- Spain

- /

- Telecom Services and Carriers

- /

- BME:TEF

Does Telefónica (BME:TEF) Tie Dividend Ambitions to Core Free Cash Flow Strength?

Reviewed by Sasha Jovanovic

- On November 4, 2025, Telefónica announced third quarter 2025 earnings and updated its dividend policy, confirming a proposed €0.15 per share cash dividend for 2026 and outlining a new payout framework tied to free cash flow for 2027 and 2028.

- This combination of financial disclosure and future dividend guidance has drawn heightened investor interest, particularly as the company signals a renewed focus on capital returns alongside operational performance.

- We'll now examine how Telefónica's updated dividend plan may reshape its investment narrative and outlook for shareholders.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Telefónica Investment Narrative Recap

To be a Telefónica shareholder today, you need confidence in its ability to leverage ongoing fiber and 5G investments, monetize digital services, and execute on portfolio streamlining to offset pressures from mature core markets and elevated debt. While the recently updated dividend policy affirms management’s commitment to capital returns, it does not materially shift the spotlight away from the company’s need to reduce high leverage, which continues to be a central risk and short-term catalyst for sentiment. The market’s primary focus remains on whether operational improvements and asset sales can meaningfully lower debt and unlock earnings growth.

Among the recent announcements, Telefónica’s Q3 2025 earnings are most relevant, with net income rising year over year despite a drop in sales. This improvement in profitability, albeit from a low base, provides context to the dividend update by giving investors some evidence of underlying cash flow generation capacity, which will be crucial to sustaining future payouts, especially as the new dividend framework ties remuneration directly to free cash flow targets.

Yet, in contrast to the optimism around dividend policy, investors should be aware of Telefónica’s persistent high leverage and how it could...

Read the full narrative on Telefónica (it's free!)

Telefónica's outlook anticipates €38.3 billion in revenue and €2.2 billion in earnings by 2028. This projection reflects a 2.6% annual revenue decline and a €3.0 billion increase in earnings from the current €-797.0 million.

Uncover how Telefónica's forecasts yield a €4.51 fair value, a 23% upside to its current price.

Exploring Other Perspectives

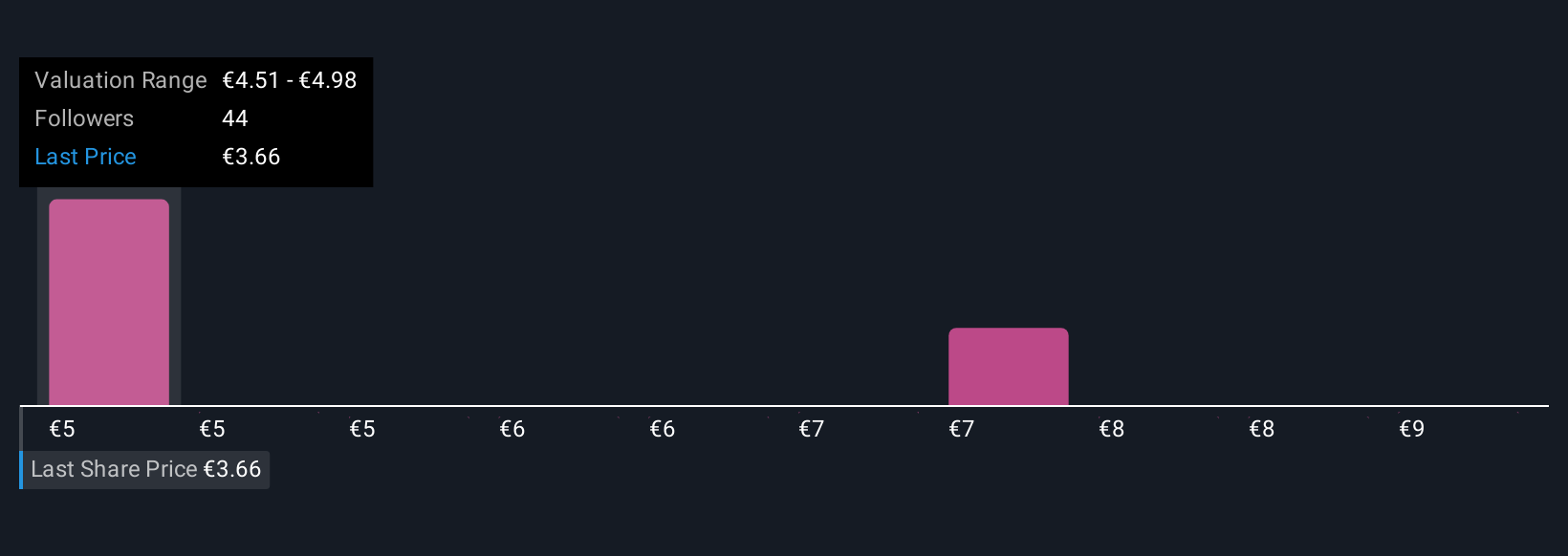

Five perspectives from the Simply Wall St Community place Telefónica’s fair value between €4.51 and €9.24 per share. As investors debate these differences, many still point to debt levels as a core influence on the company’s future path.

Explore 5 other fair value estimates on Telefónica - why the stock might be worth just €4.51!

Build Your Own Telefónica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telefónica research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Telefónica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telefónica's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefónica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:TEF

Telefónica

Provides telecommunications services in Europe and Latin America.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives