- Germany

- /

- Professional Services

- /

- XTRA:BDT

3 German Stocks Estimated To Be Undervalued In August 2024

Reviewed by Simply Wall St

As the European economy shows signs of optimism with the pan-European STOXX Europe 600 Index and Germany’s DAX both rising in August 2024, investors are increasingly looking for opportunities within this buoyant market environment. With interest rate cuts anticipated from both the Federal Reserve and the European Central Bank, identifying undervalued stocks becomes crucial as these conditions could potentially enhance their value. In such a climate, a good stock is typically characterized by strong fundamentals, solid earnings potential, and resilience to economic fluctuations—factors that can help it capitalize on favorable market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bertrandt (XTRA:BDT) | €24.60 | €42.32 | 41.9% |

| technotrans (XTRA:TTR1) | €17.20 | €30.22 | 43.1% |

| MBB (XTRA:MBB) | €105.00 | €195.28 | 46.2% |

| M1 Kliniken (XTRA:M12) | €14.15 | €23.69 | 40.3% |

| Friedrich Vorwerk Group (XTRA:VH2) | €21.85 | €36.70 | 40.5% |

| RENK Group (DB:R3NK) | €24.975 | €43.17 | 42.1% |

| Schweizer Electronic (XTRA:SCE) | €4.50 | €7.64 | 41.1% |

| MTU Aero Engines (XTRA:MTX) | €267.50 | €491.50 | 45.6% |

| Dr. Hönle (XTRA:HNL) | €15.70 | €28.40 | 44.7% |

| elumeo (XTRA:ELB) | €2.32 | €3.93 | 41% |

We'll examine a selection from our screener results.

Bertrandt (XTRA:BDT)

Overview: Bertrandt Aktiengesellschaft offers engineering services and has a market cap of €248.60 million.

Operations: The company's revenue segments include Digital Engineering (€640.06 million), Physical Engineering (€253.89 million), and Electrical Systems/Electronics (€409.76 million).

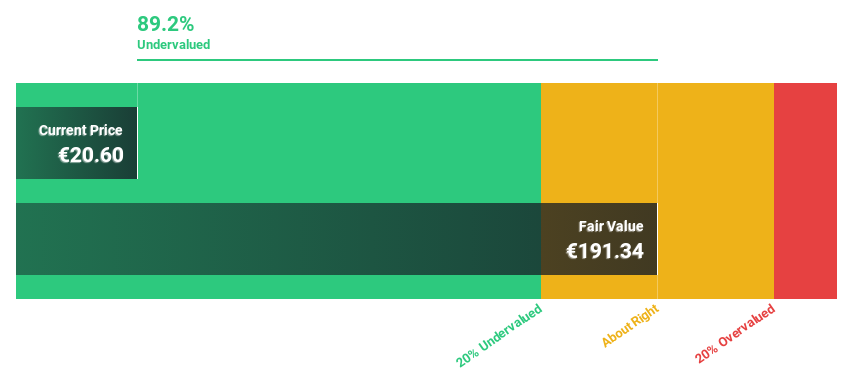

Estimated Discount To Fair Value: 41.9%

Bertrandt Aktiengesellschaft is trading at €24.6, significantly below its estimated fair value of €42.32, indicating potential undervaluation based on discounted cash flows. Despite a low forecasted Return on Equity (10.6%) and slower revenue growth (5.3% per year), the company's earnings are expected to grow significantly at 60.1% annually, outpacing the German market's 19.8%. Recent earnings reports show increased sales but a net loss for Q3 and reduced net income over nine months compared to last year.

- Our expertly prepared growth report on Bertrandt implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Bertrandt with our comprehensive financial health report here.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users in Germany and internationally, with a market cap of €308.66 million.

Operations: Revenue from the camera segment amounts to €180.06 million.

Estimated Discount To Fair Value: 28.7%

Basler Aktiengesellschaft is trading at €10.04, significantly below its estimated fair value of €14.09, suggesting it may be undervalued based on discounted cash flows. The company is forecast to become profitable in the next three years with earnings expected to grow 99.19% annually, outpacing the German market's growth rate of 5.1%. However, recent earnings reports show a net loss of €3.37 million for H1 2024 compared to a smaller loss last year.

- The analysis detailed in our Basler growth report hints at robust future financial performance.

- Get an in-depth perspective on Basler's balance sheet by reading our health report here.

MAX Automation (XTRA:MXHN)

Overview: MAX Automation SE, with a market cap of €244.98 million, provides automation solutions for various industries including automotive, electrical, recycling, packaging, and medical technology across Germany and internationally.

Operations: MAX Automation SE's revenue segments include €52.18 million from Elwema, €6.83 million from AIM Micro, €54.61 million from NSM + Jücker, €111.47 million from Bdtronic Group, and €170.18 million from Vecoplan Group, with Ma Micro Group - Discontinued Operation contributing an additional €33.92 million.

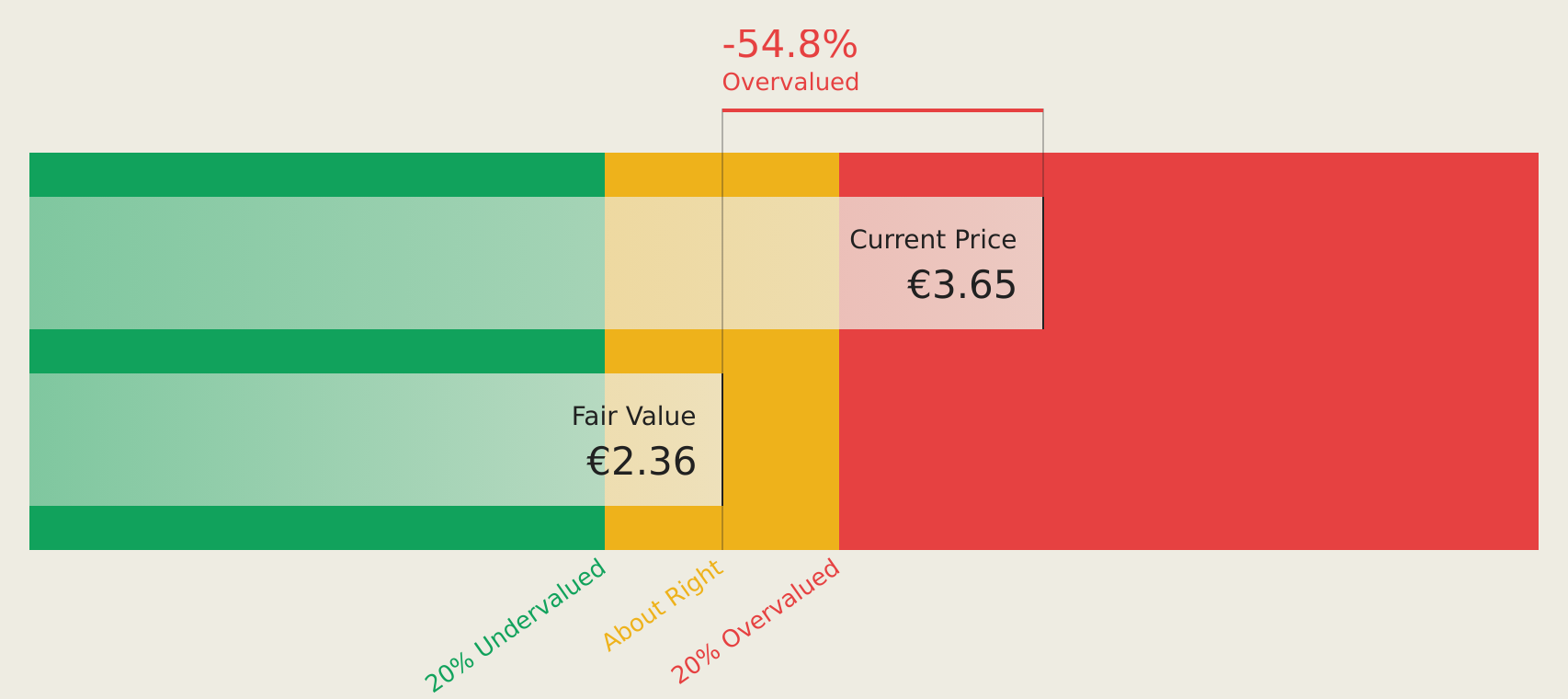

Estimated Discount To Fair Value: 26.8%

MAX Automation is trading at €5.94, well below its estimated fair value of €8.12, indicating it is undervalued based on cash flows. Despite a challenging earnings report with net income dropping to €0.361 million in Q2 2024 from €15.35 million a year ago, the company is forecast to grow earnings by 69.44% annually and become profitable within three years, surpassing average market growth expectations.

- Our comprehensive growth report raises the possibility that MAX Automation is poised for substantial financial growth.

- Click here to discover the nuances of MAX Automation with our detailed financial health report.

Next Steps

- Reveal the 28 hidden gems among our Undervalued German Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bertrandt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BDT

Undervalued with excellent balance sheet and pays a dividend.