- Estonia

- /

- Real Estate

- /

- TLSE:PKG1T

AS Pro Kapital Grupp's (TAL:PKG1T) Fundamentals Look Pretty Strong: Could The Market Be Wrong About The Stock?

AS Pro Kapital Grupp (TAL:PKG1T) has had a rough week with its share price down 10%. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Particularly, we will be paying attention to AS Pro Kapital Grupp's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for AS Pro Kapital Grupp is:

9.3% = €5.4m ÷ €57m (Based on the trailing twelve months to June 2025).

The 'return' is the income the business earned over the last year. That means that for every €1 worth of shareholders' equity, the company generated €0.09 in profit.

View our latest analysis for AS Pro Kapital Grupp

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of AS Pro Kapital Grupp's Earnings Growth And 9.3% ROE

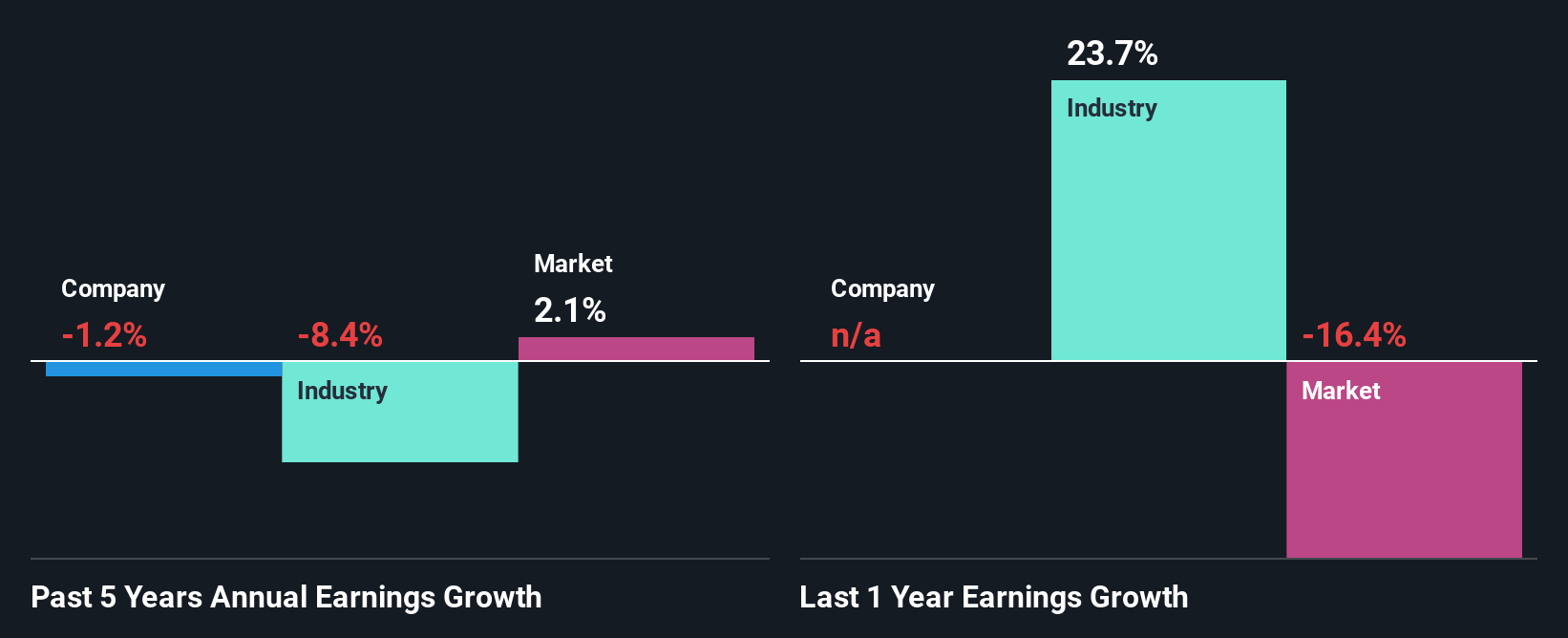

At first glance, AS Pro Kapital Grupp's ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 6.0% which we definitely can't overlook. However, AS Pro Kapital Grupp has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is a bit low to begin with, just that it is higher than the industry average. Therefore, the low to flat growth in earnings could also be the result of this.

As a next step, we compared AS Pro Kapital Grupp's performance with the industry and discovered the industry has shrunk at a rate of 8.4% in the same period meaning that the company has been shrinking its earnings at a rate lower than the industry. This does offer shareholders some relief

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is AS Pro Kapital Grupp fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is AS Pro Kapital Grupp Making Efficient Use Of Its Profits?

AS Pro Kapital Grupp doesn't pay any regular dividends, meaning that the company is keeping all of its profits, which makes us wonder why it is retaining its earnings if it can't use them to grow its business. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Conclusion

Overall, we feel that AS Pro Kapital Grupp certainly does have some positive factors to consider. However, while the company does have a decent ROE and a high profit retention, its earnings growth number is quite disappointing. This suggests that there might be some external threat to the business, that's hampering growth. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on AS Pro Kapital Grupp and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TLSE:PKG1T

AS Pro Kapital Grupp

A real estate development company, purchases, develops, operates, manages, rents, and sells commercial and residential real estate properties in Estonia, Latvia, Germany, Lithuania, and Italy.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives