- Germany

- /

- Medical Equipment

- /

- XTRA:EUZ

Undiscovered Gems Südwestdeutsche Salzwerke Plus 2 Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

As global markets react to anticipated interest rate cuts and the European economy shows signs of resilience, Germany's DAX index has seen a notable uptick. Amid this backdrop, investors are increasingly turning their attention to small-cap stocks with solid fundamentals that could offer promising opportunities. In this article, we will explore three such undiscovered gems in Germany, including Südwestdeutsche Salzwerke AG and two other small-cap companies that stand out due to their strong financial health and potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €619.94 million, mines, produces, and sells salt in Germany, the European Union, and internationally through its subsidiaries.

Operations: Salt sales contribute €283.67 million to revenue, while waste management adds €62.46 million. Net profit margin stands at 8%.

Südwestdeutsche Salzwerke, a small-cap player in Germany, has shown impressive growth with earnings surging 4290.9% over the past year, far outpacing the Food industry’s 21.1%. The company reported half-year sales of €163.06 million and net income of €15.4 million as of June 2024, compared to €154.03 million and €7.96 million respectively from the previous year. Basic earnings per share rose to €1.47 from €0.76 last year, indicating robust profitability and high-quality earnings despite recent share price volatility.

- Navigate through the intricacies of Südwestdeutsche Salzwerke with our comprehensive health report here.

Learn about Südwestdeutsche Salzwerke's historical performance.

All for One Group (XTRA:A1OS)

Simply Wall St Value Rating: ★★★★★☆

Overview: All for One Group SE, with a market cap of €235.02 million, provides business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Operations: The company generates revenue primarily from its CORE segment (€442.47 million) and LOB segment (€77.01 million). The net profit margin is not provided in the available data.

All for One Group has shown impressive growth, with earnings surging 59.6% over the past year, significantly outpacing the IT industry average of 4.5%. The company's net debt to equity ratio stands at a satisfactory 29.5%, and its EBIT covers interest payments 12.6 times over, indicating strong financial health. Recent buybacks saw the company repurchasing shares worth €3.7 million since October 2022, enhancing shareholder value while trading at nearly 73% below estimated fair value.

- Click here and access our complete health analysis report to understand the dynamics of All for One Group.

Assess All for One Group's past performance with our detailed historical performance reports.

Eckert & Ziegler (XTRA:EUZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide, with a market cap of €933.88 million.

Operations: Eckert & Ziegler SE generates revenue primarily from its Medical segment (€132.80 million) and Isotope Products segment (€150.97 million). The company experienced a negative adjustment of €10.32 million from eliminations.

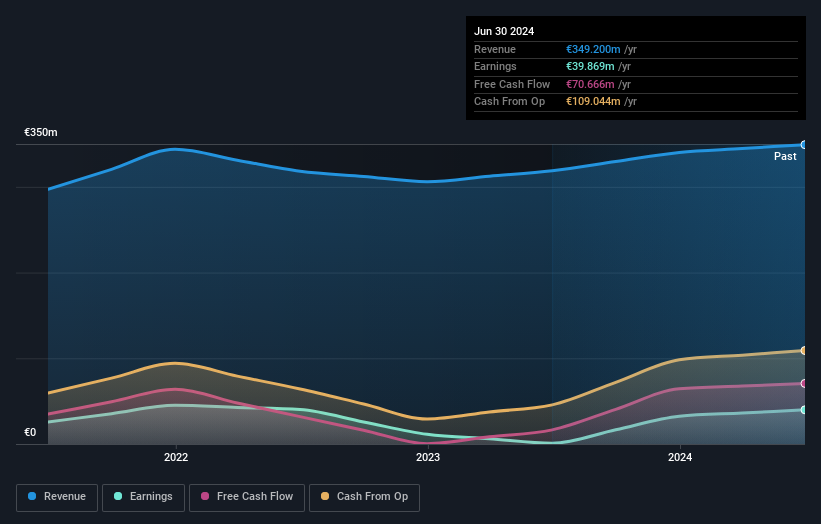

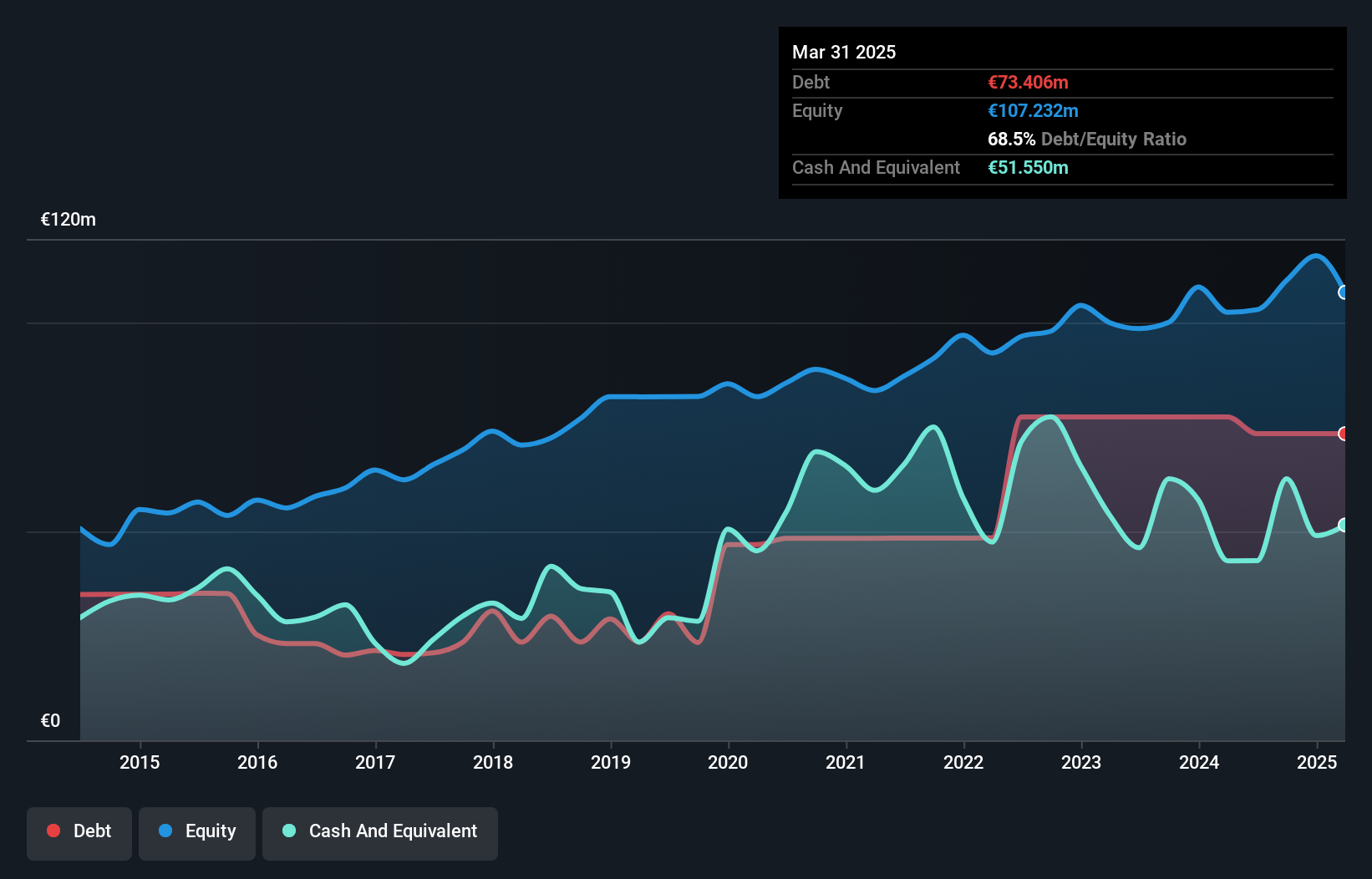

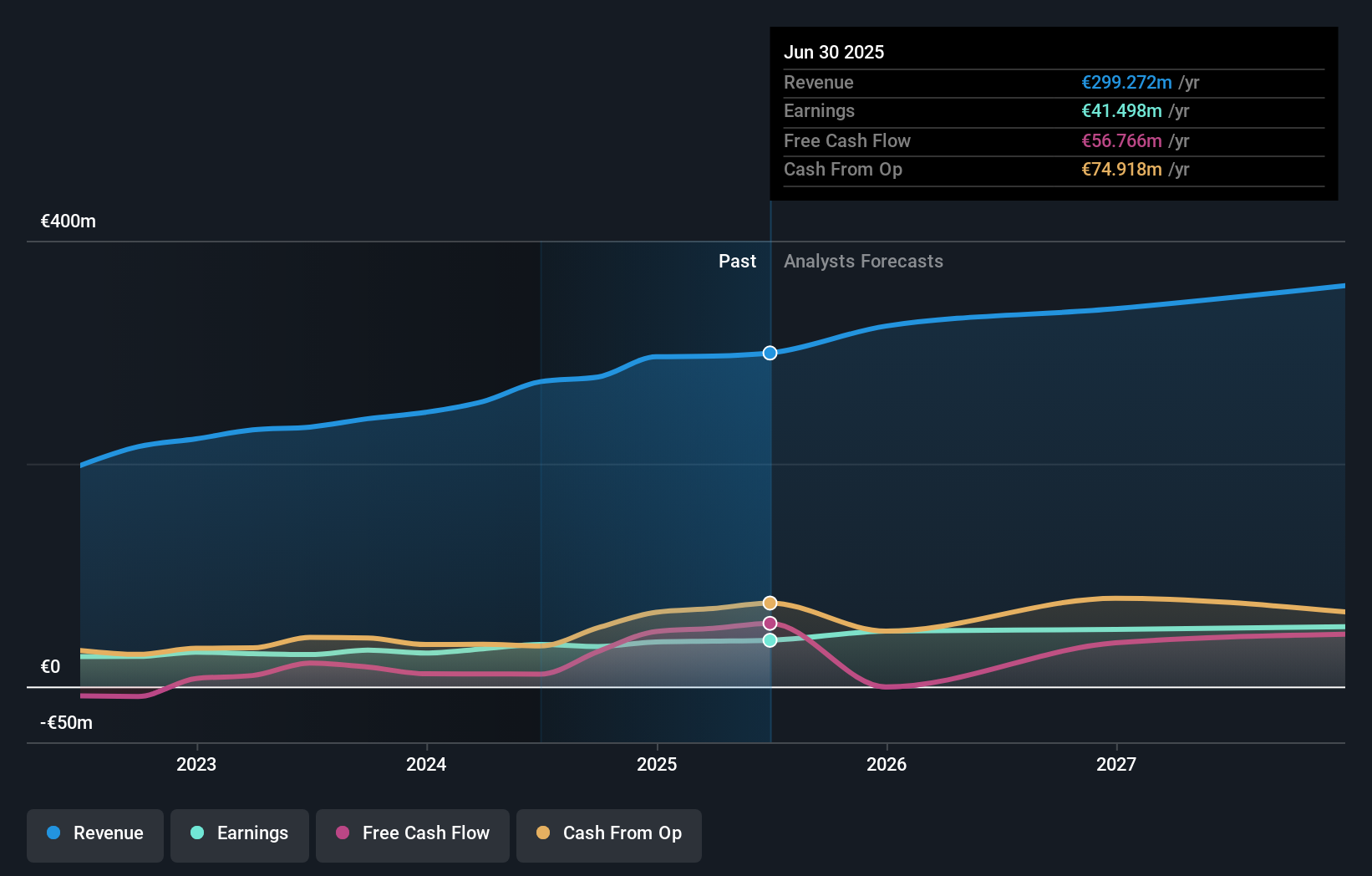

Earnings for Eckert & Ziegler surged by 31.6% last year, outpacing the Medical Equipment industry’s 16.2% growth. The firm reported Q2 sales of €77.76M, up from €60.03M a year ago, with net income rising to €9.54M from €6.17M previously. Its debt-to-equity ratio improved to 9.5% over five years from 14.7%. With a price-to-earnings ratio of 24.8x below the industry average and high-quality earnings, EUZ shows promising potential despite its small size in the market.

Taking Advantage

- Investigate our full lineup of 45 German Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eckert & Ziegler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EUZ

Eckert & Ziegler

Manufactures and sells isotope technology components worldwide.

Flawless balance sheet with solid track record.