- Germany

- /

- Life Sciences

- /

- XTRA:SRT3

A Fresh Look at Sartorius (XTRA:SRT3) Valuation as Market Sentiment Shifts

Reviewed by Simply Wall St

Most Popular Narrative: 24.9% Undervalued

The current valuation narrative sees Sartorius as significantly undervalued, projecting notable upside if key growth assumptions play out as expected.

“Solid order book trends and a consistently improving rolling 12-month book-to-bill ratio, particularly in consumables, signal a sustained forward growth trajectory. Once customer equipment investment hesitancy subsides, pent-up demand could unlock additional top-line growth.”

What is driving this bold price target? Explore the vital financial forecasts hiding just below the surface, such as accelerating sales and profits, plus ambitious margin expansion over the next few years. The full narrative breaks down the quantitative catalysts that could send Sartorius shares beyond current levels.

Result: Fair Value of €260.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, continued weakness in Sartorius' equipment sales and ongoing regulatory pressures could undermine the case for a sustained turnaround.

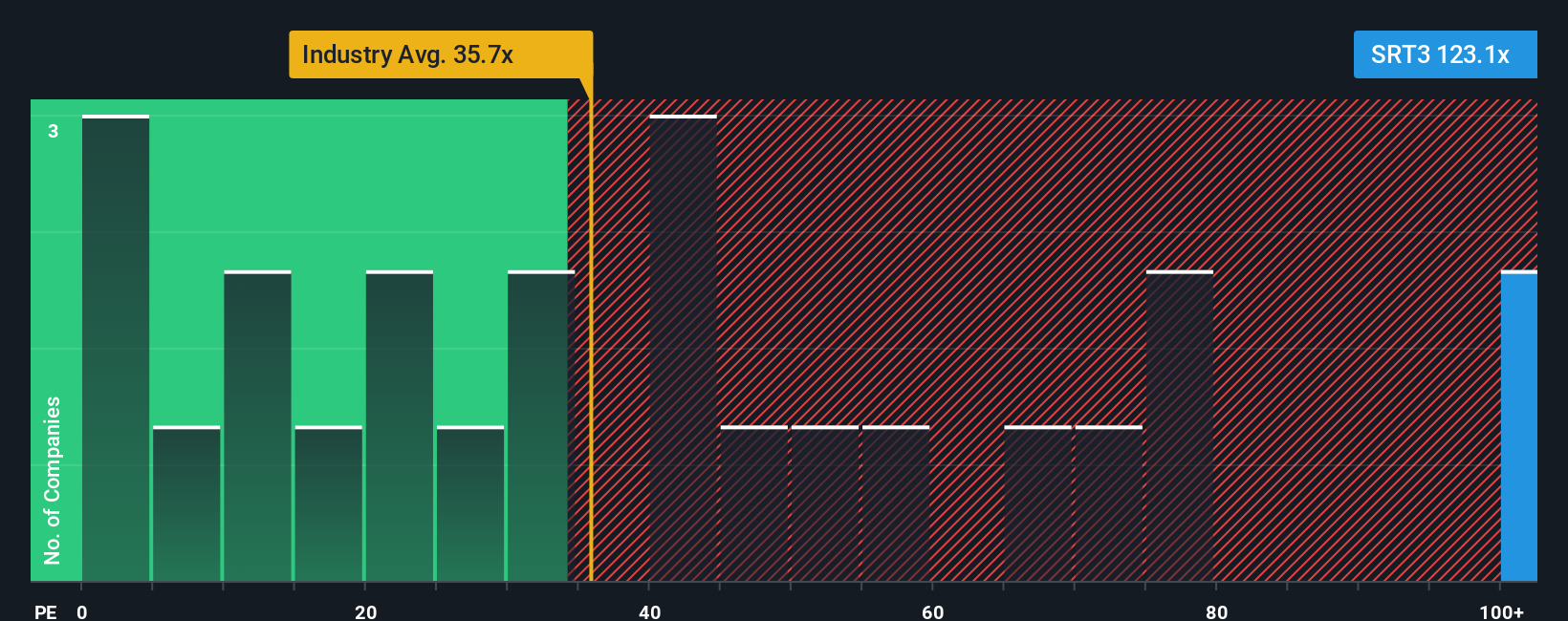

Find out about the key risks to this Sartorius narrative.Another View: Looking at Traditional Ratios

While the growth-based outlook points to opportunity, a traditional valuation measure paints a less optimistic picture. By this standard, Sartorius looks far more expensive than many of its industry peers. This puts the optimism to the test. Is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sartorius Narrative

If you think there is more behind Sartorius’ story or want to test your own views, you can craft your own analysis in just a few minutes. Do it your way

A great starting point for your Sartorius research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to a single opportunity. Move ahead of the crowd and uncover new stocks that match your individual strategy with Simply Wall Street’s unique tools.

- Target future potential with stocks that could be undervalued right now and tap into undervalued stocks based on cash flows for fresh finds the market might be overlooking.

- Fuel your growth hunt by pinpointing emerging companies harnessing artificial intelligence, as highlighted in AI penny stocks and making waves in tomorrow’s economy.

- Strengthen your income game by unlocking a universe of reliable payouts with dividend stocks with yields > 3% and take your passive income to the next level.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About XTRA:SRT3

Sartorius

Provides bioprocess solutions, and lab products and services worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives