- Germany

- /

- Specialty Stores

- /

- XTRA:ZAL

Zalando (XTRA:ZAL): Valuation Insights After Q3 Results Show Strong Sales but Lower Profits

Reviewed by Simply Wall St

Zalando (XTRA:ZAL) just released its third quarter results, drawing attention as sales climbed compared to last year, while net income moved lower. Investors are now watching closely to interpret what these shifts mean.

See our latest analysis for Zalando.

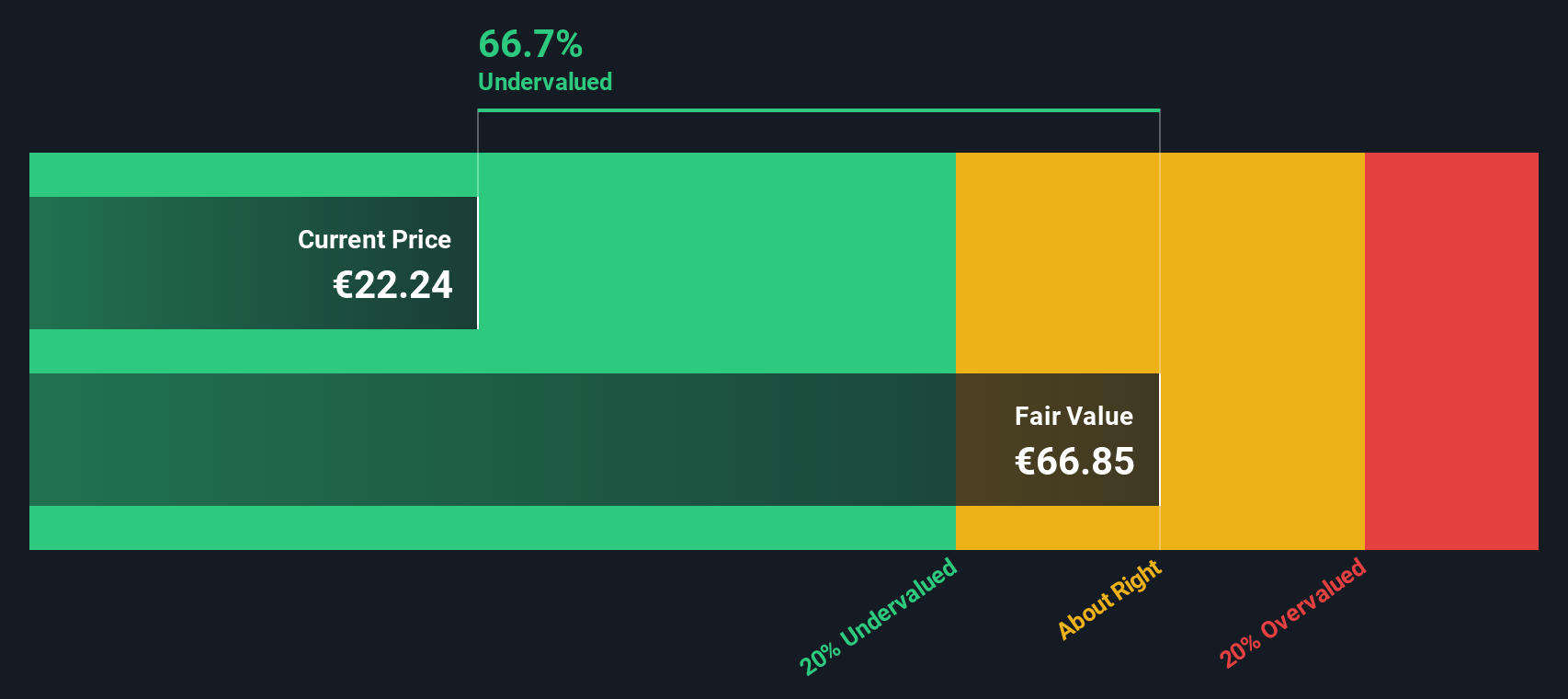

It has been a challenging stretch for Zalando’s shares, with the latest price at €22.24 after a sharp 7.87% drop in a single day. This caps off a 30.97% share price decline since the start of the year. Even with healthy top-line growth and a new CFO incoming in January, the 1-year total shareholder return stands at -18.24%. This suggests that investors remain cautious about profit trends and long-term prospects despite recent strategic moves.

If Zalando’s market swings have you thinking about where the next big movers might be, why not take the opportunity to discover fast growing stocks with high insider ownership

With Zalando’s shares trading well below recent analyst targets, investors are left to wonder whether the current valuation represents a bargain entry point or if the market has already factored in all the potential upside ahead.

Most Popular Narrative: 39.6% Undervalued

Zalando’s fair value, based on the most widely followed narrative, is set at €36.85, a significant premium over the latest close of €22.24. This reflects notable optimism in forward earnings and margin expansion. This narrative outlines a catalyst-rich outlook that depends on the company’s ability to unlock growth levers across technology and European markets.

The rollout of Zalando's new AI-powered discovery feed and continued investment in personalized, curated shopping experiences are expected to increase user engagement, shopping frequency, and ultimately drive higher average order value and revenue per customer, leveraging broader consumer migration to mobile/online and personalization.

Want to see what’s fueling this lofty target? There is a set of bold, headline-grabbing growth forecasts and profit margin ambitions under the surface. The narrative’s vision unfolds with aggressive earnings expansion and a profitability profile that rivals the best-in-class retailers. Ready to uncover the strategy and projections that underpin this valuation? The full narrative reveals the financial blueprint.

Result: Fair Value of €36.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressures or a prolonged slump in European consumer demand could quickly undermine even the most optimistic growth projections for Zalando.

Find out about the key risks to this Zalando narrative.

Another View: The DCF Model Perspective

Taking a different approach, the SWS DCF model calculates Zalando's fair value at €67.35. This figure is significantly higher than both the latest share price and analyst estimates. This suggests that, from a discounted cash flow perspective, the company could be deeply undervalued. But does this long-term forecast hold up given today’s profitability pressures?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zalando Narrative

If you think the numbers tell a different story or want to test your own perspectives, you can build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zalando.

Looking for More Investment Ideas?

Why settle for just one opportunity? Give yourself an edge by checking out investment ideas that are making waves right now, handpicked for their strong upside. If you want your portfolio to work harder, these screens can reveal promising stocks you might otherwise miss.

- Tap into rapid innovation by scanning these 24 AI penny stocks and find AI-driven companies shaking up their industries right now.

- Boost your returns with regular income by seeing which companies offer strong yields among these 16 dividend stocks with yields > 3%.

- Accelerate your portfolio's growth and spot hidden gems with these 870 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zalando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ZAL

Zalando

Operates an online platform for fashion and lifestyle products in Germany and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives