Stock Analysis

In a week marked by intense economic and earnings activity, global markets experienced varied performances with the technology-heavy Nasdaq Composite and S&P MidCap 400 Index hitting record highs before pulling back, while small-cap stocks showed resilience compared to their larger counterparts. As growth stocks lagged behind value shares amid cautious earnings reports from major tech players, identifying promising high-growth tech stocks requires careful consideration of fundamentals such as innovation potential and adaptability in the face of evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Genmab (CPSE:GMAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genmab A/S is a Danish company focused on developing antibody therapeutics for cancer and other diseases, with a market cap of DKK100.95 billion.

Operations: Genmab A/S specializes in developing antibody therapeutics primarily targeting cancer, generating revenue from collaborations and licensing agreements. The company operates with a focus on innovation in biotechnology, leveraging partnerships to advance its therapeutic pipeline.

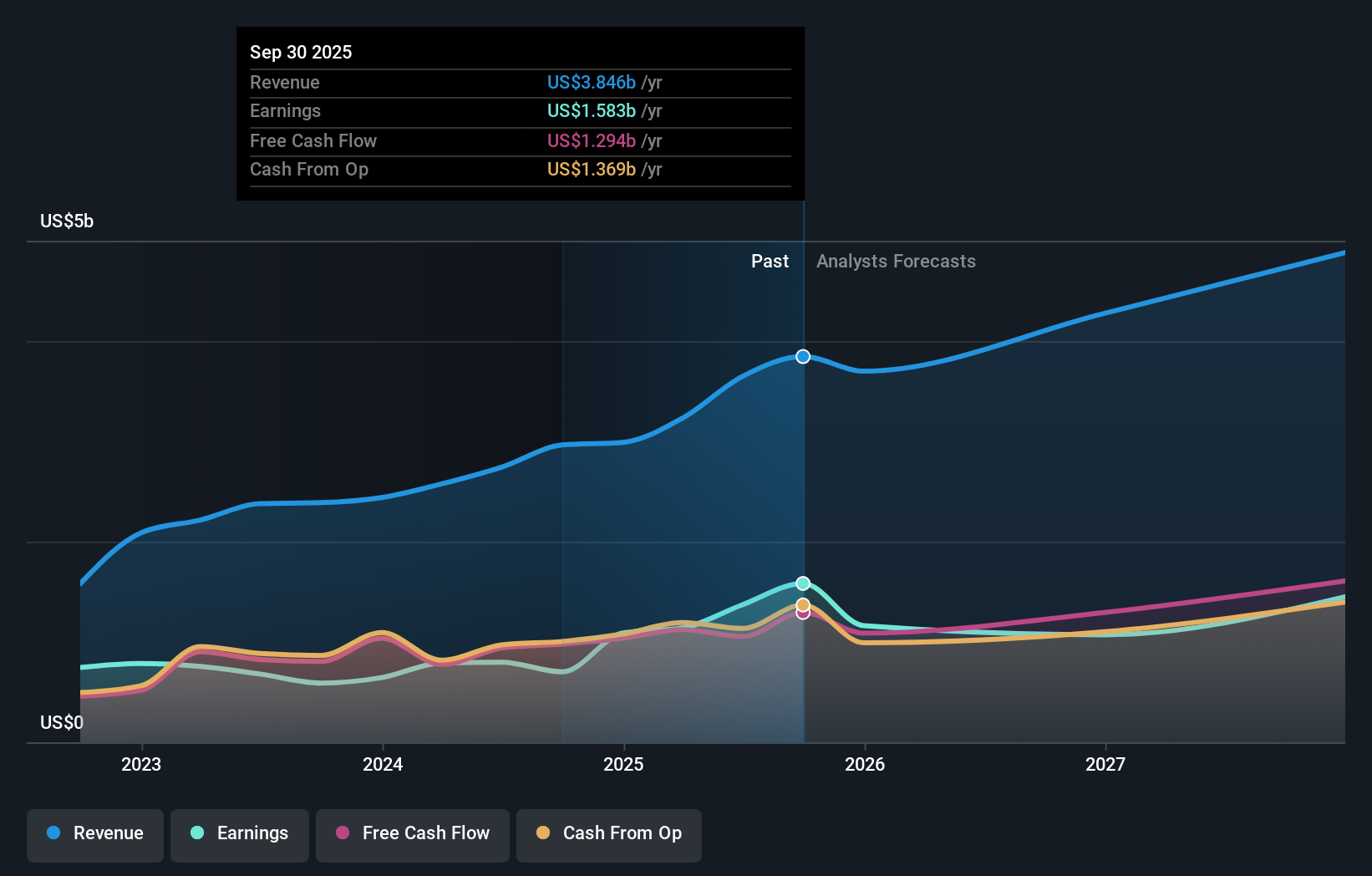

Genmab, a notable presence in the biotech sector, has demonstrated robust financial and operational growth. With a revenue forecast to increase by 14.3% annually, the company outpaces Denmark's market growth rate of 10.2%. Significantly, its earnings are expected to surge by 23% per year, showcasing stronger momentum compared to the broader market's 11.3%. This performance is underpinned by substantial R&D investment, crucial for sustaining innovation and competitive edge in biotechnology—a field where Genmab is actively expanding its portfolio as evidenced by recent successful trials and product launches.

- Get an in-depth perspective on Genmab's performance by reading our health report here.

Understand Genmab's track record by examining our Past report.

DBAPPSecurity (SHSE:688023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DBAPPSecurity Co., Ltd. is a company focused on the research, development, manufacture, and sale of cybersecurity products in China with a market capitalization of CN¥5.04 billion.

Operations: DBAPPSecurity specializes in cybersecurity solutions, focusing on research, development, and manufacturing within China. The company generates revenue through the sale of its cybersecurity products.

DBAPPSecurity, amidst a challenging tech landscape, has shown resilience with a notable reduction in net losses from CNY 535.53 million to CNY 336 million year-over-year and an improvement in basic loss per share from CNY 5.22 to CNY 3.28 as of September 2024. This progress is underpinned by a consistent investment in R&D, vital for fostering innovation and staying competitive; indeed, their R&D expenses as a percentage of revenue are substantial, aligning with industry leaders who prioritize growth through technological advancements. Despite current unprofitability, the company's revenue is expected to grow by 19.1% annually, outstripping the broader Chinese market's growth rate of 14%. Moreover, earnings are projected to surge by nearly 69.7% annually over the next few years—a testament to DBAPPSecurity’s potential pivot towards profitability and sector leadership.

- Delve into the full analysis health report here for a deeper understanding of DBAPPSecurity.

Gain insights into DBAPPSecurity's historical performance by reviewing our past performance report.

Nexwise Intelligence China (SZSE:301248)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexwise Intelligence China Limited provides security and intelligent systems globally, with a market cap of CN¥2.47 billion.

Operations: Nexwise Intelligence China focuses on developing and supplying advanced security and intelligent systems internationally. Its business model revolves around creating innovative solutions for various industries, contributing to its market presence.

Nexwise Intelligence China, amidst a challenging fiscal year, reported a significant revenue drop to CNY 458.28 million from CNY 604.93 million previously, reflecting a challenging operational environment. However, the company's commitment to innovation is evident with an R&D expenditure ratio that remains robust compared to industry norms. This strategic focus is crucial as it navigates through current losses—CNY 58.45 million from a prior profit—and aims for future profitability with expected earnings growth of 107% annually over the next few years. Additionally, its recent share buyback of over 2.43 million shares for CNY 30.01 million underscores management's confidence in the company’s prospects and dedication to shareholder value despite short-term hurdles.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1282 High Growth Tech and AI Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

Develops antibody therapeutics for the treatment of cancer and other diseases primarily in Denmark.