- Germany

- /

- Wireless Telecom

- /

- XTRA:FNTN

Does freenet’s (XTRA:FNTN) Shift in Earnings Per Share Reveal a Deeper Profit Strategy?

Reviewed by Sasha Jovanovic

- freenet AG recently reported its earnings for the nine months ended September 30, 2025, with sales reaching €1.85 billion and net income rising to €204.3 million compared to the prior year.

- An interesting detail is that while both sales and net income increased, basic earnings per share from continuing operations saw a slight decrease, suggesting shifting profit sources within the business.

- With higher net income yet mixed per-share results, we'll examine how these earnings developments may influence freenet's overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

freenet Investment Narrative Recap

The core case for freenet shares centers on its ability to convert stable subscriber growth, particularly in postpaid mobile and waipu.tv, into higher profitability, even as ARPU pressures and competition persist. The latest earnings showed a slight uptick in total revenue and net income, while diluted earnings per share from continuing operations decreased, a development that does not appear to shift short-term catalysts or the biggest risk: ongoing ARPU pressure from price-sensitive segments and competition. Among recent updates, the August 2025 share buyback stands out as most relevant, signaling management’s confidence in the stock’s value despite lackluster earnings progression per share. While this move can support shareholder returns, the effectiveness of such capital allocation is closely tied to the company’s ability to overcome stagnating margin improvement and deliver on its cost-optimization narrative. Yet, despite management’s optimism, investors should also keep in mind the risk that...

Read the full narrative on freenet (it's free!)

freenet's narrative projects €2.7 billion revenue and €312.7 million earnings by 2028. This requires 2.2% yearly revenue growth and a €56.7 million earnings increase from €256.0 million today.

Uncover how freenet's forecasts yield a €32.03 fair value, a 15% upside to its current price.

Exploring Other Perspectives

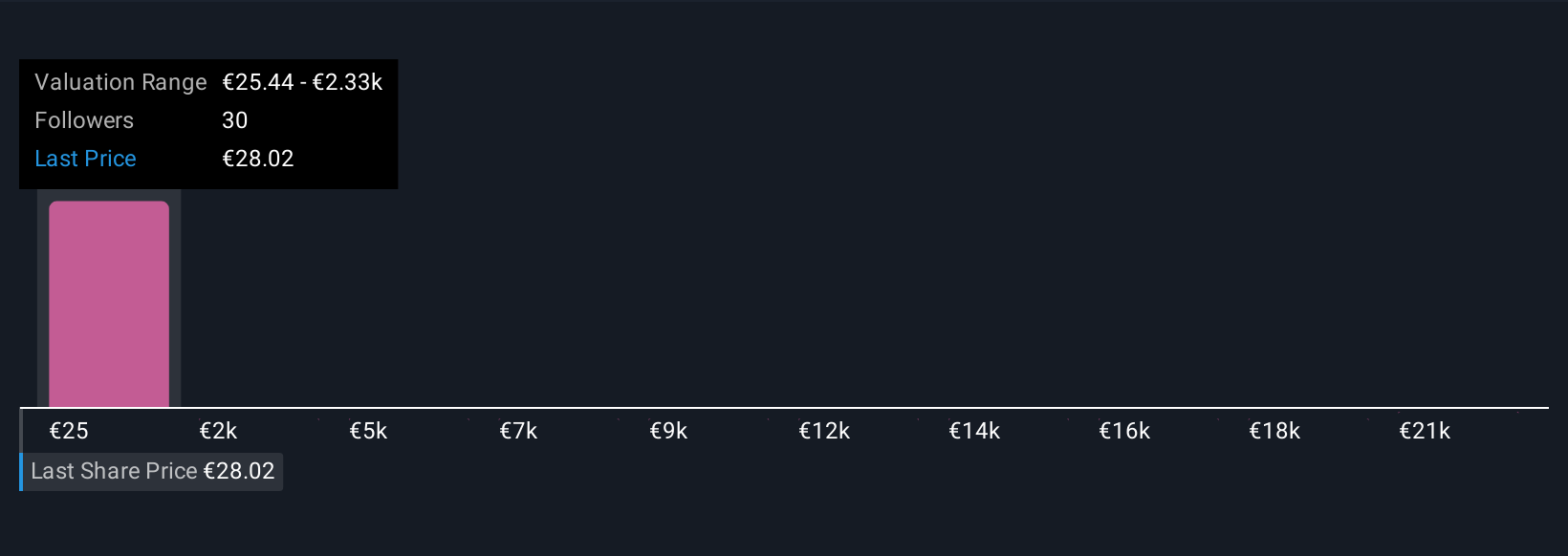

Eight individual Simply Wall St Community fair value estimates for freenet range from €25.44 to an outlier above €23,000, showing substantial variation in expectations. Several members weigh management’s focus on cost discipline against risks from persistent ARPU pressure, offering different potential scenarios for future performance.

Explore 8 other fair value estimates on freenet - why the stock might be a potential multi-bagger!

Build Your Own freenet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your freenet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free freenet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate freenet's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if freenet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FNTN

freenet

Provides telecommunications, broadcasting, and multimedia services for mobile communications/mobile internet, and digital lifestyle sectors in Germany.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives