Novozymes (CPSE:NSIS B): Assessing Valuation Following Recent Share Price Gains and Financial Growth

Reviewed by Simply Wall St

See our latest analysis for Novozymes.

Novozymes’ share price has climbed 3.2% over the past month and surged more than 6% in the last week, suggesting renewed investor interest amid its ongoing growth story. However, the total shareholder return over the past year is still slightly negative at -1.6%, which points to momentum that is recovering but not yet consistent across longer timeframes.

If you’re interested in uncovering other stocks where momentum and insider confidence could signal future growth, now is a great time to discover fast growing stocks with high insider ownership

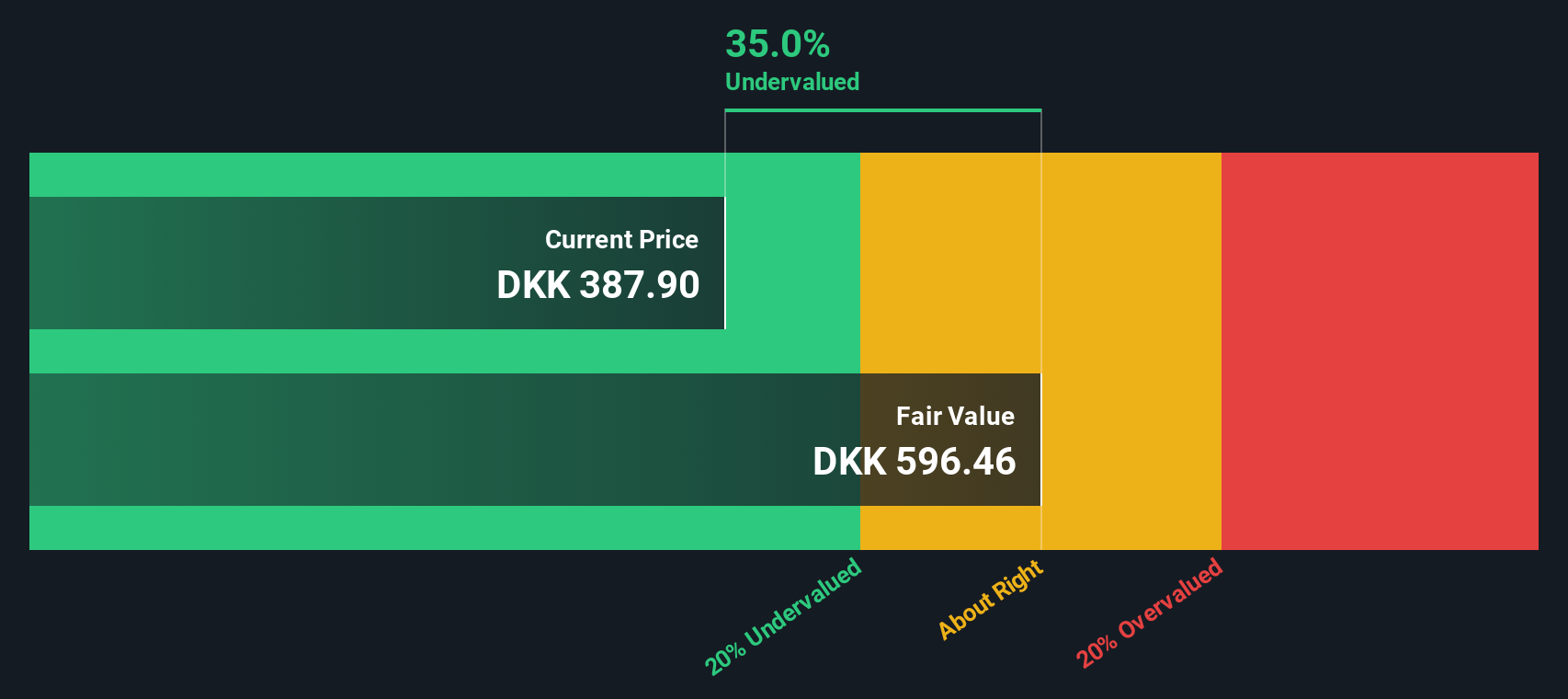

Given Novozymes’ recent uptick in share price, along with solid growth in revenue and net income, the key question emerges: is this sustainable momentum a sign of undervaluation, or has the market already priced in its future potential?

Price-to-Earnings of 47.1x: Is it justified?

Novozymes is currently trading at a price-to-earnings (P/E) ratio of 47.1x, which is considerably higher than both its industry peers and what might be expected based on its growth. The latest closing price of DKK412.9 suggests investors are valuing future earnings quite aggressively relative to the sector.

The price-to-earnings ratio is a widely used measure for valuing companies, showing how much investors are willing to pay per krone of earnings. In sectors with stable profits, a high P/E can signal strong confidence in future earnings growth and profitability.

However, Novozymes’ current P/E stands well above the European Chemicals industry average of 17.4x, as well as the peer group average of 33.4x. The market appears to be factoring in an optimistic outlook that surpasses sector norms and even the estimated fair P/E of 29.9x. This benchmark often acts as a ceiling during revaluations.

Given this substantial premium, the share price looks expensive on a relative basis. Investors should note that if the market revisits this fair ratio, there could be a shift in how Novozymes' shares are valued going forward.

Explore the SWS fair ratio for Novozymes

Result: Price-to-Earnings of 47.1x (OVERVALUED)

However, slower revenue growth or shifts in investor sentiment could quickly challenge the sustainability of Novozymes’ current valuation premium.

Find out about the key risks to this Novozymes narrative.

Another View: What Does the DCF Model Say?

While Novozymes’ earnings ratio suggests the stock is expensive compared to peers, our DCF model offers a strikingly different perspective. Based on projected future cash flows, the SWS DCF model values Novozymes at DKK598.37 per share, which is well above the current price. Is the market underestimating its long-term value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novozymes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novozymes Narrative

If these conclusions do not align with your own insights, you’re welcome to review the facts and piece together your perspective in just a few minutes. Do it your way

A great starting point for your Novozymes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Smart investors keep their edge by finding sectors and trends others overlook. Use our tools to uncover exciting possibilities today.

- Maximize your passive income potential and secure comfortable yields as you scan these 16 dividend stocks with yields > 3% for proven companies with over 3% annual returns.

- Embrace innovation and seek out the breakthrough businesses at the forefront of AI advancements through these 25 AI penny stocks to tap into technology’s next wave of leaders.

- Position yourself for strong upside by evaluating these 875 undervalued stocks based on cash flows, which the market may be underrating, giving you a jump on hidden value plays.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novozymes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NSIS B

Novozymes

Produces and sells industrial enzymes, functional proteins, and microorganisms in Denmark, rest of Europe, North America, the Asia Pacific, the Middle East, Africa, Latin America, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives