- Denmark

- /

- Life Sciences

- /

- CPSE:GUBRA

Do Recent Insider Purchases at Gubra (CPSE:GUBRA) Hint at Shifting Leadership Convictions?

Reviewed by Sasha Jovanovic

- In recent days, several Gubra board members, including co-founder Jacob Jelsing, Chairman Monika Lessl, and CEO Markus Rohrwild, purchased company shares on NASDAQ Copenhagen, with total acquisitions exceeding DKK 16.6 million.

- This wave of insider buying was disclosed in official announcements and often signals heightened confidence in Gubra’s outlook among its leadership.

- We'll examine how these substantial insider share purchases may impact perceptions of Gubra’s resilience amid shifting biotech and CRO industry conditions.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Gubra Investment Narrative Recap

To be a shareholder in Gubra, you need conviction in the continued expansion of global metabolic disease pipelines and confidence that industry partnerships can drive long-term revenue, despite lumpiness in Discovery & Partnerships income. The recent insider buying by Gubra's leadership, while reinforcing management’s confidence, does not materially shift the immediate catalyst, clarity on U.S. biotech funding environment and recovery of CRO revenue growth remains key. Ongoing funding risks from prolonged market weakness remain a top concern for near-term performance.

The most relevant recent announcement is Gubra’s revised earnings guidance from August, which now points to organic revenue growth slightly below 2024 levels, reflecting challenging external conditions. This update frames the insider purchases as occurring against a backdrop of CRO market pressure and cautious management projections for the remainder of the year. However, against this cautious outlook, it is hard to ignore...

Read the full narrative on Gubra (it's free!)

Gubra's outlook anticipates DKK256.6 million in revenue and DKK188.4 million in earnings by 2028. This reflects a 54.0% annual decline in revenue and a decrease in earnings of DKK1.5 billion from current earnings of DKK1.7 billion.

Uncover how Gubra's forecasts yield a DKK502.50 fair value, a 24% upside to its current price.

Exploring Other Perspectives

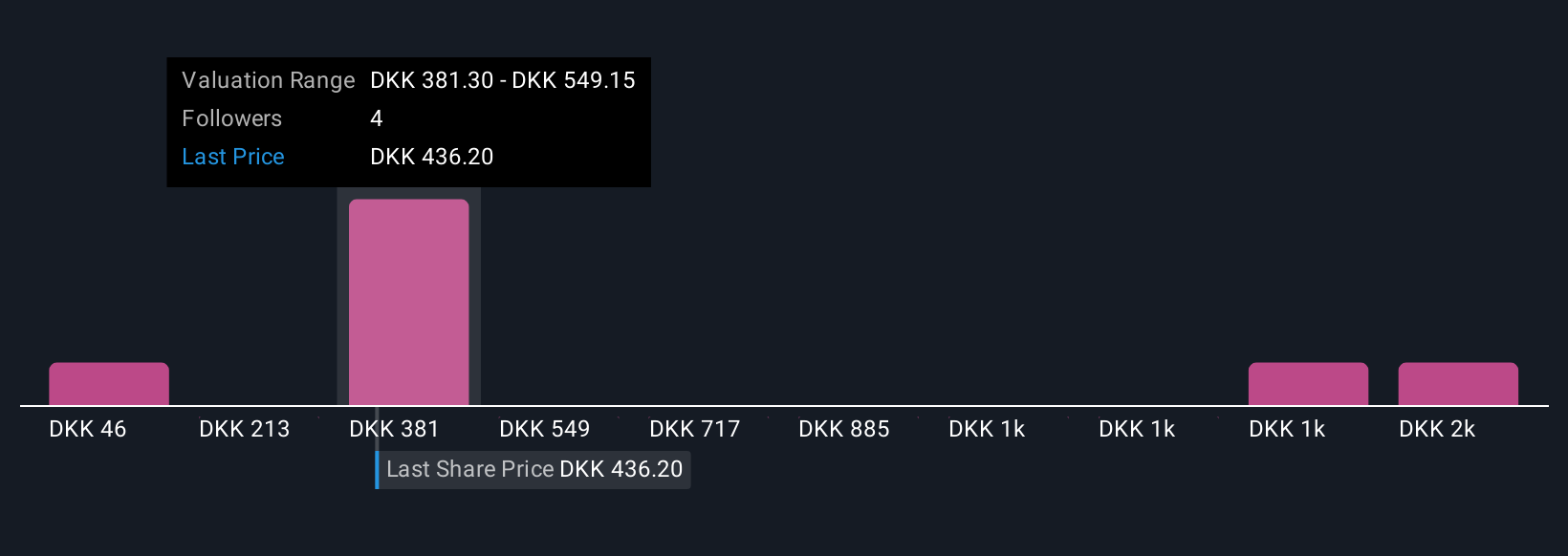

Four fair value estimates from the Simply Wall St Community range from DKK45.61 up to DKK1,724.06 per share. While these opinions reflect widely diverging outlooks, attention is heightened by macro-driven funding risks that could impact Gubra’s revenue and earnings trajectory, explore the range of views to see how individual investors weigh these factors.

Explore 4 other fair value estimates on Gubra - why the stock might be worth less than half the current price!

Build Your Own Gubra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gubra research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gubra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gubra's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GUBRA

Gubra

A biotech company, focuses on the pre-clinical contract research and peptide-based drug discovery within metabolic and fibrotic diseases in Europe, North America, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives