- Finland

- /

- Auto Components

- /

- HLSE:TYRES

Nokian Renkaat Oyj (HEL:TYRES) shareholders are up 7.9% this past week, but still in the red over the last three years

Nokian Renkaat Oyj (HEL:TYRES) shareholders should be happy to see the share price up 13% in the last month. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 70% in that time. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Nokian Renkaat Oyj

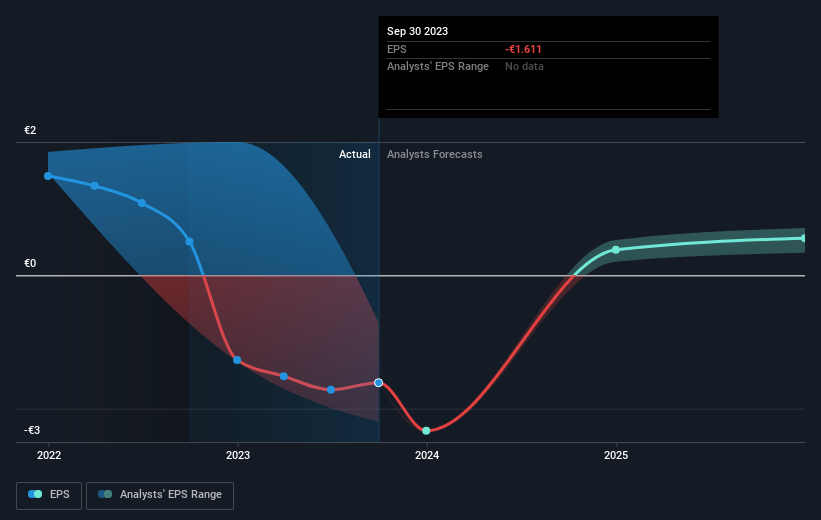

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the three years that the share price declined, Nokian Renkaat Oyj's earnings per share (EPS) dropped significantly, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Nokian Renkaat Oyj's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Nokian Renkaat Oyj the TSR over the last 3 years was -66%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Nokian Renkaat Oyj shareholders are down 17% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 9.0%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 10% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Nokian Renkaat Oyj you should know about.

Nokian Renkaat Oyj is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nokian Renkaat Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TYRES

Nokian Renkaat Oyj

Develops and manufactures tires in Finland, Nordics, the rest of Europe, the Americas, and internationally.

Reasonable growth potential and fair value.