- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

What A.P. Møller - Mærsk (CPSE:MAERSK B)'s Q3 Profit Decline Means for Shareholders Amid Market Pressures

Reviewed by Sasha Jovanovic

- A.P. Møller - Mærsk A/S announced third quarter 2025 results, reporting sales of US$14.21 billion and net income of US$1.05 billion, both down from the same period last year.

- Over the first nine months of 2025, sales held relatively steady year-on-year, but net income and earnings per share fell markedly, highlighting ongoing pressures on profitability.

- We’ll examine how the recent earnings decline could impact Maersk’s longer-term outlook, especially amid challenging global freight market trends.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

A.P. Møller - Mærsk Investment Narrative Recap

To be a shareholder in A.P. Møller - Mærsk, you need confidence in the company's ability to maintain its leadership through integrated logistics, resilient terminal operations, and efficiency gains, especially as profit margins remain under pressure from cyclical freight rate declines. The recent earnings drop is significant for short-term sentiment, but unless underlying demand or trade policies shift further, it does not materially change the most immediate catalyst: the scale of ongoing savings from the Gemini network, nor does it lessen the structural risk of overcapacity-driven freight rate declines.

The most relevant recent announcement is Maersk's third-quarter 2025 results, which highlight both steady revenue and sharply lower profits year-on-year. This echoes the challenge facing the company, as cost savings from operational initiatives like the Gemini network are being tested by weaker freight pricing, reinforcing the need for ongoing improvements if margins are to stabilize and earnings volatility is to be reduced further.

In contrast, investors should be aware that when temporary market conditions such as port congestion fade, freight rates, and therefore profitability, could...

Read the full narrative on A.P. Møller - Mærsk (it's free!)

A.P. Møller - Mærsk is expected to report $50.9 billion in revenue and $1.2 billion in earnings by 2028. This forecast reflects a 3.6% annual revenue decline and a $5.7 billion decrease in earnings from current earnings of $6.9 billion.

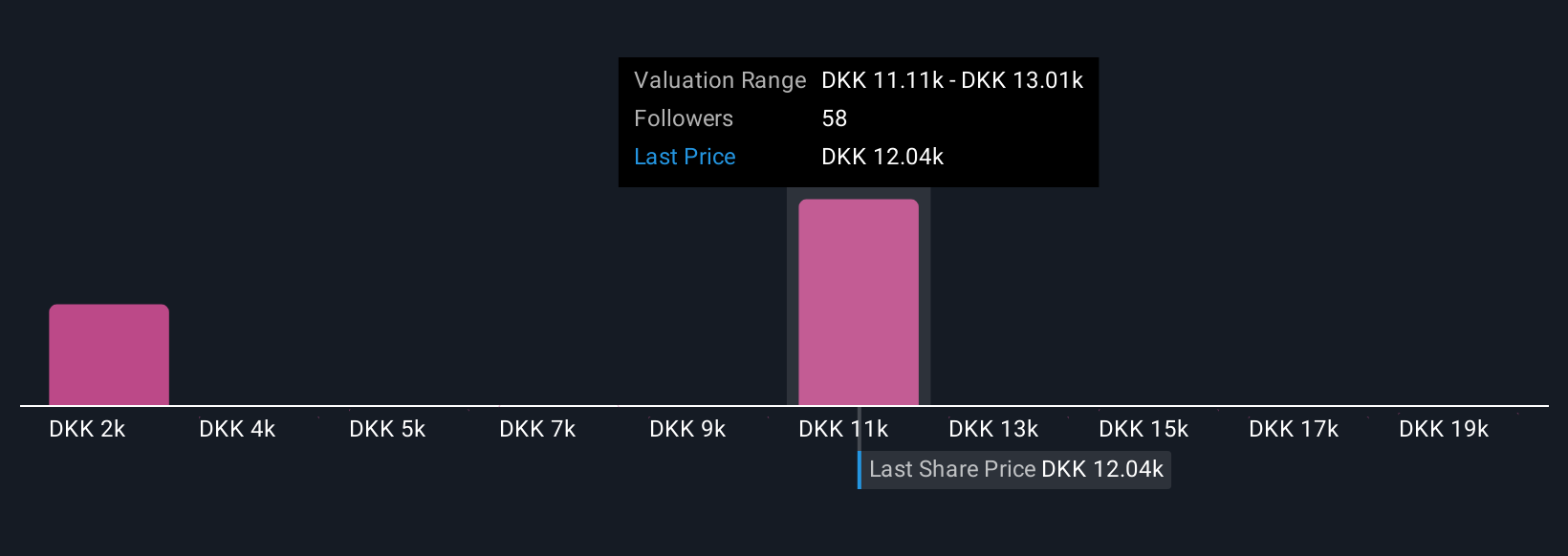

Uncover how A.P. Møller - Mærsk's forecasts yield a DKK11925 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Seven community fair value estimates for Maersk range from US$8,410 to US$20,587, revealing wide divergence among Simply Wall St Community members. Against these varied outlooks, the risk of declining freight rates poses a key challenge for the company’s earnings trajectory going forward.

Explore 7 other fair value estimates on A.P. Møller - Mærsk - why the stock might be worth as much as 60% more than the current price!

Build Your Own A.P. Møller - Mærsk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your A.P. Møller - Mærsk research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free A.P. Møller - Mærsk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate A.P. Møller - Mærsk's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives