Exploring High Growth Tech Stocks In Germany Including adesso

Reviewed by Simply Wall St

The German market has shown resilience, with the DAX index posting modest gains despite broader European caution following the U.S. Federal Reserve's interest rate cut. This environment presents a unique opportunity to explore high-growth tech stocks in Germany, including adesso, which could benefit from favorable economic indicators and investor sentiment. In such a dynamic market, identifying promising tech stocks involves looking for companies with strong fundamentals, innovative products or services, and robust growth potential that align well with current economic trends.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 31.78% | 30.52% | ★★★★★☆ |

| Ströer SE KGaA | 7.39% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

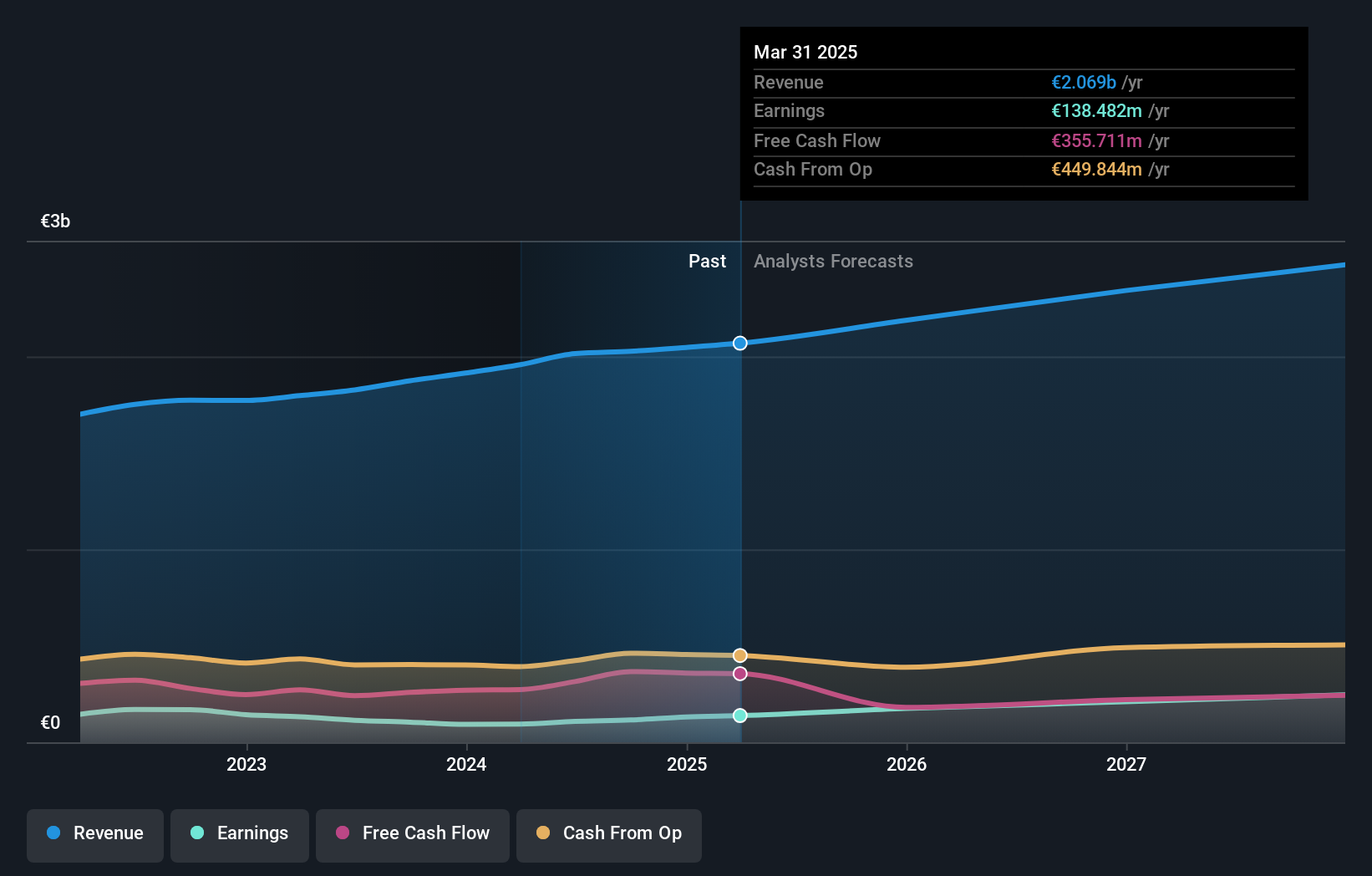

Overview: adesso SE, along with its subsidiaries, offers IT services in Germany, Austria, Switzerland, and internationally with a market cap of €400.99 million.

Operations: The company generates revenue primarily from IT services (€1.39 billion) and IT solutions (€128.12 million).

Despite recent financial setbacks, adesso SE shows promise with a reported revenue increase to EUR 633.47 million, up from EUR 548.19 million last year. However, the company faced a deepened net loss of EUR 9.86 million. On the innovation front, adesso is aligning with market demands; its R&D expenses are pivotal in driving future growth amidst tough competition in tech sectors where continuous innovation is crucial. Looking ahead, adesso’s revenue is expected to grow annually by 11.7%, and earnings could surge by 46.45%, positioning it for a potential turnaround within three years as it aims to transition into profitability and harness higher than average market growth rates.

- Click here and access our complete health analysis report to understand the dynamics of adesso.

Understand adesso's track record by examining our Past report.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, offers a range of applications, technology solutions, and services globally and has a market cap of approximately €241.01 billion.

Operations: SAP SE generates revenue primarily from its Applications, Technology & Services segment, which accounted for €32.54 billion. The company operates globally through various subsidiaries and focuses on providing comprehensive technology solutions.

Amidst a challenging landscape, SAP's commitment to innovation is evident in its R&D spending, which is crucial for maintaining its competitive edge. The company has strategically increased its R&D expenses to foster product development and technological advancements. This investment aligns with SAP's robust earnings forecast, which anticipates a significant 37.9% annual growth rate. Additionally, recent engagements like the GROW With SAP initiative underscore their focus on scalable cloud solutions, enhancing client capabilities across various industries. This approach not only solidifies SAP’s position in high-growth tech sectors but also promises substantial future growth by leveraging cutting-edge technology and comprehensive service offerings to meet evolving market needs.

- Get an in-depth perspective on SAP's performance by reading our health report here.

Assess SAP's past performance with our detailed historical performance reports.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA offers out-of-home media and online advertising solutions in Germany and internationally, with a market cap of €3.15 billion.

Operations: Ströer SE & Co. KGaA generates revenue primarily from Out-Of-Home Media (€922.53 million), Digital & Dialog Media (€862.76 million), and Daas & E-Commerce (€357.19 million). The company operates extensively in both Germany and international markets, focusing on media and advertising solutions.

Ströer SE & Co. KGaA is making notable strides in the high-growth tech sector in Germany, underscored by its recent robust financial performance and active participation in key industry conferences. The company's commitment to innovation is reflected through a significant 29.9% forecasted annual earnings growth, outpacing the German market average of 20.1%. Moreover, Ströer's revenue growth rate stands at 7.4%, which is higher than the national average of 5.5%, indicating a strong market position and potential for future expansion. This financial health is further exemplified by a substantial increase in net income from €19.38 million to €32.9 million year-over-year for Q2, showcasing effective operational execution and strategic market positioning that could drive sustained long-term growth within Germany’s vibrant tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Ströer SE KGaA.

Explore historical data to track Ströer SE KGaA's performance over time in our Past section.

Turning Ideas Into Actions

- Click this link to deep-dive into the 42 companies within our German High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.