- Spain

- /

- Hospitality

- /

- BME:NHH

Is Minor Hotels Europe & Americas (BME:NHH) Undervalued? A Fresh Look at Current Market Pricing

Reviewed by Simply Wall St

Minor Hotels Europe & Americas (BME:NHH) may not have made headlines with a single event this week, but that fact alone is causing investors to pause for a closer look. Sometimes, when the news flow quiets down, it gives everyone a chance to re-evaluate what is truly baked into the share price. With the stock holding steady, the question shifts from reacting to the latest headline to asking whether current valuations are offering an opportunity or a warning sign about future expectations.

In the bigger picture, Minor Hotels Europe & Americas has delivered significant share price gains over the last year, with momentum remaining evident in recent months. Short-term moves have been modest, but the stock is up more than 58% over the past year, and triple-digit returns have built up over the longer term. At the same time, annual results show some contraction in both revenues and net profit, so there is a growing disconnect between recent financials and the ongoing strength of the share price.

With so much of the company’s growth potential seemingly recognized by the market, the key question is whether Minor Hotels Europe & Americas is cheap or if the market has already factored in all the upside that lies ahead.

Price-to-Earnings of 11.2x: Is it justified?

Minor Hotels Europe & Americas is currently trading at a Price-to-Earnings (P/E) ratio of 11.2x, which places it below both its peer group average and the European hospitality industry average.

The P/E ratio measures how much investors are willing to pay for each euro of the company's earnings. It serves as a gauge for perceived growth and profitability in this sector.

This lower multiple suggests that the market may be undervaluing Minor Hotels Europe & Americas relative to its peers. It is possible the market is overlooking its recent profit growth and high return on equity.

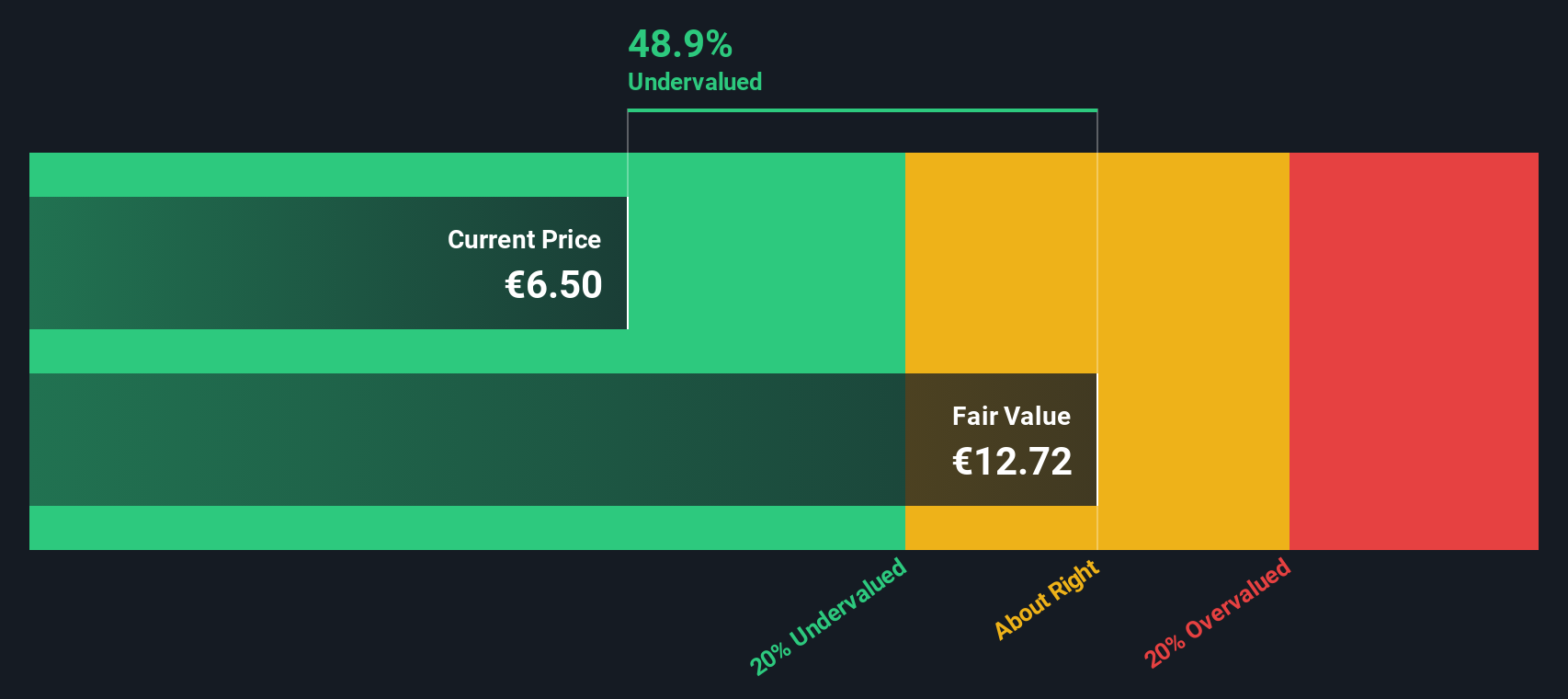

Result: Fair Value of €12.62 (UNDERVALUED)

See our latest analysis for Minor Hotels Europe & Americas.However, recent contractions in both annual revenue and net income remain potential risks that could challenge the case for sustained outperformance in the future.

Find out about the key risks to this Minor Hotels Europe & Americas narrative.Another View: What Does the DCF Model Suggest?

While market ratios suggest Minor Hotels Europe & Americas is trading below its sector, our SWS DCF model provides a different perspective. By estimating future cash flows, this approach concludes the company is undervalued. However, the question remains whether future estimates can really be trusted.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Minor Hotels Europe & Americas Narrative

If you think there’s another angle here or would rather dig into the numbers yourself, you can easily create your own take in just a few minutes. Do it your way

A great starting point for your Minor Hotels Europe & Americas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means spotting what others overlook. Fresh opportunities are waiting outside the obvious picks. Don’t let standout stocks pass you by—unlock more with these targeted lists:

- Uncover robust returns from small companies by checking out penny stocks with strong financials in penny stocks with strong financials.

- Expand your income potential and see which companies are offering attractive yields with dividend stocks with yields > 3%.

- Catalyze your portfolio with innovative businesses shaping medicine’s future. Find the top contenders in healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:NHH

Minor Hotels Europe & Americas

Operates hotels in Spain, Italy, Southern Europe, the United States, Central Europe, Benelux, Latin America, and Central Services.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives