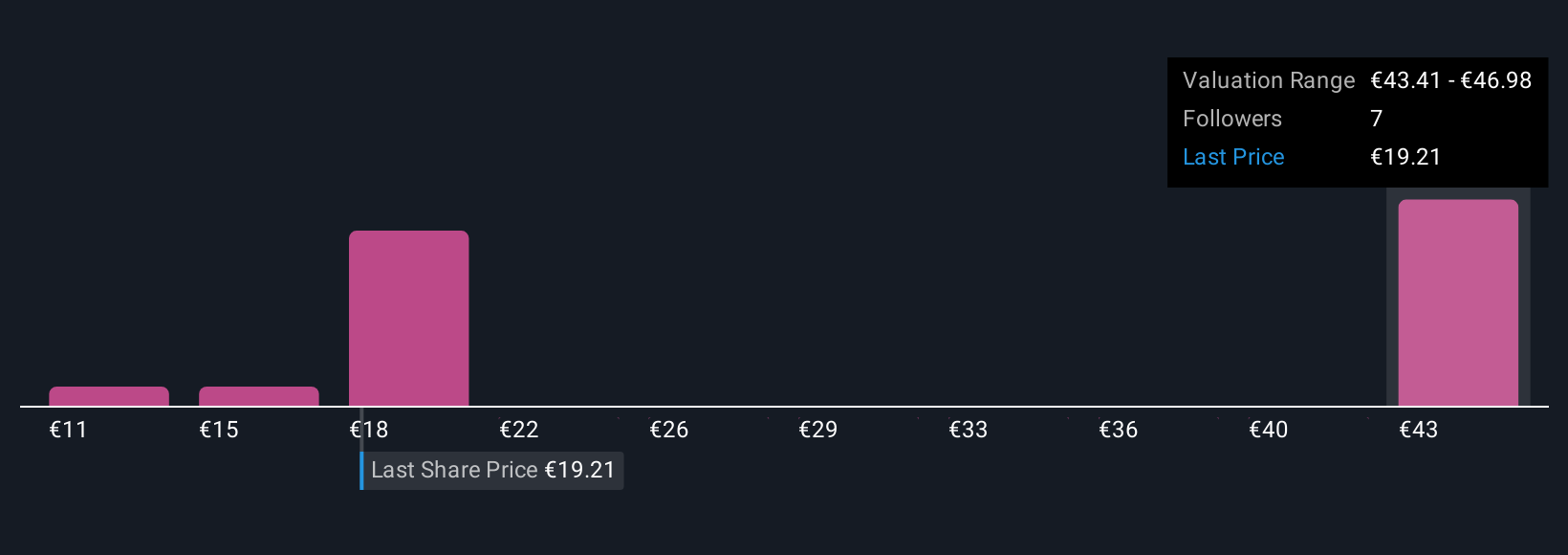

To be a Kesko Oyj shareholder right now, you need confidence in the company's ability to ride out a sluggish recovery in building and technical trade while navigating uncertain consumer and market conditions. The recent Q3 results show modest sales and profit growth, but the company has lowered its 2025 profit outlook, reflecting near-term challenges. This adjustment may dampen enthusiasm for a quick turnaround, making the 2026 recovery forecast a crucial short-term catalyst for sentiment and potential valuation resets. Compared to earlier analysis, risks such as weak consumer confidence and unpredictable investment appetites have become more pronounced, now taking center stage in Kesko’s narrative as profit and revenue growth continues to underperform industry and market averages. While longer-term management optimism remains unchanged, this guidance shift highlights that momentum may take time to rebuild.

Yet, cautious investors should keep in mind how fragile consumer confidence can quickly reshape expectations.

Exploring Other Perspectives

Explore 3 other fair value estimates on Kesko Oyj - why the stock might be worth 13% less than the current price!

Build Your Own Kesko Oyj Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kesko Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kesko Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kesko Oyj's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kesko Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:KESKOB

Kesko Oyj

Engages in the chain operations in Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Denmark, and Poland.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives