- China

- /

- Electrical

- /

- SZSE:002335

3 Companies That May Be Priced Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive sentiment and geopolitical developments, investors are increasingly looking for opportunities that may be overlooked in the current bullish environment. Identifying stocks priced below their estimated intrinsic value can offer potential for growth and stability, especially when broader market indices are performing well.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY41.22 | TRY82.15 | 49.8% |

| PharmaResearch (KOSDAQ:A214450) | ₩213500.00 | ₩426006.27 | 49.9% |

| Giant Biogene Holding (SEHK:2367) | HK$48.30 | HK$96.27 | 49.8% |

| DAEDUCK ELECTRONICS (KOSE:A353200) | ₩14050.00 | ₩28039.12 | 49.9% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| Enento Group Oyj (HLSE:ENENTO) | €18.02 | €35.91 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.726 | €5.42 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.84 | €15.60 | 49.7% |

| First Advantage (NasdaqGS:FA) | US$19.37 | US$38.63 | 49.9% |

| AeroVironment (NasdaqGS:AVAV) | US$203.19 | US$404.34 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

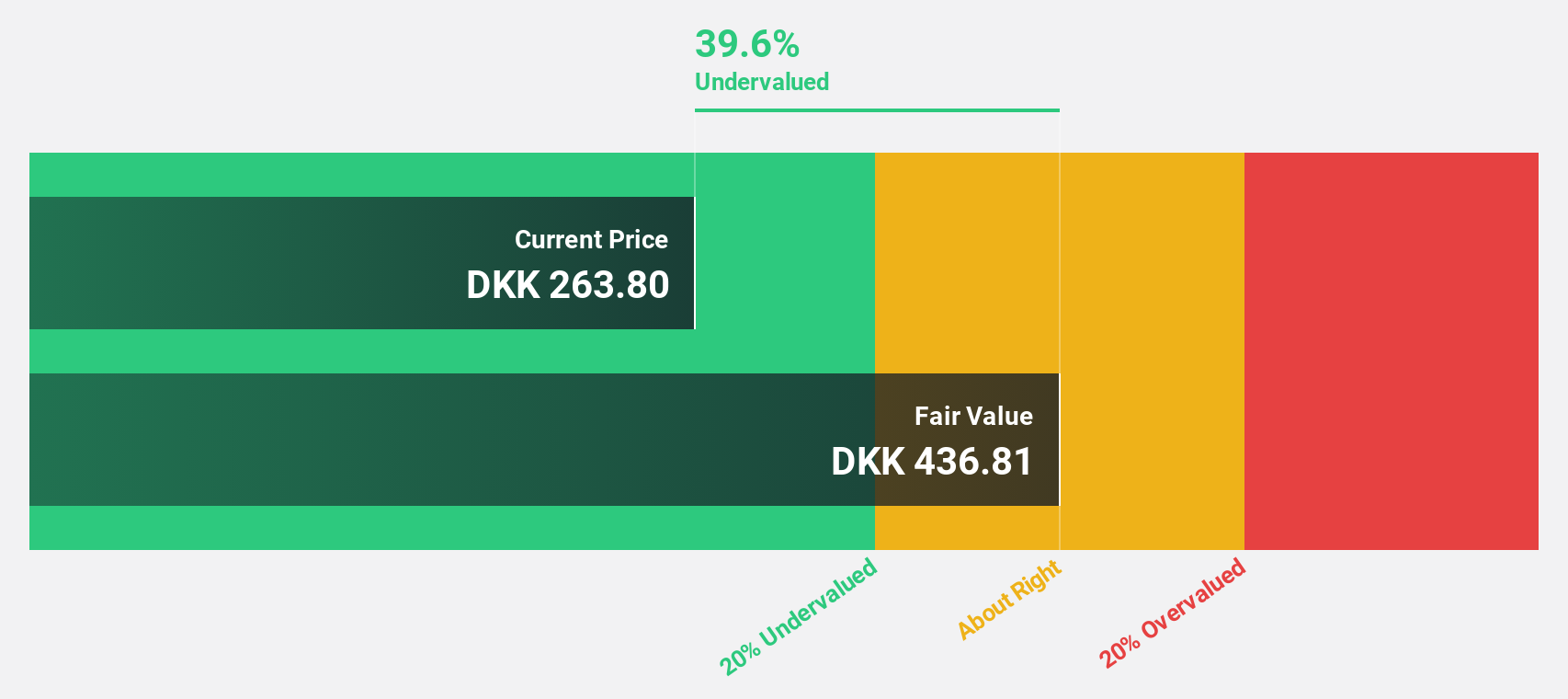

Netcompany Group (CPSE:NETC)

Overview: Netcompany Group A/S is an IT services company that provides business-critical IT solutions to public and private sector clients across several countries including Denmark, Norway, the UK, and others, with a market cap of DKK17.28 billion.

Operations: Revenue segments for the company include DKK4.41 billion from public sector clients and DKK2.04 billion from private sector clients.

Estimated Discount To Fair Value: 28.9%

Netcompany Group is trading at DKK364, significantly below its estimated fair value of DKK512.28, indicating potential undervaluation based on cash flows. The company reported strong earnings growth for Q3 2024, with net income rising to DKK139.5 million from DKK79.8 million a year ago and basic EPS increasing to DKK2.89 from DKK1.61. Despite high debt levels, its forecasted annual profit growth of 30% outpaces the Danish market's average of 11.9%.

- Upon reviewing our latest growth report, Netcompany Group's projected financial performance appears quite optimistic.

- Take a closer look at Netcompany Group's balance sheet health here in our report.

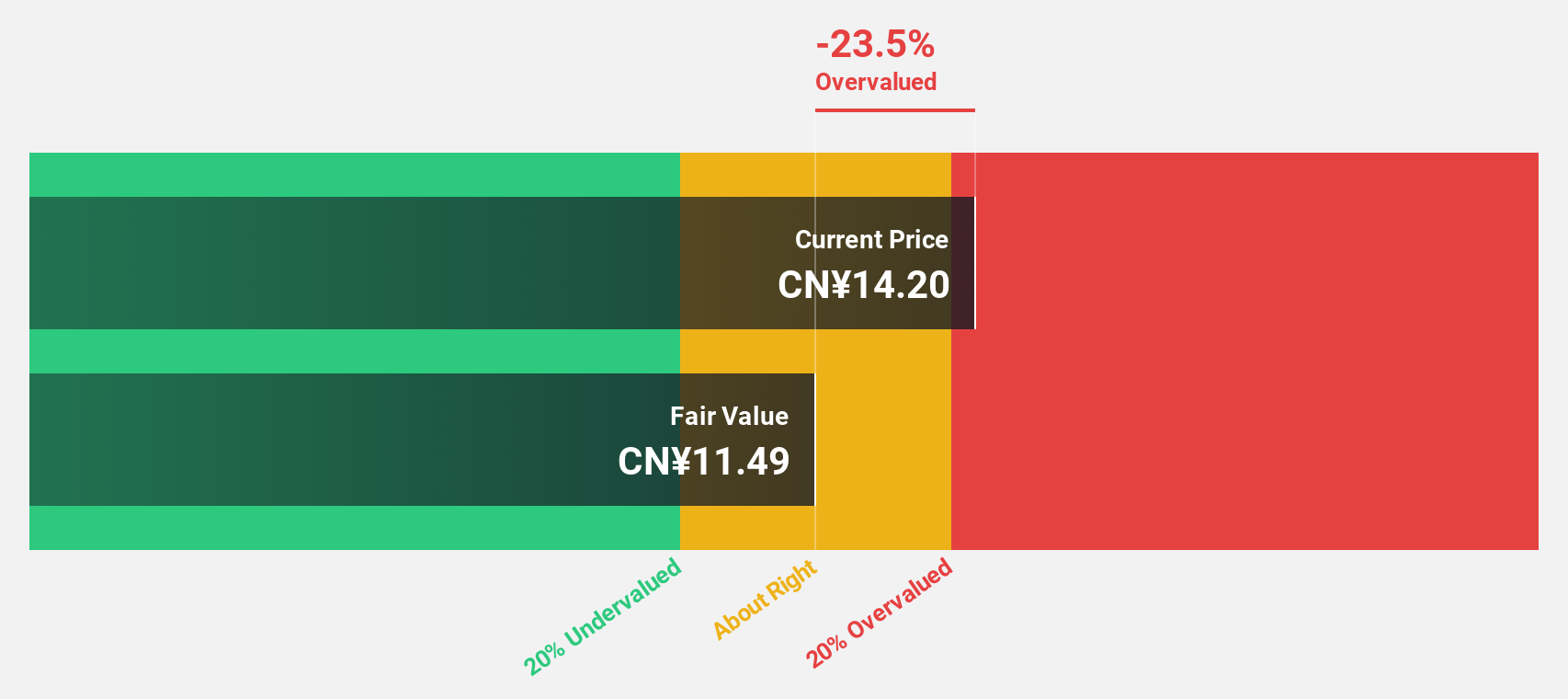

Harbin Dongan Auto EngineLtd (SHSE:600178)

Overview: Harbin Dongan Auto Engine Co., Ltd. produces and markets automobile products with a market cap of CN¥6.07 billion.

Operations: The company generates revenue of CN¥4.55 billion from its auto parts manufacturing segment.

Estimated Discount To Fair Value: 24.5%

Harbin Dongan Auto Engine Ltd is trading at CNY 12.9, over 20% below its estimated fair value of CNY 17.08, suggesting potential undervaluation based on cash flows. Despite a volatile share price and recent net loss of CNY 1.6 million for the first nine months of 2024, revenue is forecast to grow at an annual rate of 23.8%, outpacing the Chinese market's average growth rate and indicating strong future prospects despite low expected return on equity.

- In light of our recent growth report, it seems possible that Harbin Dongan Auto EngineLtd's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Harbin Dongan Auto EngineLtd.

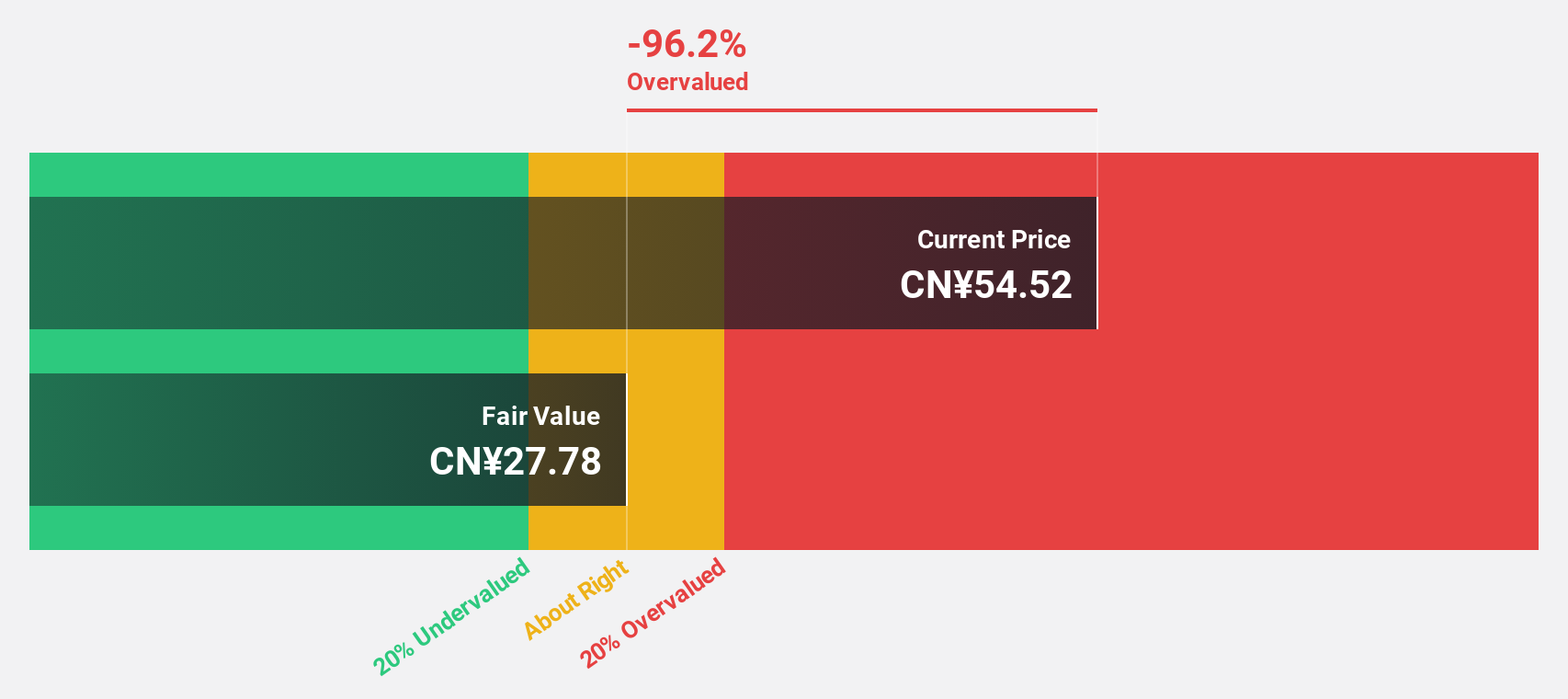

Kehua Data (SZSE:002335)

Overview: Kehua Data Co., Ltd. offers integrated solutions for power protection and energy conservation globally, with a market cap of CN¥11.15 billion.

Operations: The company's revenue segments focus on providing integrated solutions for power protection and energy conservation across global markets.

Estimated Discount To Fair Value: 47.2%

Kehua Data is trading at CN¥24.16, significantly below its estimated fair value of CN¥45.73, highlighting potential undervaluation based on cash flows. Despite a decrease in net income to CN¥238.07 million for the first nine months of 2024 compared to last year, earnings are projected to grow substantially at 42% annually over the next three years, outpacing both revenue growth and the Chinese market average, though profit margins have declined recently.

- Our growth report here indicates Kehua Data may be poised for an improving outlook.

- Click here to discover the nuances of Kehua Data with our detailed financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 900 Undervalued Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kehua Data might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002335

Kehua Data

Provides integrated solutions for power protection and energy conservation worldwide.

Flawless balance sheet with reasonable growth potential.