- Spain

- /

- Construction

- /

- BME:GSJ

Discover 3 Promising Penny Stocks With Market Cap Over US$300M

Reviewed by Simply Wall St

Global markets have experienced a turbulent week, with major indices finishing mostly lower amid a flurry of earnings reports and economic data releases. Despite these challenges, certain investment opportunities continue to capture attention, particularly in the realm of penny stocks. Although the term "penny stocks" might seem outdated, it still represents an intriguing segment of the market where smaller or newer companies can offer growth potential at accessible price points. In this article, we explore three promising penny stocks that combine strong financial health with potential for long-term growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Seafco (SET:SEAFCO) | THB2.28 | THB1.85B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.52 | MYR756.88M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.255 | £849.6M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.78 | £207.57M | ★★★★★★ |

Click here to see the full list of 5,787 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Grupo Empresarial San José (BME:GSJ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grupo Empresarial San José, S.A. operates in the construction industry both in Spain and internationally, with a market cap of €306.92 million.

Operations: The company's revenue is primarily derived from its Construction segment (€1.33 billion), followed by Concessions and Services (€72.79 million), Energy (€10.63 million), and Real Estate and Urban Development (€9.61 million).

Market Cap: €306.92M

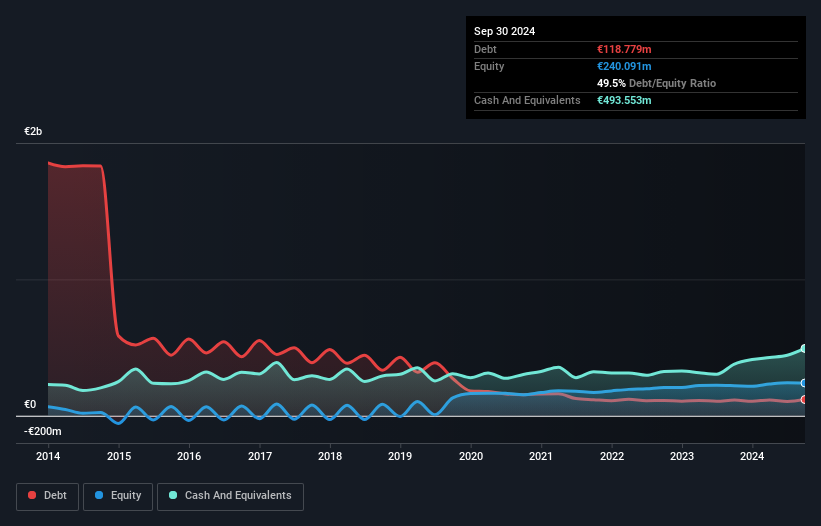

Grupo Empresarial San José, with a market cap of €306.92 million, shows mixed signals for investors interested in smaller-cap stocks. The company operates primarily in the construction sector with significant revenues from this segment (€1.33 billion). Its debt is well-managed, covered by operating cash flow and short-term assets exceeding liabilities. However, despite high-quality earnings and recent profit growth (93%), its Return on Equity remains low at 13.4%, and earnings are expected to decline by 7.7% annually over the next three years. The Price-To-Earnings ratio (9.1x) suggests it trades below market value but dividend stability is uncertain.

- Get an in-depth perspective on Grupo Empresarial San José's performance by reading our balance sheet health report here.

- Examine Grupo Empresarial San José's earnings growth report to understand how analysts expect it to perform.

Global Green Chemicals (SET:GGC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Global Green Chemicals Public Company Limited is involved in the production, distribution, and transportation of oleochemical products across Thailand, China, India, Korea, and other international markets with a market cap of THB5.02 billion.

Operations: The company's revenue is primarily derived from Methyl Ester at THB11.76 billion and Fatty Alcohols at THB5.53 billion.

Market Cap: THB5.02B

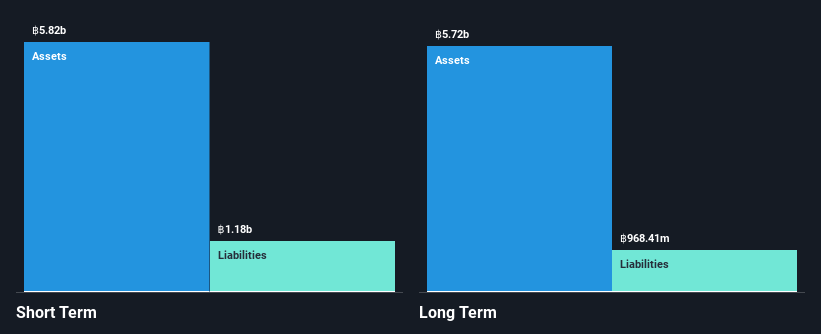

Global Green Chemicals Public Company Limited, with a market cap of THB5.02 billion, presents a complex picture for investors. Despite having more cash than total debt and short-term assets exceeding both short- and long-term liabilities, the company remains unprofitable with losses increasing 19% annually over five years. The management team is experienced; however, the board's inexperience may be a concern. Trading at 48.6% below estimated fair value suggests potential undervaluation compared to peers, though its negative Return on Equity (-5.04%) and unsustainable dividend raise caution about financial health and future profitability prospects in the oleochemical sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Global Green Chemicals.

- Learn about Global Green Chemicals' future growth trajectory here.

D&O Home Collection GroupLTD (SZSE:002798)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: D&O Home Collection Group Co., LTD is engaged in the production and sale of sanitary ware and architectural ceramic products in China, with a market cap of CN¥1.54 billion.

Operations: Currently, no specific revenue segments are reported for the company.

Market Cap: CN¥1.54B

D&O Home Collection Group Co., LTD, with a market cap of CN¥1.54 billion, faces significant challenges as it remains unprofitable with increasing losses over the past five years. Despite this, the company has a stable weekly volatility and its short-term assets exceed both short- and long-term liabilities, indicating some financial resilience. The management team and board are experienced, which may provide strategic stability amid financial difficulties. However, the high net debt to equity ratio (103%) raises concerns about leverage levels. Recent earnings showed a decline in sales and increased net loss compared to last year, further emphasizing financial struggles.

- Click to explore a detailed breakdown of our findings in D&O Home Collection GroupLTD's financial health report.

- Gain insights into D&O Home Collection GroupLTD's past trends and performance with our report on the company's historical track record.

Key Takeaways

- Get an in-depth perspective on all 5,787 Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GSJ

Grupo Empresarial San José

Engages in construction business in Spain and internationally.

Flawless balance sheet with proven track record.