- Germany

- /

- Tech Hardware

- /

- DB:JY0

High Growth Tech Stocks in Germany for September 2024

Reviewed by Simply Wall St

Germany's DAX has risen by 2.17%, buoyed by the European Central Bank's recent interest rate cut, reflecting a positive sentiment in the broader European market. As we explore high growth tech stocks in Germany for September 2024, it's crucial to consider companies that can leverage current economic conditions and exhibit strong potential for innovation and scalability.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 31.78% | 30.52% | ★★★★★☆ |

| Ströer SE KGaA | 7.39% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| medondo holding | 36.23% | 82.66% | ★★★★★☆ |

| Rubean | 59.40% | 73.87% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★★

Overview: ParTec AG develops, manufactures, and supplies supercomputer and quantum computer solutions with a market cap of €688 million.

Operations: ParTec AG specializes in the development, manufacturing, and supply of supercomputer and quantum computer solutions. The company has a market capitalization of €688 million.

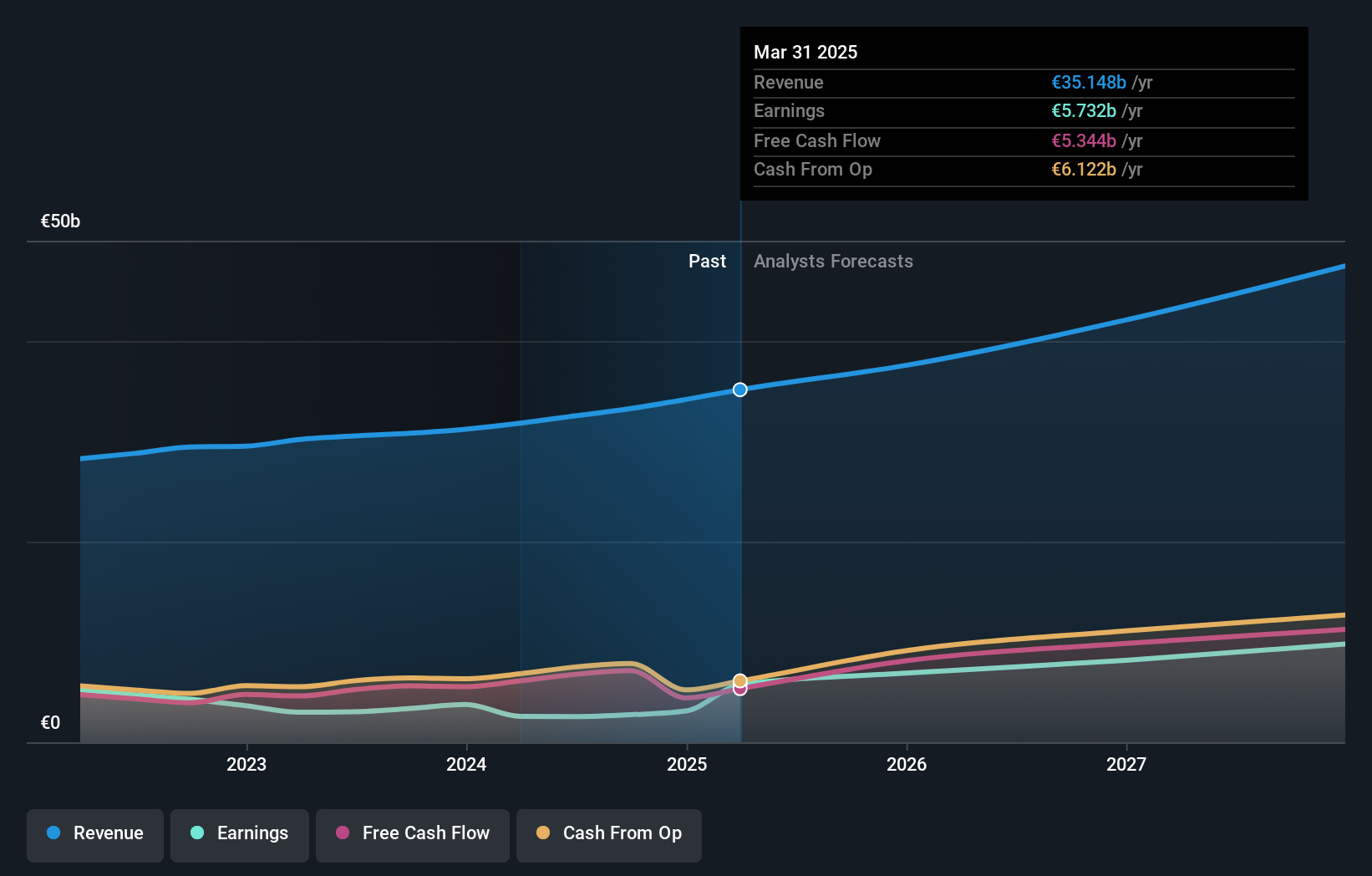

ParTec AG, amidst a backdrop of rapid technological shifts, is gearing up to capitalize on its robust revenue growth trajectory, which at 41.2% annually outpaces the broader German market's 5.4%. This surge is supported by an impressive forecast of earnings growth at 63.3% per year. Despite current unprofitability and financial data limitations under three years, ParTec's strategic engagements—evident from recent presentations at key tech forums like IEEE Quantum Week and HPC Roundtable Germany—signal a strong alignment with industry advancements and client needs. Furthermore, their R&D expenditure trends underscore a commitment to innovation essential for sustaining long-term competitiveness in the high-tech sector.

- Navigate through the intricacies of ParTec with our comprehensive health report here.

Gain insights into ParTec's historical performance by reviewing our past performance report.

Stemmer Imaging (XTRA:S9I)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stemmer Imaging AG specializes in providing machine vision technology for various applications globally and has a market capitalization of €318.50 million.

Operations: Stemmer Imaging AG generates revenue primarily from its machine vision technology segment, which accounted for €126.23 million. The company operates globally, serving both industrial and non-industrial applications.

Amidst a transformative takeover, Stemmer Imaging AG stands poised for significant shifts. The recent offer from MiddleGround Capital pegs shares at €48, a 52% premium over July's closing, signaling strong market confidence and immediate shareholder value. Concurrently, the company's R&D commitment is reflected in its strategic focus on advanced imaging solutions—crucial as industries increasingly rely on high-precision technology. Despite a 39.4% dip in earnings last year and sales falling to €58.31 million from €78.37 million, forecasts suggest robust growth with earnings expected to surge by 23.2% annually. This scenario presents both challenges and opportunities as Stemmer navigates through acquisition adjustments while aiming to maintain its innovative edge in a competitive landscape.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, delivers applications, technology, and services globally and has a market cap of approximately €240.14 billion.

Operations: SAP SE generates revenue primarily through its Applications, Technology & Services segment, which brought in €32.54 billion. The company's operations span globally, providing a comprehensive suite of software and technology solutions to various industries.

SAP, a stalwart in the software industry, is navigating through a challenging landscape with its R&D expenses reflecting a strategic commitment to innovation. In the last fiscal year, these expenses constituted 9.8% of its revenue, underscoring a robust investment in developing cutting-edge solutions. Despite experiencing a 16.2% dip in earnings over the past year, SAP's forecast suggests an impressive rebound with earnings growth projected at 37.9% annually. This growth trajectory is bolstered by recent expansions like the GROW With SAP initiative and notable client acquisitions such as Xerox and Kyndryl, enhancing its cloud offerings and enterprise architecture capabilities. These developments not only highlight SAP's adaptability but also position it well for leveraging emerging tech trends to sustain its competitive edge in the market.

- Take a closer look at SAP's potential here in our health report.

Explore historical data to track SAP's performance over time in our Past section.

Next Steps

- Gain an insight into the universe of 44 German High Growth Tech and AI Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:JY0

ParTec

Partec AG develops, manufacturers, and supplies supercomputer and quantum computer solutions.

Exceptional growth potential with mediocre balance sheet.