SimCorp A/S (CPH:SIM) has announced that it will pay a dividend of €7.50 per share on the 28th of March. This makes the dividend yield 1.5%, which will augment investor returns quite nicely.

Check out our latest analysis for SimCorp

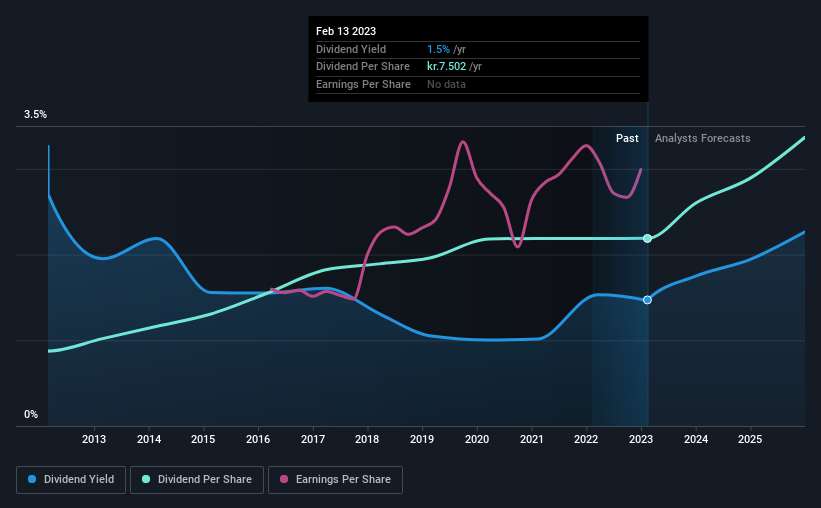

SimCorp Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, SimCorp was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to expand by 51.4%. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio getting very high over the next year.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the annual payment back then was €0.403, compared to the most recent full-year payment of €1.01. This implies that the company grew its distributions at a yearly rate of about 9.6% over that duration. We like to see dividends have grown at a reasonable rate, but with at least one substantial cut in the payments, we're not certain this dividend stock would be ideal for someone intending to live on the income.

SimCorp Could Grow Its Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. SimCorp has impressed us by growing EPS at 8.4% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

SimCorp Looks Like A Great Dividend Stock

In summary, it is good to see that the dividend is staying consistent, and we don't think there is any reason to suspect this might change over the medium term. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All of these factors considered, we think this has solid potential as a dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for SimCorp that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:SIM

SimCorp

SimCorp A/S, together with its subsidiaries, provides investment management solutions for asset management, fund management, insurance, life/pension, central banks, asset servicing, treasury, sovereign wealth, and wealth management companies.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Grid Modernizer: Leidos and the $2.4 Billion Bet on Sovereign AI and Energy

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.