- Denmark

- /

- Medical Equipment

- /

- CPSE:AMBU B

Ambu (CPSE:AMBU B): Valuation Insights Following Strong Results and a Higher Dividend

Reviewed by Simply Wall St

Ambu (CPSE:AMBU B) just released its full-year and fourth-quarter results, revealing higher sales and a significant boost in profitability compared to last year. The company also announced an increased annual dividend, reflecting its stronger financial position.

See our latest analysis for Ambu.

While Ambu is celebrating stronger sales and a raised dividend, the market reaction has been anything but upbeat. Shares have slid over 23% in the past month and the one-year total shareholder return is down a steep 34%. That puts recent gains in perspective, hinting that investor sentiment is still cautious despite the improved financial results.

If this kind of volatility has you wondering what else is out there, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the share price lagging despite solid financial growth and a sizable discount to analysts’ targets, investors are left to ponder whether Ambu is a bargain waiting to be seized or if the market has simply priced in all future gains.

Most Popular Narrative: 32.7% Undervalued

Ambu’s most widely followed valuation narrative places fair value at DKK121.41 per share, a significant premium to the last close of DKK81.75. This difference has fueled conversations on whether the company is significantly mispriced given its underlying growth story.

Ongoing portfolio expansion and first-mover advantages in new segments (e.g., urology, pediatric blades, and complex endoscopy procedures) enable continued penetration of under-served clinical areas. These advances should drive both higher average selling prices and top-line revenue growth over the medium to long term.

Want to know what’s powering this aggressive valuation? The secret isn’t just sales momentum. The narrative is built on ambitious growth projections and bold assumptions about sector dominance and expanding margins. Ready to unpack the high-stakes forecasts behind this eye-catching fair value?

Result: Fair Value of DKK121.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing currency volatility and increasing competition in single-use endoscopy could challenge Ambu’s growth assumptions and reduce future earnings momentum.

Find out about the key risks to this Ambu narrative.

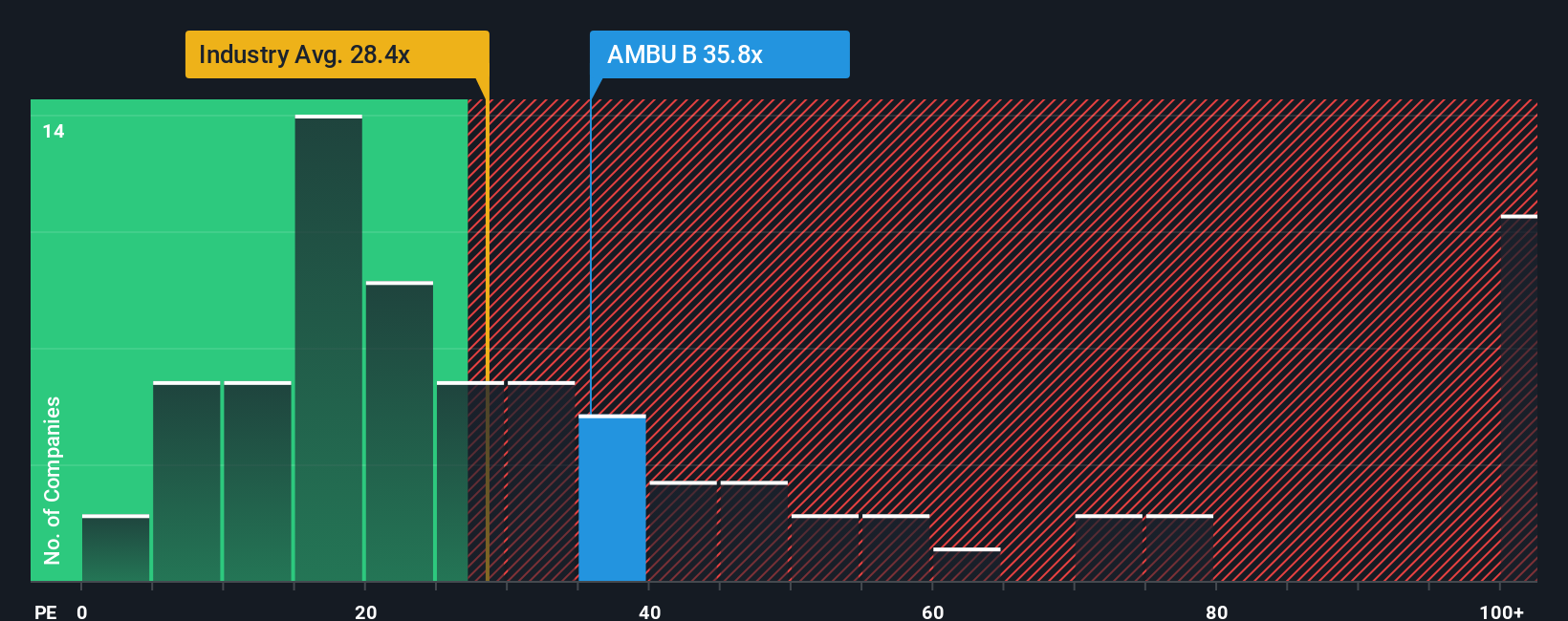

Another View: Market Multiples Raise Doubts

While the narrative and price targets point to Ambu being significantly undervalued, the company’s valuation using standard market multiples tells a different story. Its current price-to-earnings ratio of 35.8x is actually higher than both the European industry average of 28.1x and the fair ratio of 35x. This raises the risk that investors could be overpaying relative to peers and market fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ambu Narrative

Whether you want to dig deeper or craft your own perspective, you can shape your Ambu story with a personal analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ambu.

Looking for More Investment Ideas?

Smart investors don’t stand still. Expand your opportunities and find companies that are capturing attention for innovation, value, and future income potential by using the Simply Wall Street Screener.

- Unlock overlooked potential by targeting these 3590 penny stocks with strong financials with strong fundamentals and real momentum for ambitious growth.

- Tap into future tech by selecting these 24 AI penny stocks at the forefront of artificial intelligence advancements and emerging market leaders.

- Power up your portfolio with reliable these 16 dividend stocks with yields > 3% yielding over 3 percent for consistent income and robust financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:AMBU B

Ambu

Researches, develops, manufactures, markets, and sells medical technology solutions in North America, Europe, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives