Vestjysk Bank (CPSE:VJBA): Evaluating Valuation After Strong Recent Share Price Performance

Reviewed by Simply Wall St

Vestjysk Bank (CPSE:VJBA) has caught some interest recently, particularly following a surge in its stock performance over the past month. Investors appear to be watching how this Danish lender’s valuation compares after experiencing such momentum.

See our latest analysis for Vestjysk Bank.

The recent 37.4% jump in Vestjysk Bank’s share price over the past month has put the spotlight on both its underlying momentum and investor confidence. Looking at the bigger picture, its 1-year total shareholder return of over 80% and nearly 200% gain over five years reflect steady long-term progress. This suggests that optimism is building around its growth potential and risk profile.

If you’re watching Vestjysk Bank’s recent momentum, now’s a great moment to broaden your investment perspective and discover fast growing stocks with high insider ownership

But with such an impressive run-up, is Vestjysk Bank still trading at an attractive discount? Or has the market already priced in all of its future growth? Is this a buying opportunity, or has the market moved ahead?

Price-to-Earnings of 10.8x: Is it justified?

Vestjysk Bank’s recent closing price reflects a price-to-earnings (P/E) multiple of 10.8x, placing it slightly above the European Banks industry average of 10.1x. While this P/E ratio suggests some investor confidence, it also points to the bank being valued at a premium relative to peers in the sector.

The P/E multiple measures how much investors are willing to pay for each unit of earnings, making it an essential yardstick for banks where profits are a key driver of value. In Vestjysk Bank’s case, a higher-than-average P/E can either signal expected future growth or, alternatively, that its stock price may be running ahead of fundamentals at the moment.

Compared to the peer average of 12x, Vestjysk Bank actually looks relatively attractive. Despite being more expensive than the sector, it is cheaper than its closest directly comparable banks. However, industry averages can shift, and if sentiment changes or earnings momentum falters, the market could push the multiple closer to the fair ratio level over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10.8x (ABOUT RIGHT)

However, shifting market sentiment or unexpected financial headwinds could quickly dampen enthusiasm and pose challenges to the current optimism around Vestjysk Bank’s outlook.

Find out about the key risks to this Vestjysk Bank narrative.

Another View: Discounted Cash Flow Tells a Different Story

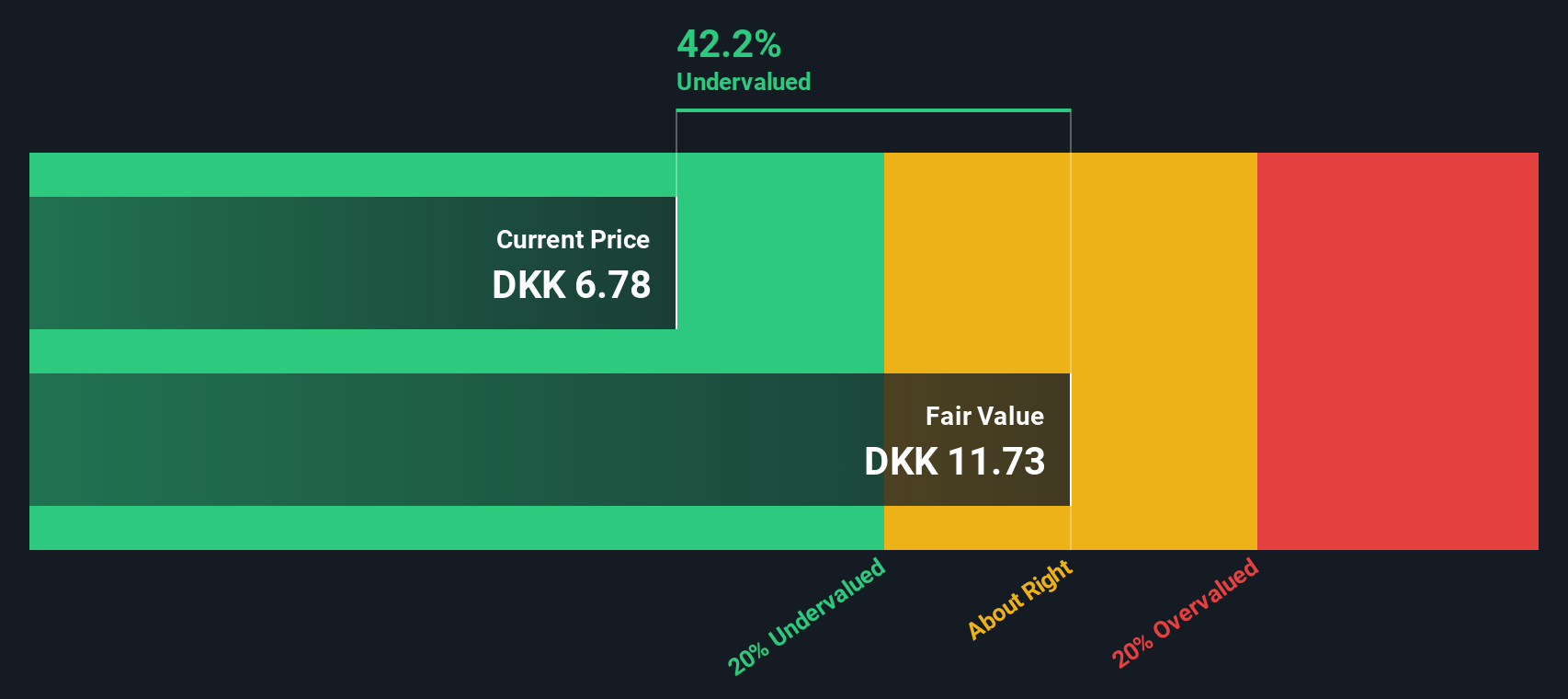

Looking through the lens of our DCF model, Vestjysk Bank appears to be trading at a significant 40.8% discount to its estimated fair value of DKK11.74. This result suggests the market may be undervaluing the bank based on future cash flows, offering a much more favorable valuation perspective than the P/E ratio indicates.

Look into how the SWS DCF model arrives at its fair value.

Could this gap between the P/E and DCF valuations signal a real opportunity, or is the market factoring in risks not captured by the model? It is a question investors will be considering as they evaluate what is influencing the bank’s current share price.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vestjysk Bank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 861 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vestjysk Bank Narrative

If you would rather draw your own conclusions or take a hands-on approach to evaluating Vestjysk Bank’s story, you can dive into the numbers yourself and build your own view in just a few minutes. Do it your way

A great starting point for your Vestjysk Bank research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to give your portfolio an edge, now is the best time to look beyond the obvious and act before the crowd catches on.

- Uncover smart income possibilities by checking out these 17 dividend stocks with yields > 3% that offer attractive yields above 3% and could boost your cash flow.

- Pounce on tomorrow’s artificial intelligence winners by spotting these 25 AI penny stocks poised to disrupt tech and transform entire industries.

- Go after value opportunities and sift through these 861 undervalued stocks based on cash flows where the numbers point to hidden gems ready for a re-rating.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VJBA

Vestjysk Bank

Provides various banking products and services for private and business customers in Denmark.

Adequate balance sheet and fair value.

Market Insights

Community Narratives