Exploring All for One Group and 2 Other High Growth Tech Stocks in Germany

Reviewed by Simply Wall St

As European inflation approaches the central bank's target, Germany's DAX index has reached a new peak, reflecting optimism in the market despite mixed economic sentiment. In this environment, high-growth tech stocks like All for One Group and two other promising companies are capturing investor interest due to their potential for robust performance amid evolving economic conditions.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 31.78% | 30.52% | ★★★★★☆ |

| Ströer SE KGaA | 7.39% | 29.86% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| medondo holding | 34.52% | 71.99% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| Rubean | 59.40% | 73.87% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

All for One Group (XTRA:A1OS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: All for One Group SE, with a market cap of €241.87 million, provides business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally through its subsidiaries.

Operations: The company generates revenue primarily from its CORE segment (€442.47 million) and LOB segment (€77.01 million). Its business focuses on providing software solutions for major platforms like SAP, Microsoft, and IBM across various regions including Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Software firms are increasingly moving to SaaS models, ensuring recurring revenue from subscriptions. All for One Group's earnings grew by 59.6% over the past year, outpacing the IT industry's 4.5%. Their R&D expenses of €10 million in 2023 reflect a commitment to innovation, driving forecasted annual profit growth of 24.6%. Recent buybacks saw the company repurchase 81,997 shares for €3.7 million, signaling confidence in their future prospects amidst a competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of All for One Group.

Gain insights into All for One Group's past trends and performance with our Past report.

Adtran Networks (XTRA:ADV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adtran Networks SE develops, manufactures, and sells optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services with a market cap of approximately €1.01 billion.

Operations: Adtran Networks SE focuses on creating and distributing optical networking equipment, generating revenue of approximately €481.90 million from this segment. The company primarily serves telecommunications carriers and enterprises by offering solutions for data, storage, voice, and video services.

Adtran Networks' revenue is forecasted to grow at 6.8% annually, outpacing the German market's 5.5%, while earnings are expected to rise by an impressive 124.08% per year over the next three years. Despite recent challenges, including a net loss of €2.03 million for the first half of 2024, their commitment to innovation is evident with significant R&D investments aimed at advancing their communications technology offerings. The company's strategic focus on high-growth segments and ongoing debt financing initiatives could bolster its competitive position in the evolving tech landscape.

- Take a closer look at Adtran Networks' potential here in our health report.

Gain insights into Adtran Networks' historical performance by reviewing our past performance report.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

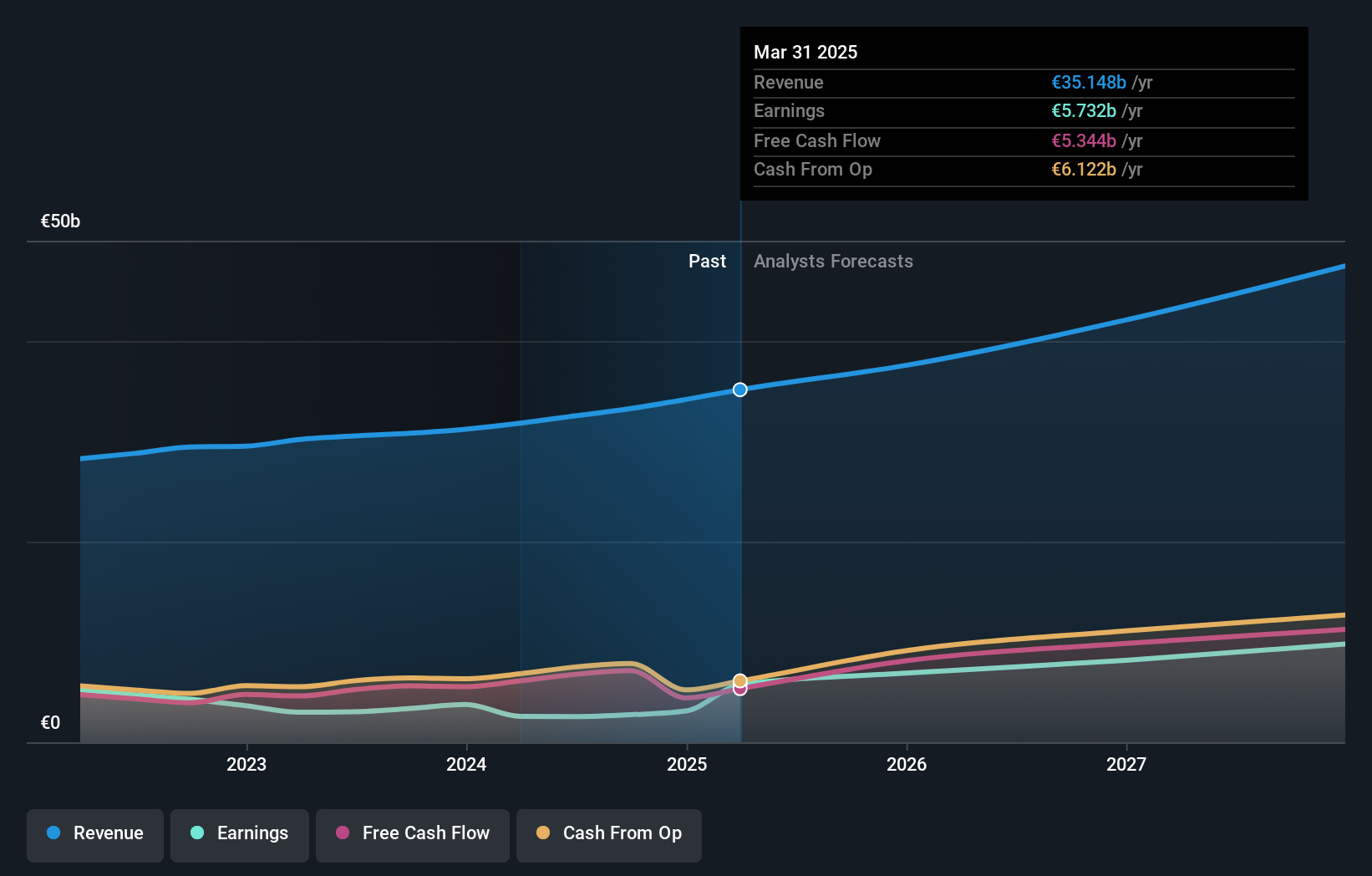

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology solutions, and services globally and has a market cap of €233.09 billion.

Operations: The company generates revenue primarily through its Applications, Technology & Services segment, which brought in €32.54 billion. The business focuses on providing a diverse portfolio of software and service solutions to clients worldwide.

SAP's strategic focus on cloud solutions, such as the RISE with SAP and GROW with SAP offerings, is driving its transformation. Despite a 16.2% earnings drop last year due to a €3.3B one-off loss, revenue grew to €16.33B in H1 2024 from €15B in H1 2023. With R&D expenses at 10% of revenue, their commitment to innovation remains strong, enhancing their SaaS model for recurring revenue and client satisfaction like Xerox and Kyndryl.

- Get an in-depth perspective on SAP's performance by reading our health report here.

Assess SAP's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock our comprehensive list of 44 German High Growth Tech and AI Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Solid track record with excellent balance sheet and pays a dividend.