As global economic uncertainties weigh on markets, Germany's DAX has seen a notable decline, reflecting broader concerns about growth and inflation across Europe. Despite this backdrop, the search for promising small-cap stocks continues to be a focal point for investors seeking hidden opportunities. In such an environment, identifying stocks with strong fundamentals and potential for growth becomes crucial. This article explores three lesser-known German companies that stand out as undiscovered gems in August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Eisen- und Hüttenwerke | NA | -14.56% | 7.71% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

HOMAG Group (DB:HG1)

Simply Wall St Value Rating: ★★★★★☆

Overview: HOMAG Group AG, with a market cap of €586.73 million, manufactures and sells machines and solutions for the woodworking and timber construction industries worldwide.

Operations: HOMAG Group generates revenue primarily from the sale of machines and solutions for the woodworking and timber construction industries. The company's net profit margin has shown variability over recent periods, reflecting changes in operating efficiency and cost management.

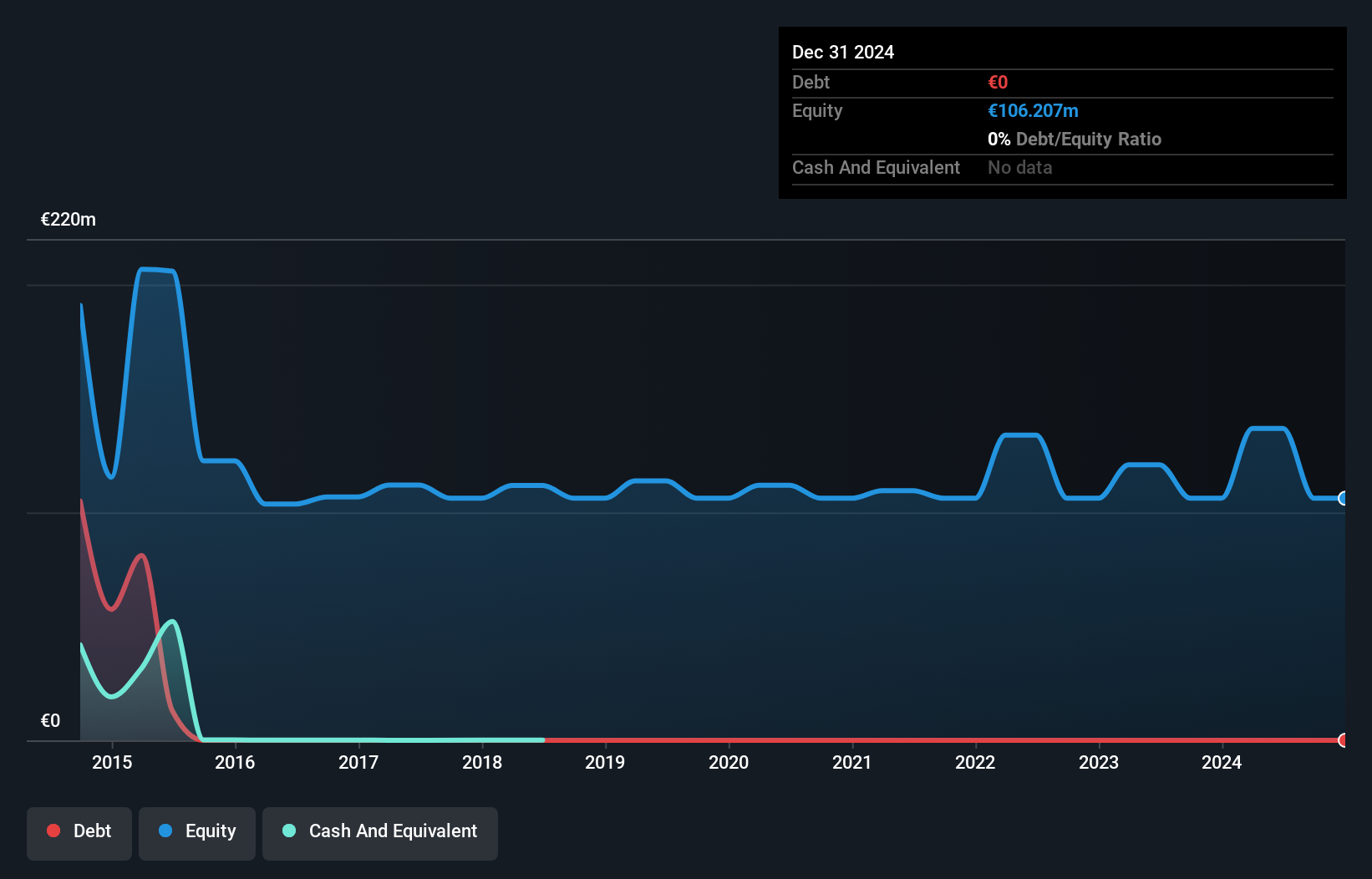

Known for its high-quality earnings, HOMAG Group has faced challenges recently, with a notable -61.9% earnings growth over the past year compared to the Machinery industry average of 5.6%. Despite being debt-free for five years and having no concerns about interest coverage due to zero debt, its net profit margins have decreased from last year. This small company continues to navigate industry pressures while maintaining a solid financial foundation without any leverage issues.

- Dive into the specifics of HOMAG Group here with our thorough health report.

Assess HOMAG Group's past performance with our detailed historical performance reports.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★★

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across various countries, including Germany, Italy, Great Britain, the United States, and China, with a market cap of €458.87 million.

Operations: EnviTec Biogas AG generates revenue from three primary segments: Service (€48.58 million), Plant Engineering (€132.13 million), and Own Operation including Energy (€236.10 million).

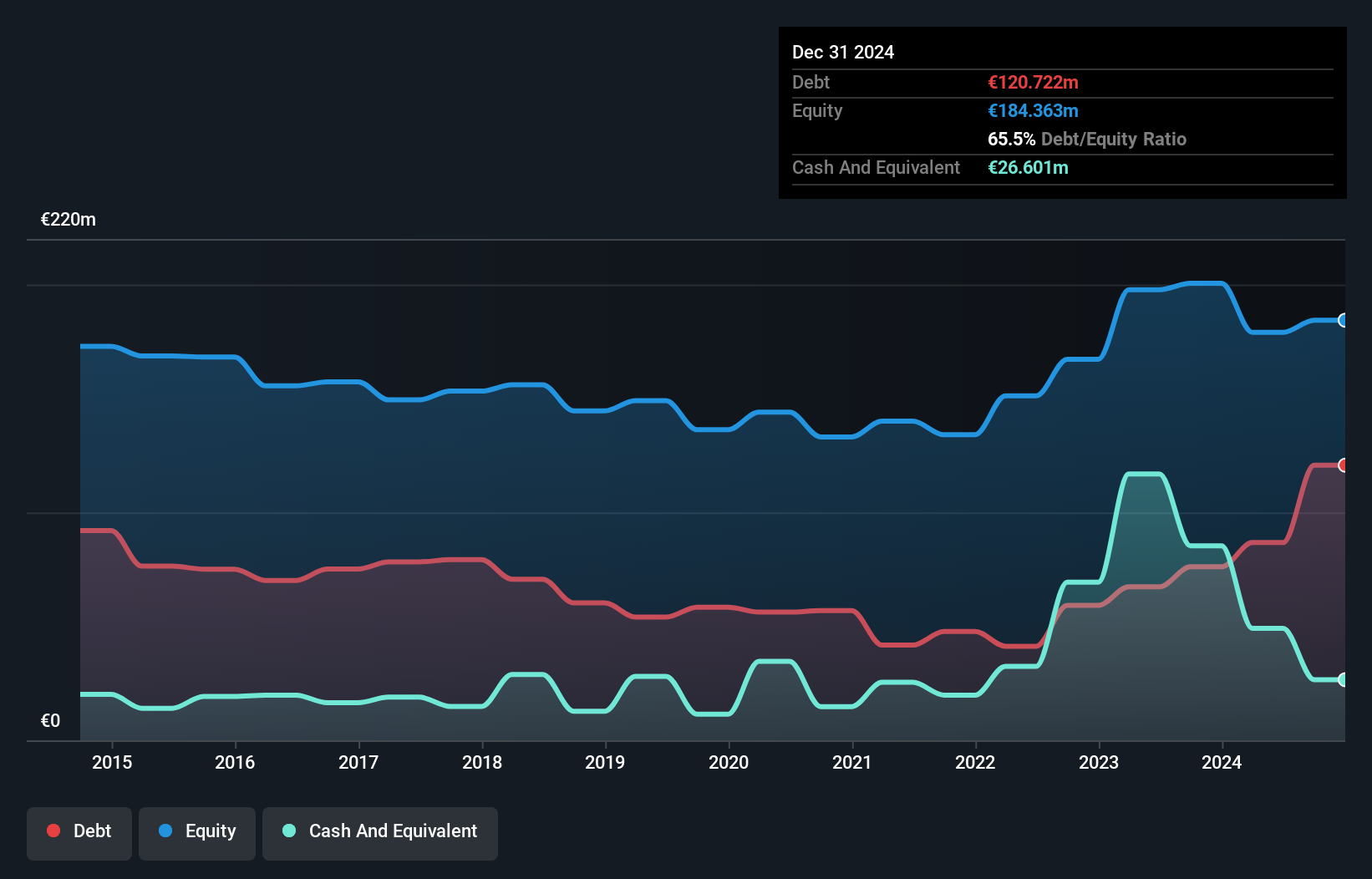

ETG's recent performance highlights its strong financial health and growth potential. Earnings surged by 27.6% in the past year, outpacing the Oil and Gas industry at -24.9%. The company has reduced its debt to equity ratio from 41.7% to 38% over five years, indicating prudent financial management. With a price-to-earnings ratio of 7.8x compared to the German market's 16.5x, ETG appears undervalued, suggesting potential for future appreciation. EnviTec Biogas reported impressive full-year results with sales reaching €441.9 million and net income of €58.46 million, up from €45.81 million previously. The company's earnings are robust enough to cover interest payments by an impressive margin (419x). Additionally, EnviTec is set to distribute a cash dividend of €3 per share on June 26, reflecting confidence in its financial stability and commitment to shareholder returns.

- Get an in-depth perspective on EnviTec Biogas' performance by reading our health report here.

Examine EnviTec Biogas' past performance report to understand how it has performed in the past.

IVU Traffic Technologies (XTRA:IVU)

Simply Wall St Value Rating: ★★★★★★

Overview: IVU Traffic Technologies AG, along with its subsidiaries, develops, installs, maintains, and operates integrated IT solutions for buses and trains worldwide with a market cap of €244.05 million.

Operations: Revenue from public transport, including logistics, amounts to €126.66 million.

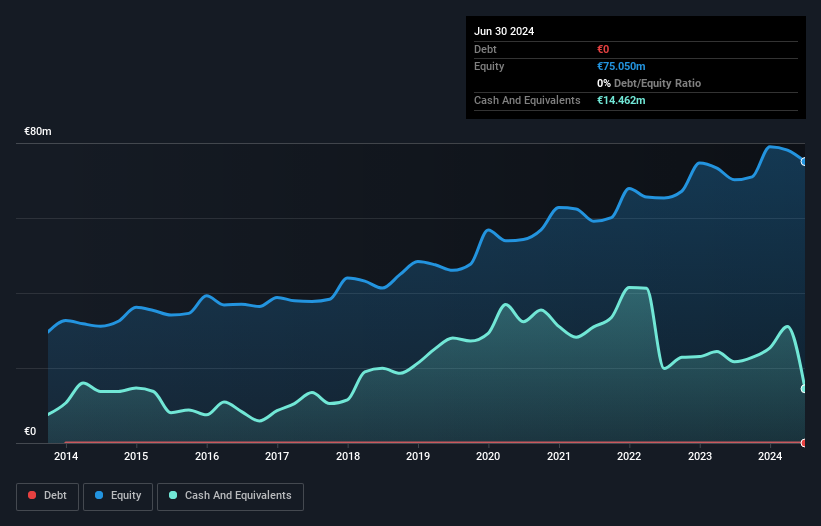

IVU Traffic Technologies, a niche player in the software industry, has shown robust performance with a 13% earnings growth over the past year, outpacing the industry’s -4.4%. The company boasts high-quality earnings and operates debt-free. With a P/E ratio of 21x compared to the industry's 26.6x, IVU appears undervalued. Recently, IVU initiated a share repurchase program for up to €1.77 million and reported Q1 sales of €26.83 million, up from €22.73 million last year.

- Delve into the full analysis health report here for a deeper understanding of IVU Traffic Technologies.

Gain insights into IVU Traffic Technologies' past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 40 German Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOMAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:HG1

HOMAG Group

Manufactures and sells machines and solutions for woodworking and timber construction industries worldwide.

Excellent balance sheet average dividend payer.