- Denmark

- /

- Entertainment

- /

- CPSE:BIF

Brøndbyernes IF Fodbold's(CPH:BIF) Share Price Is Down 49% Over The Past Five Years.

Brøndbyernes IF Fodbold A/S (CPH:BIF) shareholders will doubtless be very grateful to see the share price up 41% in the last quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 49% in that time, significantly under-performing the market.

View our latest analysis for Brøndbyernes IF Fodbold

Brøndbyernes IF Fodbold wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Brøndbyernes IF Fodbold grew its revenue at 2.4% per year. That's far from impressive given all the money it is losing. Given the weak growth, the share price fall of 8% isn't particularly surprising. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

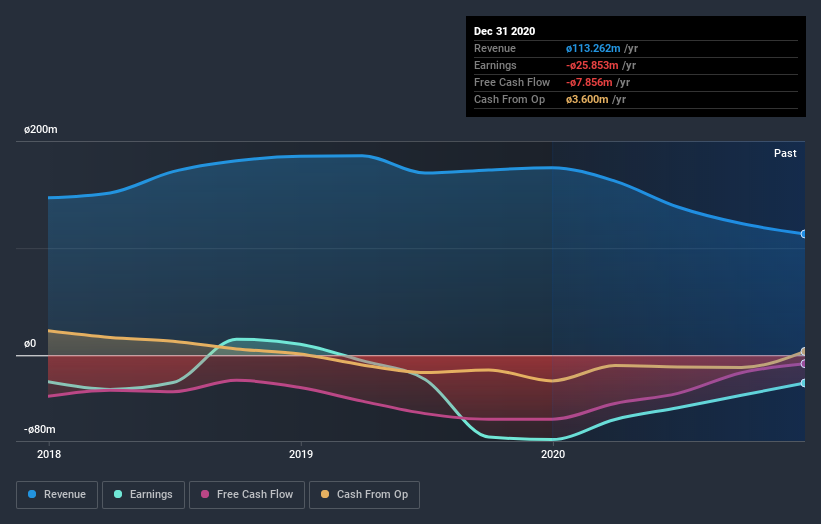

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We've already covered Brøndbyernes IF Fodbold's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Brøndbyernes IF Fodbold hasn't been paying dividends, but its TSR of -31% exceeds its share price return of -49%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Brøndbyernes IF Fodbold's TSR for the year was broadly in line with the market average, at 39%. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 5%, which was endured over half a decade. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. It's always interesting to track share price performance over the longer term. But to understand Brøndbyernes IF Fodbold better, we need to consider many other factors. Take risks, for example - Brøndbyernes IF Fodbold has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

When trading Brøndbyernes IF Fodbold or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brøndbyernes IF Fodbold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:BIF

Brøndbyernes IF Fodbold

Operates the Brøndbyernes Idrætsforening football club in Denmark.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives