- Germany

- /

- Capital Markets

- /

- XTRA:B8A

Three Undiscovered Gems In Germany With Strong Potential

Reviewed by Simply Wall St

As global markets face heightened volatility and economic uncertainties, the German market has not been immune, with the DAX recently tumbling by over 4%. Despite these challenges, opportunities still exist for discerning investors, particularly within Germany’s small-cap segment. In this environment, a good stock often exhibits strong fundamentals such as robust financial health and growth potential. Today, we spotlight three lesser-known German stocks that stand out for their promising prospects amidst current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Eisen- und Hüttenwerke | NA | -14.56% | 7.71% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We'll examine a selection from our screener results.

HOMAG Group (DB:HG1)

Simply Wall St Value Rating: ★★★★★☆

Overview: HOMAG Group AG, with a market cap of €577.32 million, manufactures and sells machines and solutions for the woodworking and timber construction industries worldwide.

Operations: HOMAG Group generates revenue primarily from the sale of machines and solutions for woodworking and timber construction industries. The company's net profit margin is 4.5%.

HOMAG Group, a notable player in the machinery sector, has faced challenges recently with earnings growth plummeting by 61.9% over the past year. Despite this, its debt-free status and high-quality earnings provide some stability. The company reported a net profit margin lower than last year, indicating room for improvement. However, HOMAG's position in an industry growing at 5.6% suggests potential for recovery and growth if market conditions stabilize.

- Click here and access our complete health analysis report to understand the dynamics of HOMAG Group.

Explore historical data to track HOMAG Group's performance over time in our Past section.

BAVARIA Industries Group (XTRA:B8A)

Simply Wall St Value Rating: ★★★★★☆

Overview: BAVARIA Industries Group AG acquires and manages investments primarily in the manufacturing and industrial service sectors in Germany, with a market cap of approximately €415.76 million.

Operations: The company generates revenue primarily from three segments: Business Services (€45.50 million), Plant Engineering (€11.40 million), and Series/Automotive (€53.90 million).

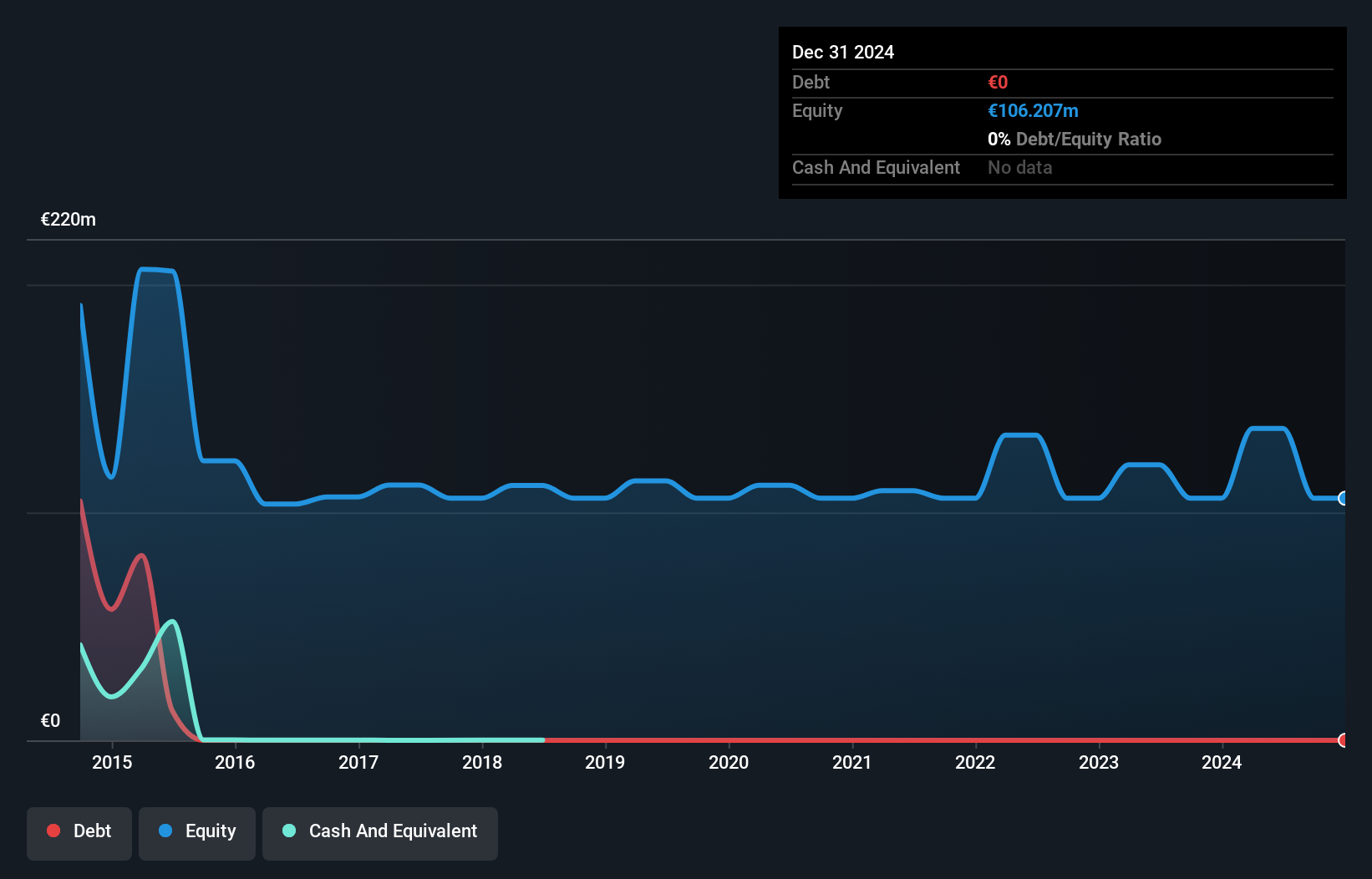

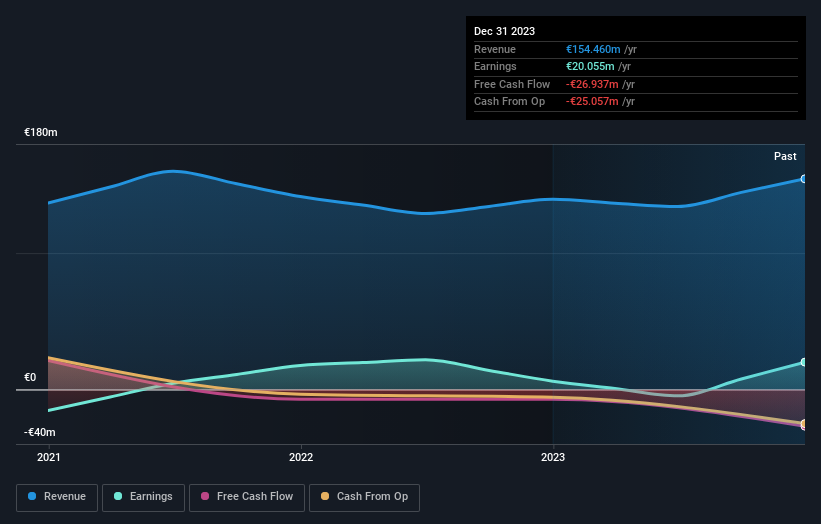

BAVARIA Industries Group has seen impressive earnings growth of 231.2% over the past year, far outpacing the Capital Markets industry average of 10%. The company’s debt to equity ratio improved from 4.5 to 3.2 over five years, indicating better financial health. Recent earnings announcements revealed net income surged to €20.06 million from €6.06 million last year, despite a slight dip in sales to €111.32 million from €112.29 million previously.

- Click here to discover the nuances of BAVARIA Industries Group with our detailed analytical health report.

Evaluate BAVARIA Industries Group's historical performance by accessing our past performance report.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

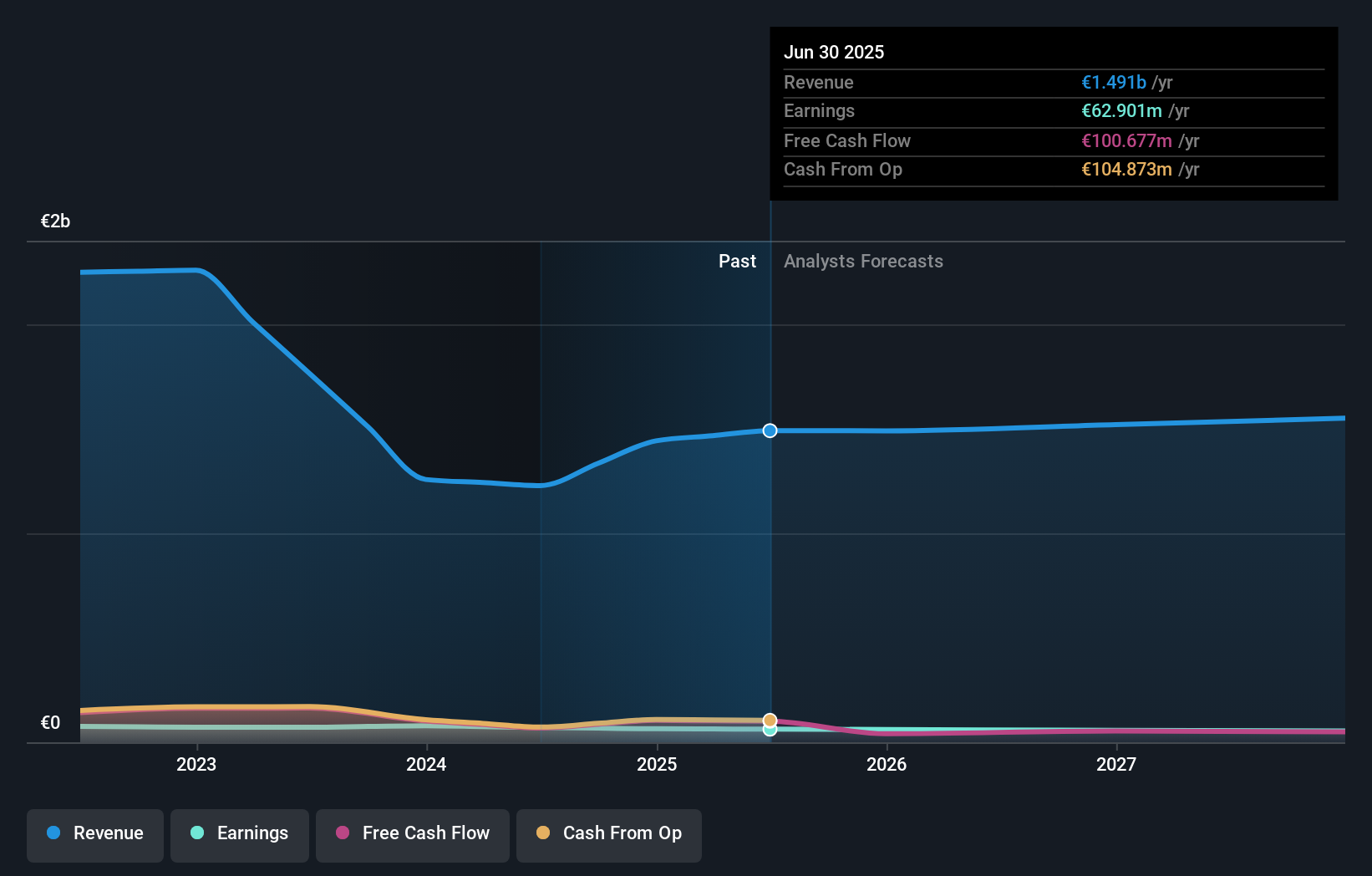

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market cap of €760.11 million.

Operations: Logwin AG generates revenue primarily from its Air + Ocean segment (€954.25 million) and Solutions segment (€275.78 million). The company has a market cap of €760.11 million.

Logwin's recent earnings report for the half-year ended June 30, 2024, revealed sales of €643.5 million, down from €672.97 million the previous year. Net income also saw a drop to €31.86 million from last year's €40.49 million, with basic earnings per share falling to €11.07 from €14.06 a year ago. Despite these setbacks, Logwin trades at 18% below its estimated fair value and has reduced its debt-to-equity ratio over five years from 0.04% to 0.03%.

- Delve into the full analysis health report here for a deeper understanding of Logwin.

Review our historical performance report to gain insights into Logwin's's past performance.

Taking Advantage

- Click here to access our complete index of 42 German Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAVARIA Industries Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:B8A

BAVARIA Industries Group

Acquires and manages investments primarily in manufacturing and industrial service sectors in Germany.

Excellent balance sheet with proven track record.