- Spain

- /

- Electrical

- /

- BME:ART

Exploring Europe's Undiscovered Gems In November 2025

Reviewed by Simply Wall St

As of late October 2025, the European market has shown mixed performance with the pan-European STOXX Europe 600 Index slightly declining after reaching a new high, while expectations for further interest rate cuts from the European Central Bank have diminished. Despite these fluctuations, economic indicators such as steady inflation near target and modest GDP growth suggest underlying resilience in the region's economy. In this context, identifying promising stocks involves looking for companies that can thrive amid shifting monetary policies and geopolitical uncertainties. These undiscovered gems often exhibit strong fundamentals and adaptability to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Arteche Lantegi Elkartea (BME:ART)

Simply Wall St Value Rating: ★★★★★☆

Overview: Arteche Lantegi Elkartea, S.A. specializes in designing, manufacturing, integrating, and supplying electrical equipment and solutions with a focus on renewable energy and smart grids globally, with a market cap of €1.13 billion.

Operations: Arteche generates revenue primarily from three segments: Systems Measurement and Monitoring (€352.38 million), Automation of Transmission and Distribution Networks (€79.77 million), and Network Reliability (€46.51 million).

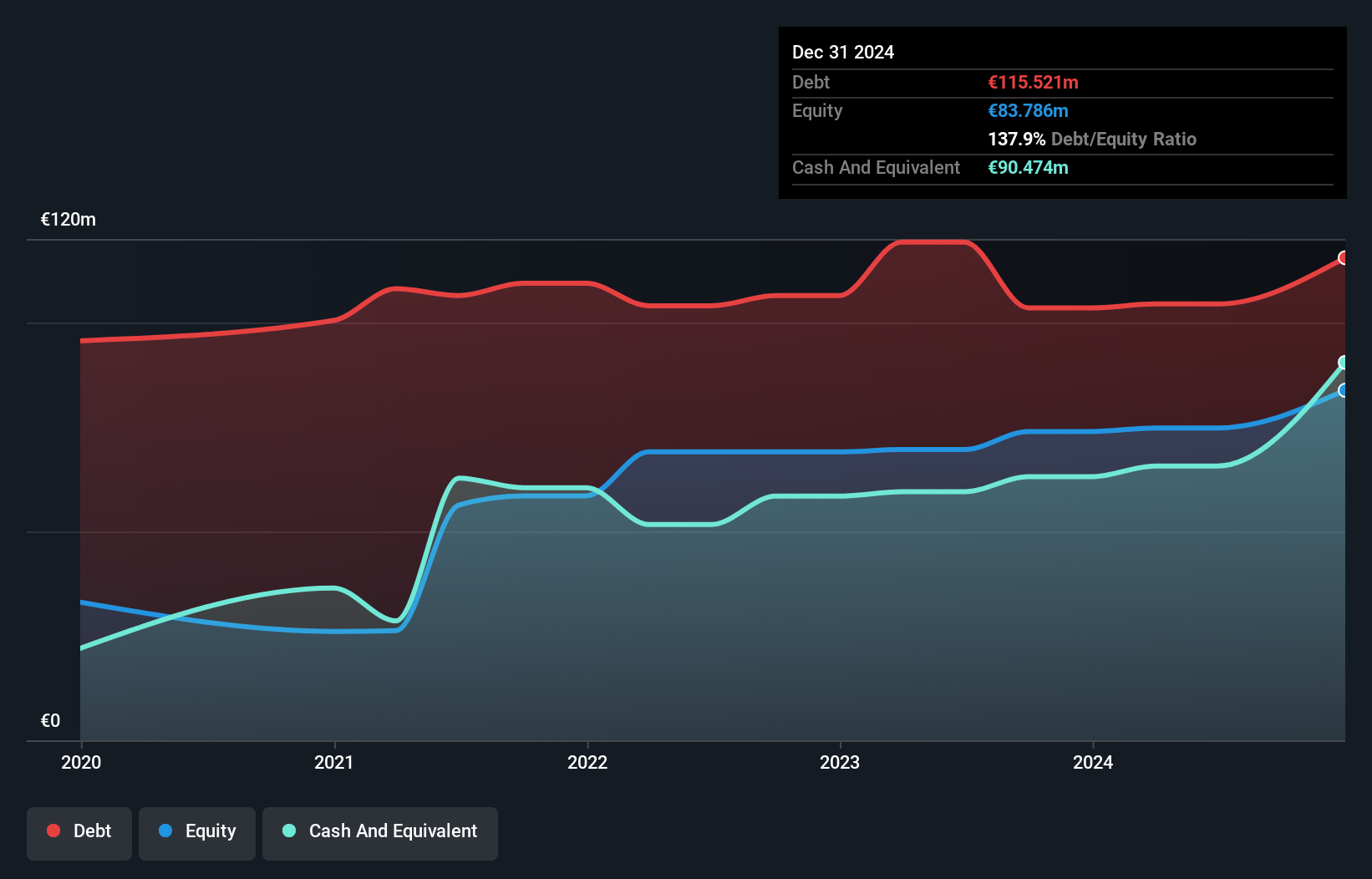

Arteche Lantegi Elkartea, a key player in electrical equipment for renewables and smart grids, showcases impressive earnings growth of 120.6% over the past year, outpacing the Electrical industry average of 9.3%. Despite a high net debt to equity ratio at 41.3%, its interest payments are well covered with EBIT at 9.4 times coverage. Recent half-year results highlight sales climbing to €244 million from €212 million last year, while net income jumped to €19.91 million from €7.42 million previously; basic earnings per share rose to €0.35 from €0.13, reflecting strong financial performance amid industry challenges and opportunities in electrification demand.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. offers infrastructure, application, and consulting services in France with a market cap of €1 billion.

Operations: Neurones S.A. generates revenue primarily from infrastructure services (€510.40 million), application services (€271.70 million), and consulting (€50.08 million).

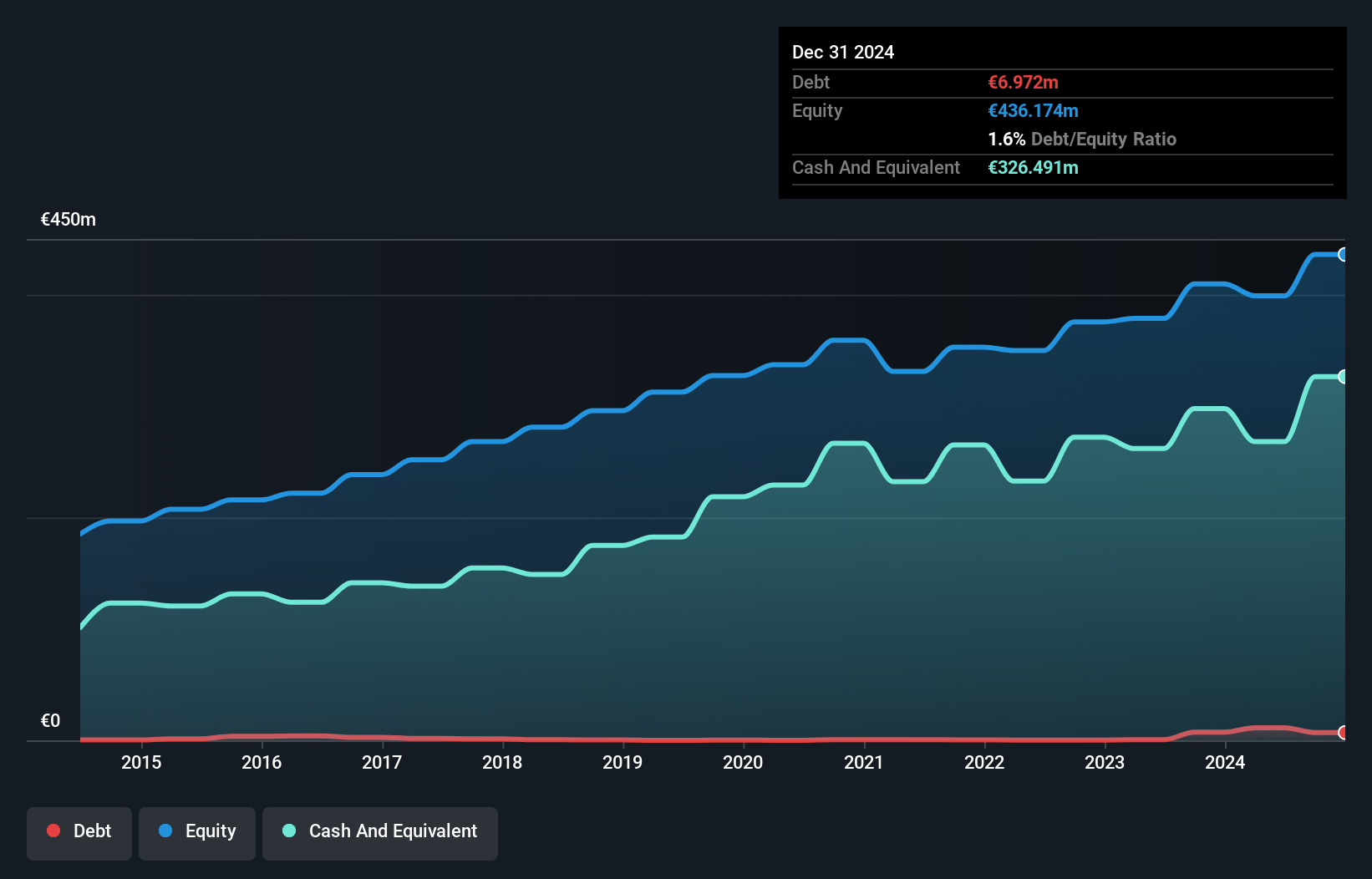

Neurones, a notable player in the IT sector, stands out with its robust financial health, evidenced by high-quality earnings and a solid net income of €22.7 million for the first half of 2025. Despite facing an uncertain economic climate, it confirmed its full-year guidance with expected revenues nearing €850 million and an operating profit around 8%. The company has shown resilience with earnings growth of 4.6% over the past year, surpassing industry averages. Its debt-to-equity ratio has risen to 1.5% over five years but remains manageable given that cash exceeds total debt levels, ensuring financial stability moving forward.

- Unlock comprehensive insights into our analysis of Neurones stock in this health report.

Explore historical data to track Neurones' performance over time in our Past section.

Apotea (OM:APOTEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Apotea AB (publ) operates an online pharmacy in Sweden with a market cap of SEK9.31 billion.

Operations: Apotea AB's primary revenue stream is from its online retail operations, generating SEK6.94 billion. The company's financial performance can be further analyzed by examining its profit margins over time to gain insights into its profitability dynamics.

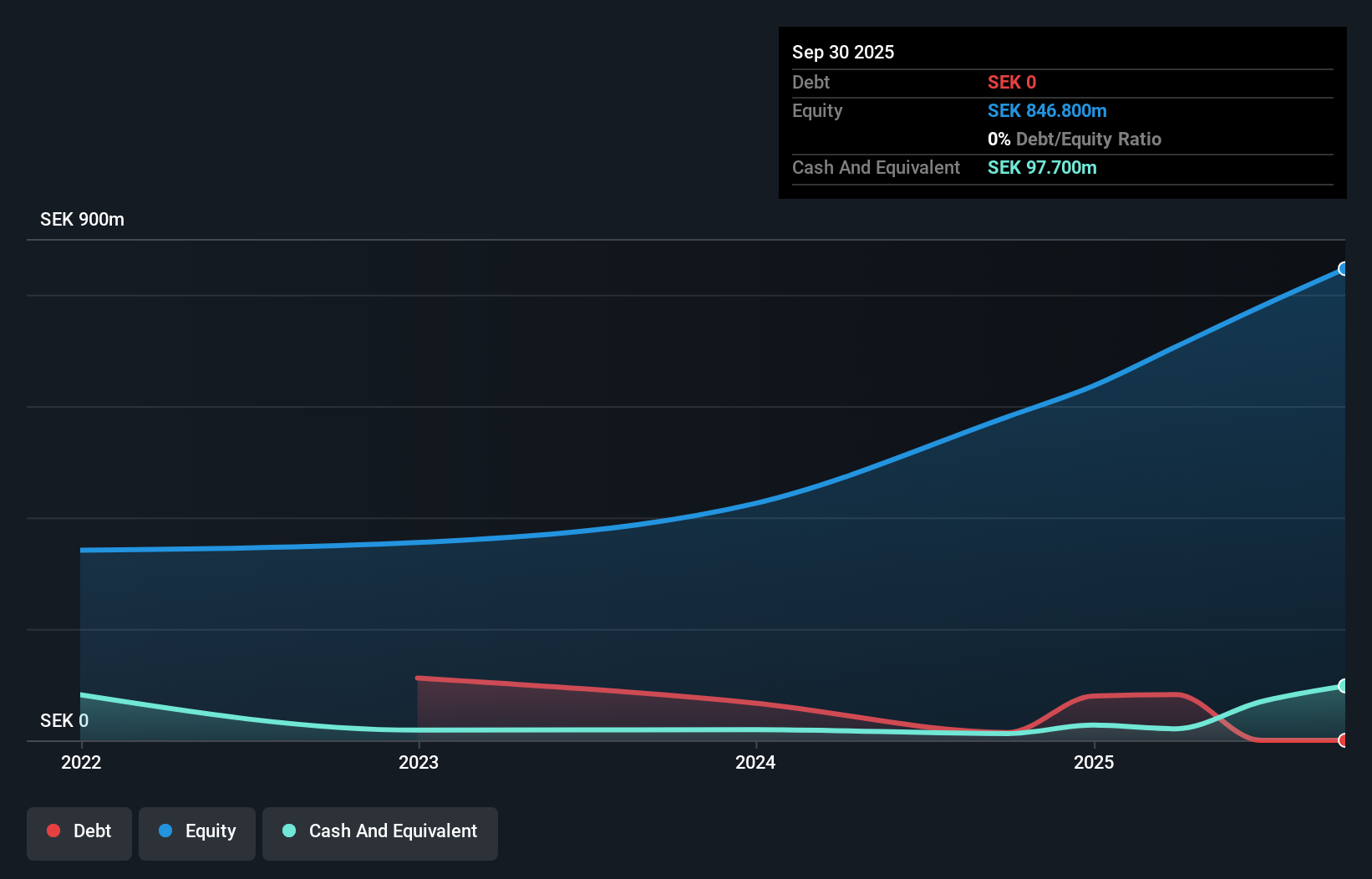

Apotea, a nimble player in the retail sector, showcases robust financial health with zero debt and impressive earnings growth of 58.8% over the past year, outpacing its industry peers who saw a 2.6% dip. Recent quarterly results highlight sales reaching SEK 1,769 million from SEK 1,625 million last year and net income climbing to SEK 69.6 million from SEK 56.2 million previously. Trading at about half its estimated fair value suggests potential upside for investors seeking undervalued opportunities in Europe’s market landscape while maintaining high-quality earnings and positive free cash flow further bolsters its appeal.

- Click here to discover the nuances of Apotea with our detailed analytical health report.

Understand Apotea's track record by examining our Past report.

Taking Advantage

- Reveal the 324 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ART

Arteche Lantegi Elkartea

Engages in the design, manufacture, integration, and supply of electrical equipment and solutions focusing on renewable energy and smart grids in Spain and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives