- China

- /

- Entertainment

- /

- SZSE:300251

Exploring Three High Growth Tech Stocks For Potential Portfolio Strength

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and consumer spending concerns, U.S. stocks have experienced volatility, with major indices like the S&P 500 initially reaching record highs before retreating due to tariff fears and economic data pointing towards contraction in services activity. In this uncertain environment, identifying high-growth tech stocks that can potentially strengthen a portfolio involves looking for companies with robust innovation capabilities and resilience to market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Travere Therapeutics | 28.44% | 65.05% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1187 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Mycronic (OM:MYCR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mycronic AB (publ) is a company that develops, manufactures, and sells production equipment for the electronics industry globally, with a market cap of SEK45.36 billion.

Operations: The company's revenue streams are primarily driven by its Pattern Generators (PG) segment, contributing SEK2.99 billion, followed by High Flex and High Volume segments with SEK1.49 billion and SEK1.43 billion, respectively. Global Technologies adds another SEK1.14 billion to the total revenue mix, showcasing a diversified portfolio across different electronics production equipment categories.

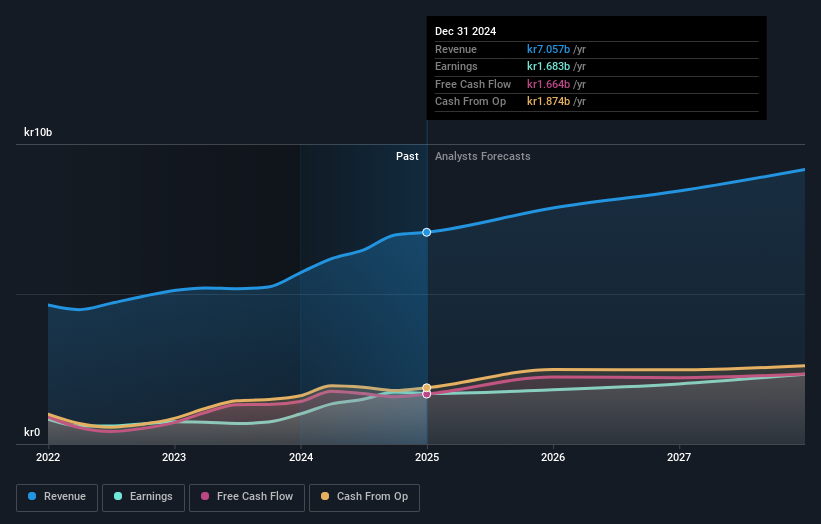

Mycronic has recently demonstrated robust financial performance, with a notable 68.6% increase in annual earnings growth, surpassing the electronic industry's average of 15.7%. This growth is supported by strategic client engagements, such as the significant orders for their advanced Prexision 8000 Evo mask writers in Asia, highlighting their strong position in semiconductor and display manufacturing technologies. Despite a slight dip in net income in Q4 2024 to SEK 460 million from SEK 510 million the previous year, Mycronic's overall sales surged to SEK 7.05 billion from SEK 5.71 billion annually, indicating sustained demand for its high-precision systems. The company’s commitment to innovation is further underscored by an R&D expenditure ratio that aligns closely with revenue growth projections of approximately SEK {rd_expense_string}, maintaining a competitive edge in developing next-generation technologies.

- Click here to discover the nuances of Mycronic with our detailed analytical health report.

Assess Mycronic's past performance with our detailed historical performance reports.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

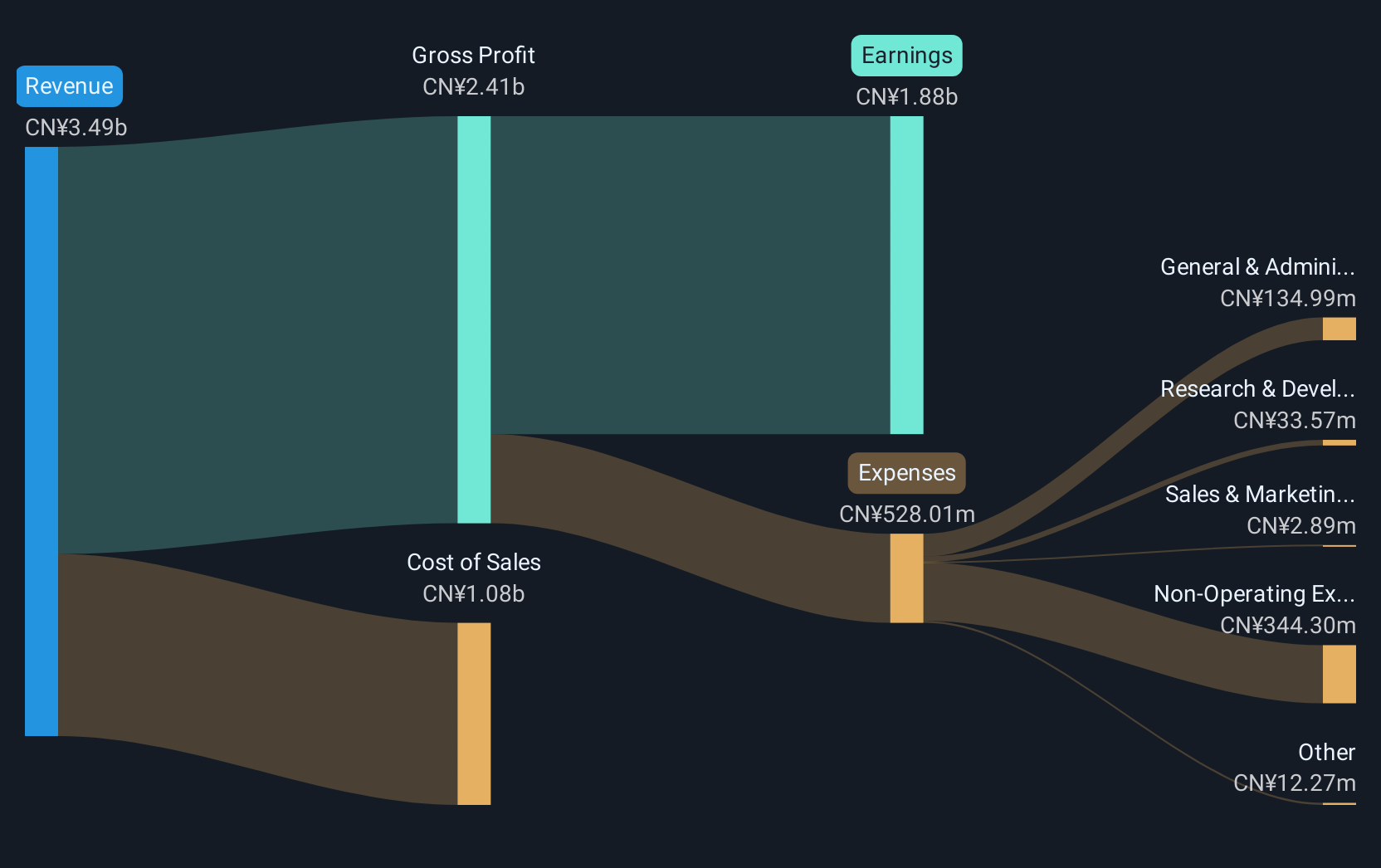

Overview: Beijing Enlight Media Co., Ltd. focuses on the investment, production, and distribution of film and television projects in China, with a market cap of CN¥71.33 billion.

Operations: Beijing Enlight Media Co., Ltd. operates primarily in the Chinese film and television industry, engaging in the investment, production, and distribution of related projects. The company is a significant player with a market capitalization of CN¥71.33 billion.

Beijing Enlight Media has demonstrated a dynamic performance in the entertainment sector, with earnings forecast to surge by 39.4% annually, outpacing the CN market's growth of 25.4%. This robust growth is supported by an impressive annual revenue increase of 19.5%, which exceeds the broader market's expansion rate of 13.4%. The company’s focus on innovation is evident from its strategic R&D investments, aligning closely with these growth projections and ensuring continuous enhancement of its product offerings. Despite recent volatility in share prices, Enlight Media's financial health is underscored by becoming profitable this year and maintaining high-quality earnings, positioning it well for sustained future growth within China’s competitive entertainment landscape.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

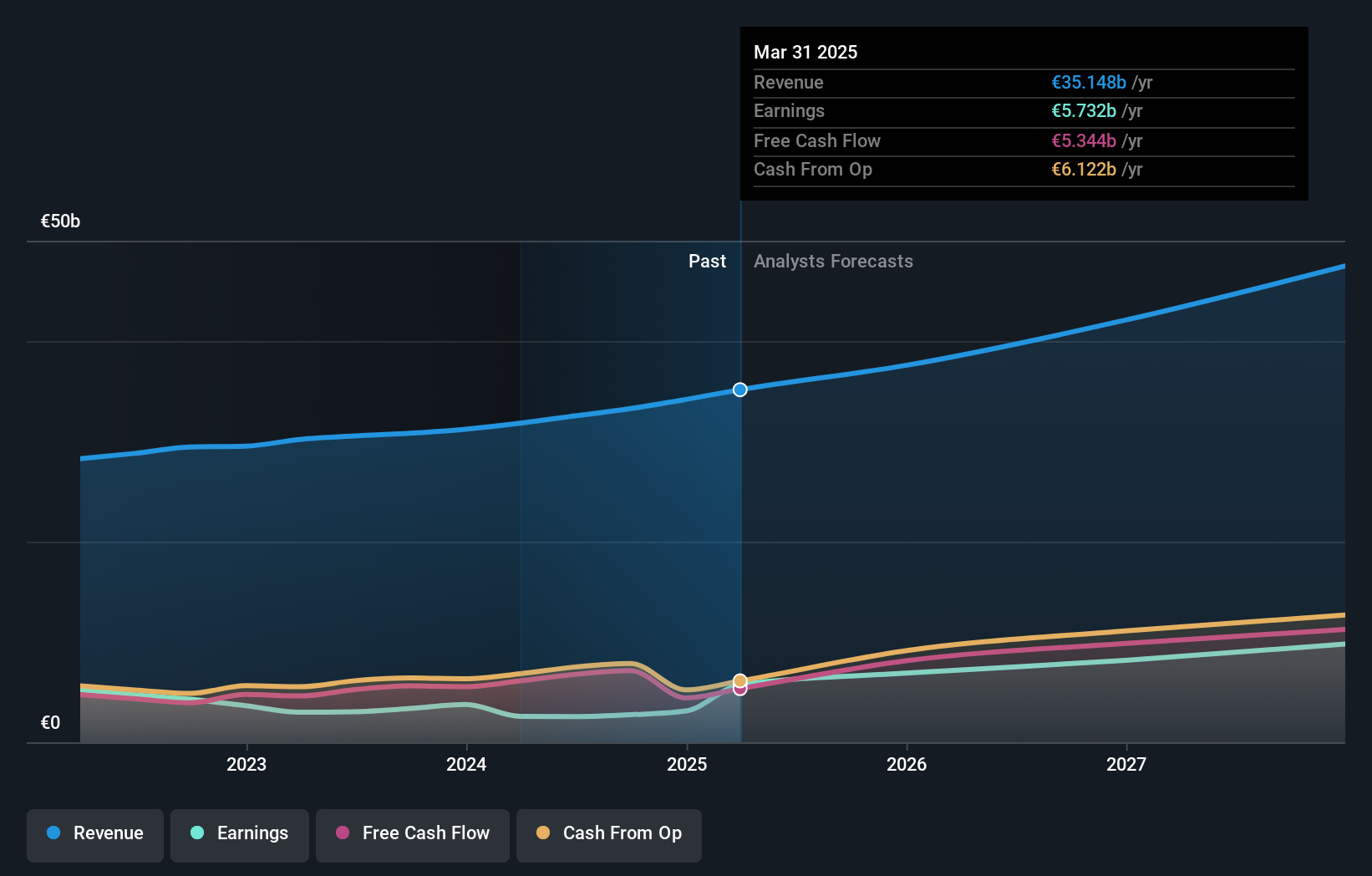

Overview: SAP SE, along with its subsidiaries, delivers a range of applications, technology, and services globally and has a market capitalization of approximately €316.90 billion.

Operations: The company generates revenue primarily from its Applications, Technology & Services segment, which accounts for €34.18 billion. The focus is on providing comprehensive software solutions and services to a global clientele.

SAP, a stalwart in the software industry, is set to outpace the German market with its earnings growth projected at 24.4% annually compared to the market's 18.6%. This growth is supported by a robust R&D commitment, which has been integral to SAP's strategy, fostering innovation and maintaining competitiveness in a rapidly evolving tech landscape. Recent strategic alliances and product integrations, like those with Glider AI and LG CNS under the RSSP initiative, demonstrate SAP's focus on expanding its technological capabilities and market reach. These efforts are complemented by a dividend increase recommendation for fiscal year 2024 and an active share buyback program that underscores confidence in its financial strategy and future prospects.

- Dive into the specifics of SAP here with our thorough health report.

Review our historical performance report to gain insights into SAP's's past performance.

Where To Now?

- Explore the 1187 names from our High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enlight Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300251

Beijing Enlight Media

A film and television media company, engages in the investment, production, and distribution of film and television series in China.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives