Can Pandora’s (CPSE:PNDORA) European Slowdown Reveal a New Path for Its Global Strategy?

Reviewed by Sasha Jovanovic

- Pandora A/S recently lowered its full-year comparable sales growth forecast due to weaker sales in Europe, despite maintaining its 2025 guidance for 7-8% organic growth and an EBIT margin around 24%.

- The company is prioritizing more affordable jewelry and saw U.S. sales strengthen with price increases, as regional differences in performance and consumer demand come into focus for its business outlook.

- We’ll examine how Pandora's reduced sales outlook and European weakness could reshape the company's investment narrative, especially around its regional strategies.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Pandora Investment Narrative Recap

To believe in Pandora as a shareholder today, you need conviction in its ability to sustain international growth and protect margins amidst economic pressure, despite short-term volatility. The recent reduction in full-year comparable sales growth guidance due to softer European demand is significant for those tracking quarterly momentum, but it does not fundamentally alter the company’s main immediate catalyst, expanding affordable jewelry collections to drive higher transaction volumes. The biggest near-term risk remains that margin resilience from pricing actions could slip if sales volumes falter further.

Pandora’s confirmation of its 2025 guidance for 7–8% organic growth and an EBIT margin around 24%, despite cutting near-term sales expectations, stands out. This suggests confidence in operational discipline and the company’s ability to offset softness in some regions through new product launches and pricing, aligning closely with the ongoing investment thesis on margin protection.

Yet, against this backdrop, investors should be aware that pricing increases to sustain margins may bring fresh risks to sales volumes if European consumer trends continue to shift...

Read the full narrative on Pandora (it's free!)

Pandora's narrative projects DKK 39.1 billion in revenue and DKK 6.5 billion in earnings by 2028. This requires 6.4% yearly revenue growth and a DKK 1.1 billion earnings increase from the current earnings of DKK 5.4 billion.

Uncover how Pandora's forecasts yield a DKK1037 fair value, a 33% upside to its current price.

Exploring Other Perspectives

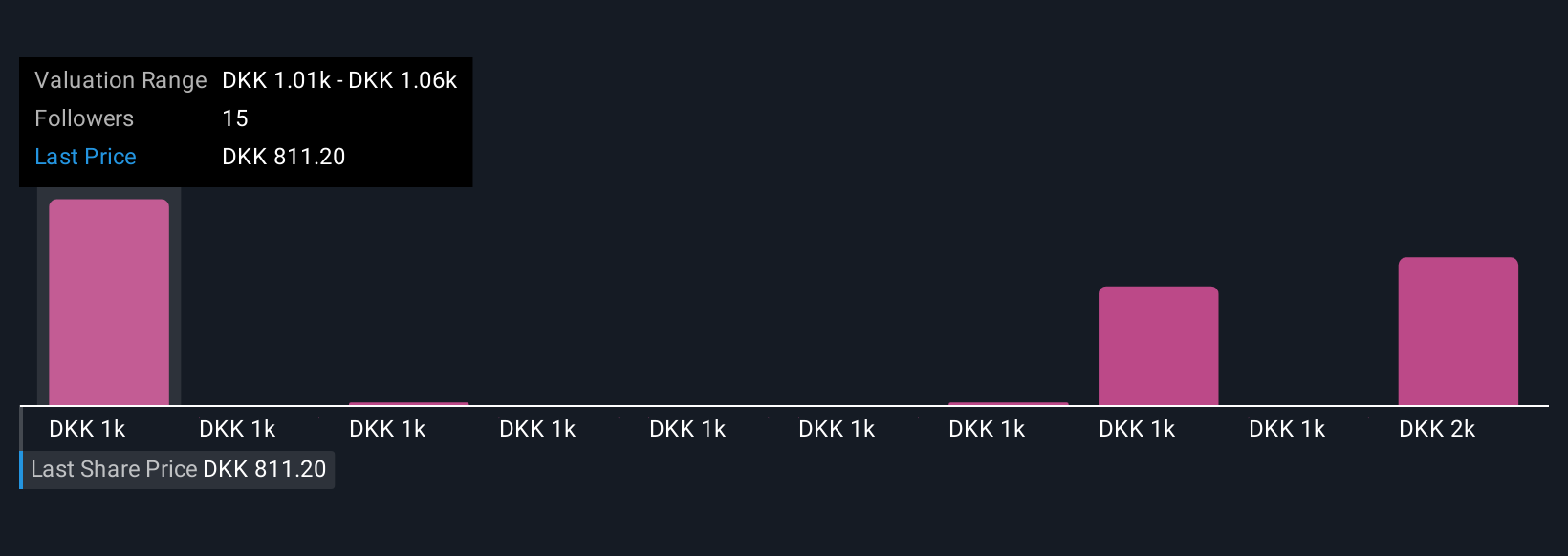

Simply Wall St Community members forecast fair values for Pandora ranging from DKK1,005 to DKK1,694 across seven estimates. With sales growth now in focus after the updated outlook, you can see how opinions vary and why many watch both top-line momentum and margin headroom so closely.

Explore 7 other fair value estimates on Pandora - why the stock might be worth over 2x more than the current price!

Build Your Own Pandora Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pandora research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pandora research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pandora's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:PNDORA

Pandora

Engages in the designing, manufacturing, and marketing of jewelry products.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives