- Germany

- /

- Healthcare Services

- /

- XTRA:M12

3 German Stocks Estimated To Be Trading Below Fair Value By 42.8%

Reviewed by Simply Wall St

The German market has recently experienced significant volatility, with the DAX index tumbling 4.11% amid global economic concerns and weak U.S. data that have sparked worries about growth. Despite these challenges, opportunities exist for discerning investors to identify stocks trading below their intrinsic value. In such an environment, a good stock is often characterized by strong fundamentals and resilience in the face of economic headwinds. This article will explore three German stocks currently estimated to be trading below fair value by 42.8%, presenting potential opportunities for value-focused investors.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Kontron (XTRA:SANT) | €17.60 | €34.10 | 48.4% |

| Allgeier (XTRA:AEIN) | €16.40 | €29.19 | 43.8% |

| M1 Kliniken (XTRA:M12) | €13.55 | €23.69 | 42.8% |

| ecotel communication ag (XTRA:E4C) | €12.75 | €22.25 | 42.7% |

| Verbio (XTRA:VBK) | €15.13 | €29.28 | 48.3% |

| RENK Group (DB:R3NK) | €25.05 | €40.43 | 38% |

| R. STAHL (XTRA:RSL2) | €17.70 | €33.06 | 46.5% |

| MTU Aero Engines (XTRA:MTX) | €256.90 | €451.56 | 43.1% |

| Vectron Systems (XTRA:V3S) | €10.65 | €17.71 | 39.9% |

| Basler (XTRA:BSL) | €9.08 | €16.36 | 44.5% |

Let's uncover some gems from our specialized screener.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users in Germany and internationally, with a market cap of €279.09 million.

Operations: Revenue Segments (in millions of €): Camera: €190.30

Estimated Discount To Fair Value: 44.5%

Basler Aktiengesellschaft appears undervalued based on cash flows, trading at €9.08, significantly below its estimated fair value of €16.36. Despite a net loss of €3.9 million in Q1 2024, revenue is forecast to grow at 13.2% annually over the next three years, outpacing the German market's growth rate of 5.5%. The company is expected to become profitable within this period with an annual profit growth rate of 84%, though return on equity remains low at an estimated 9.2%.

- In light of our recent growth report, it seems possible that Basler's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Basler.

M1 Kliniken (XTRA:M12)

Overview: M1 Kliniken AG, with a market cap of €248.17 million, offers aesthetic medicine and plastic surgery services across Germany, Austria, the Netherlands, Switzerland, the United Kingdom, Croatia, Hungary, Bulgaria, Romania and Australia.

Operations: The company's revenue segments include Trade (€245.49 million) and Beauty (€70.83 million).

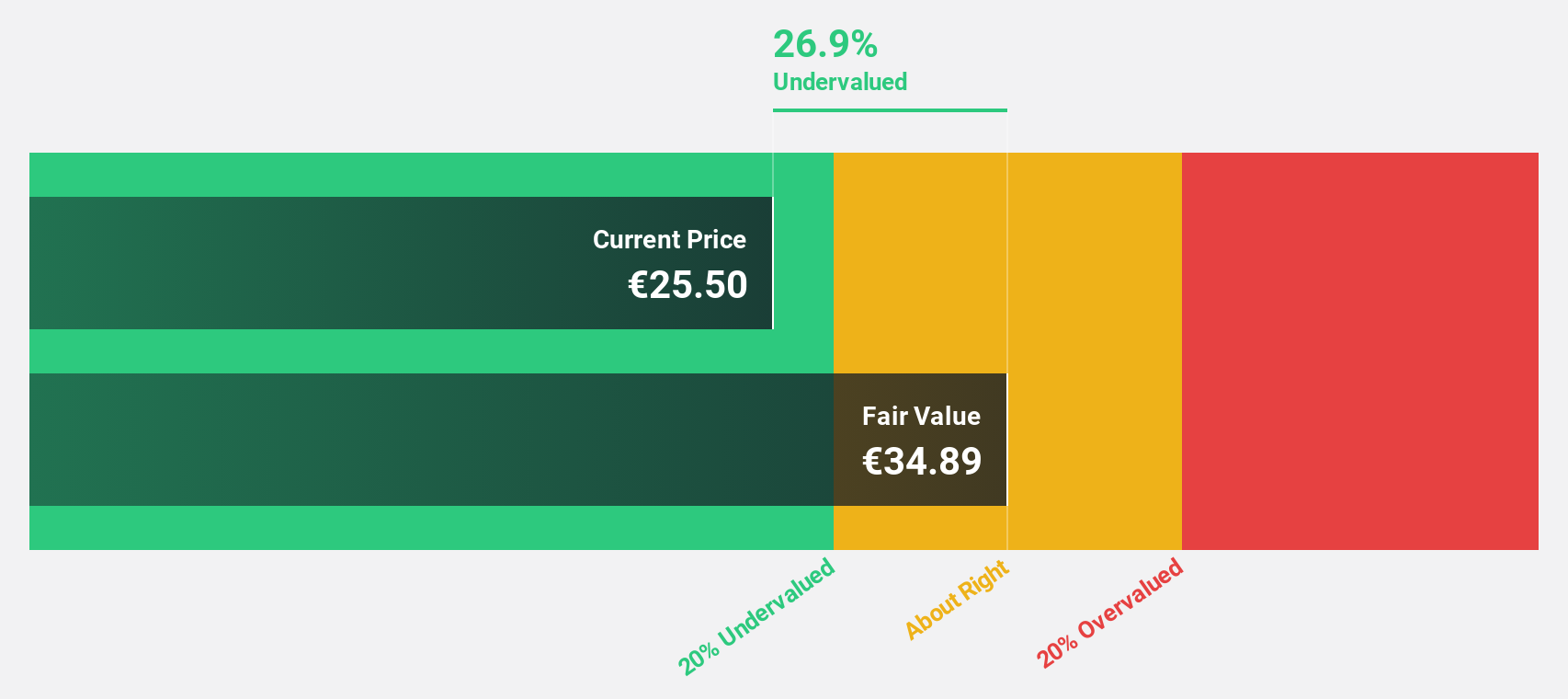

Estimated Discount To Fair Value: 42.8%

M1 Kliniken is trading at €13.55, significantly below its estimated fair value of €23.69, indicating it may be undervalued based on cash flows. Earnings grew by 138% last year and are expected to grow 24.4% annually over the next three years, outpacing the German market's growth rate of 20%. Despite this, the dividend yield of 3.69% is not well covered by earnings or free cash flows, and share price volatility remains high.

- Insights from our recent growth report point to a promising forecast for M1 Kliniken's business outlook.

- Take a closer look at M1 Kliniken's balance sheet health here in our report.

Kontron (XTRA:SANT)

Overview: Kontron AG, with a market cap of €1.08 billion, provides internet of things (IoT) solutions in Austria and internationally.

Operations: The company's revenue segments are Europe (€971.03 million), Global (€269.17 million), and Software + Solutions (€306.81 million).

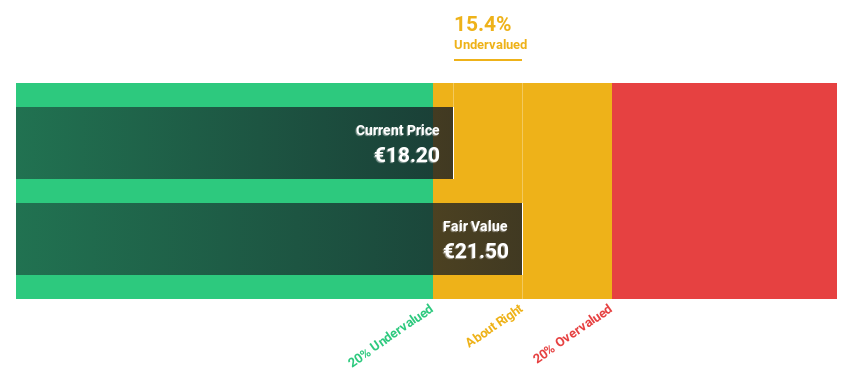

Estimated Discount To Fair Value: 48.4%

Kontron is trading at €17.6, significantly below its estimated fair value of €34.1, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow 21.1% per year over the next three years, outpacing the German market's 20%. Recent strategic partnerships and product releases bolster its position in the IoT and embedded computing sectors. However, despite strong revenue growth projections (12.9% annually), its Return on Equity is expected to remain low at 17.2%.

- Upon reviewing our latest growth report, Kontron's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Kontron.

Taking Advantage

- Gain an insight into the universe of 18 Undervalued German Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M12

M1 Kliniken

Provides aesthetic medicine and plastic surgery services in Germany, Austria, the Netherlands, Switzerland, the United Kingdom, Croatia, Hungary, Bulgaria, Romania, and Australia.

Undervalued with solid track record.