- Germany

- /

- Telecom Services and Carriers

- /

- XTRA:NFN

NFON (ETR:NFN) Shareholders Have Enjoyed A 56% Share Price Gain

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the NFON AG (ETR:NFN) share price is up 56% in the last year, clearly besting the market return of around 4.8% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! NFON hasn't been listed for long, so it's still not clear if it is a long term winner.

View our latest analysis for NFON

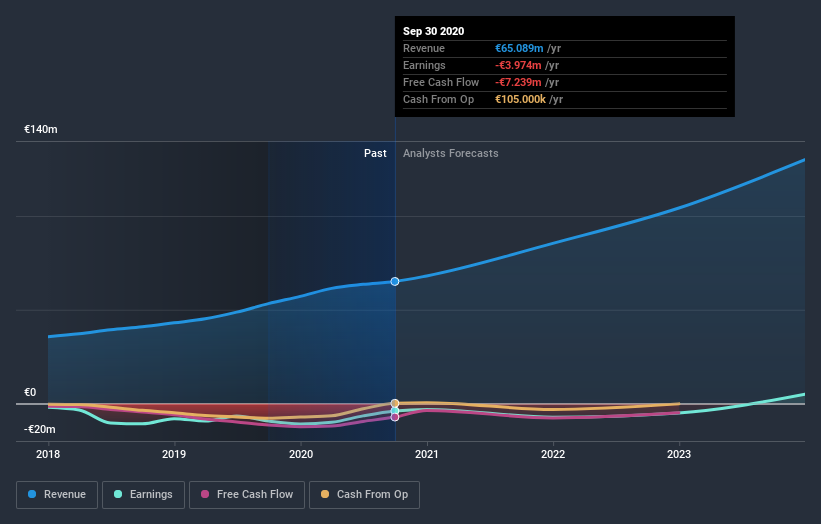

NFON isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

NFON grew its revenue by 22% last year. We respect that sort of growth, no doubt. Buyers pushed the share price 56% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at NFON's financial health with this free report on its balance sheet.

A Different Perspective

NFON shareholders should be happy with the total gain of 56% over the last twelve months. And the share price momentum remains respectable, with a gain of 37% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - NFON has 1 warning sign we think you should be aware of.

But note: NFON may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you decide to trade NFON, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NFON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:NFN

NFON

Provides integrated business communication with a focus on AI-based applications to business customers in Germany, Austria, Italy, the United Kingdom, Spain, Italy, France, Poland, and Portugal.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives