High Growth Tech Stocks To Watch In Germany This September 2024

Reviewed by Simply Wall St

Germany's DAX Index has surged recently, buoyed by hopes for interest rate cuts and positive sentiment from China's economic stimulus measures. As business activity in the Eurozone shows signs of slowing, investors are keenly watching high-growth tech stocks that could offer robust returns amid these dynamic market conditions. When evaluating potential high-growth tech stocks in Germany, it's essential to consider companies with strong innovation pipelines and the ability to adapt to evolving market trends.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 31.78% | 30.52% | ★★★★★☆ |

| Ströer SE KGaA | 7.36% | 29.88% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| cyan | 28.13% | 71.26% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

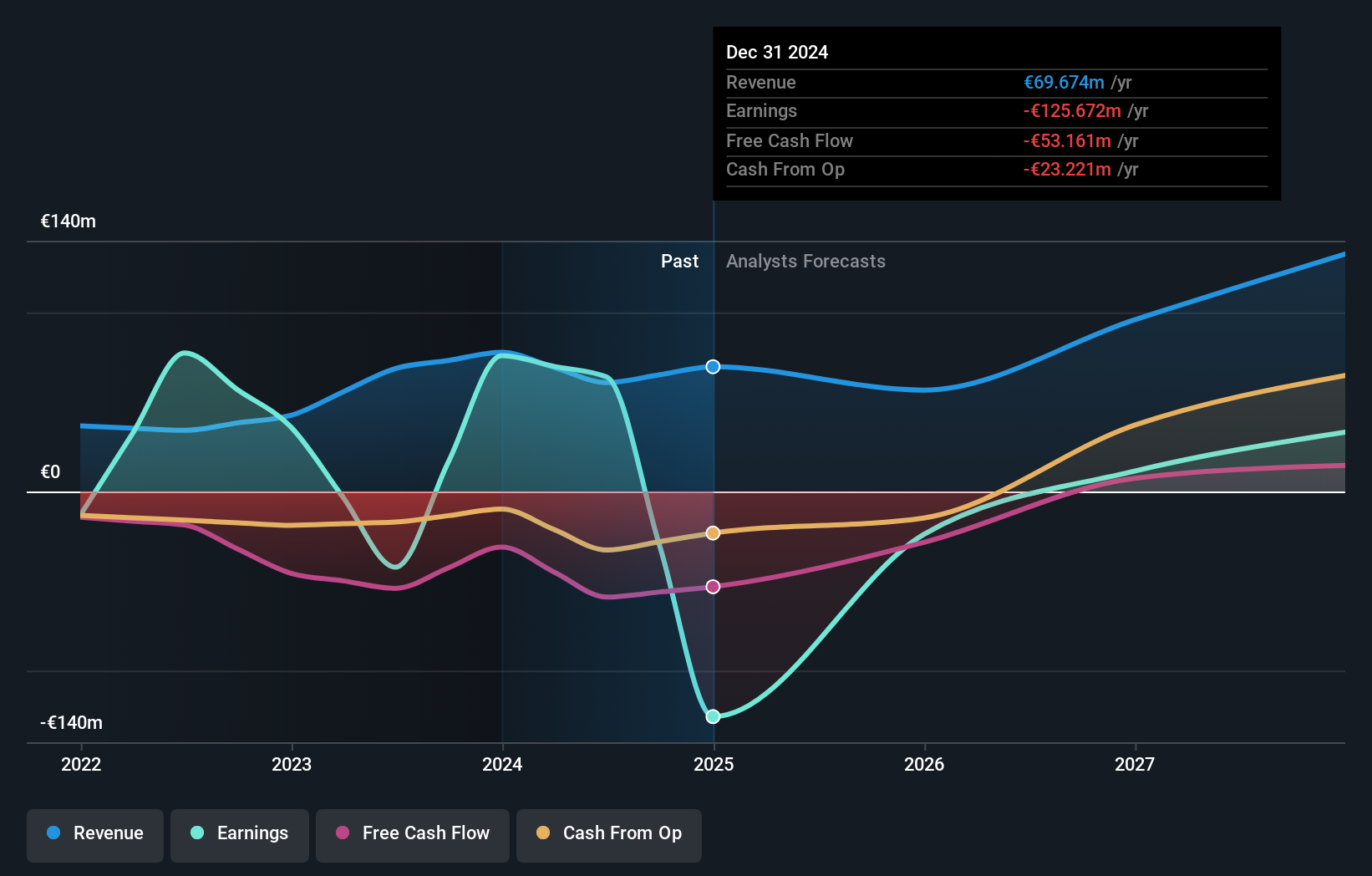

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market cap of €937.58 million.

Operations: Formycon AG generates revenue primarily through its Drug Delivery Systems segment, which accounts for €60.80 million. The company focuses on developing biosimilar drugs in Germany and Switzerland.

Formycon AG, amidst a challenging year with a net loss of EUR 10.09 million in the first half of 2024, continues to invest significantly in R&D, reflecting its commitment to innovation despite financial hurdles. This investment is crucial as the company's revenue growth forecast stands at an impressive 31.8% annually, outpacing the German market average of 5.4%. Moreover, earnings are expected to surge by 30.5% per year, showcasing potential recovery and growth prospects. The firm recently highlighted its strategic directions and pipeline developments at major industry conferences in Munich and Amsterdam, signaling ongoing efforts to align with market dynamics and expand its biotechnological footprint.

- Click here to discover the nuances of Formycon with our detailed analytical health report.

Understand Formycon's track record by examining our Past report.

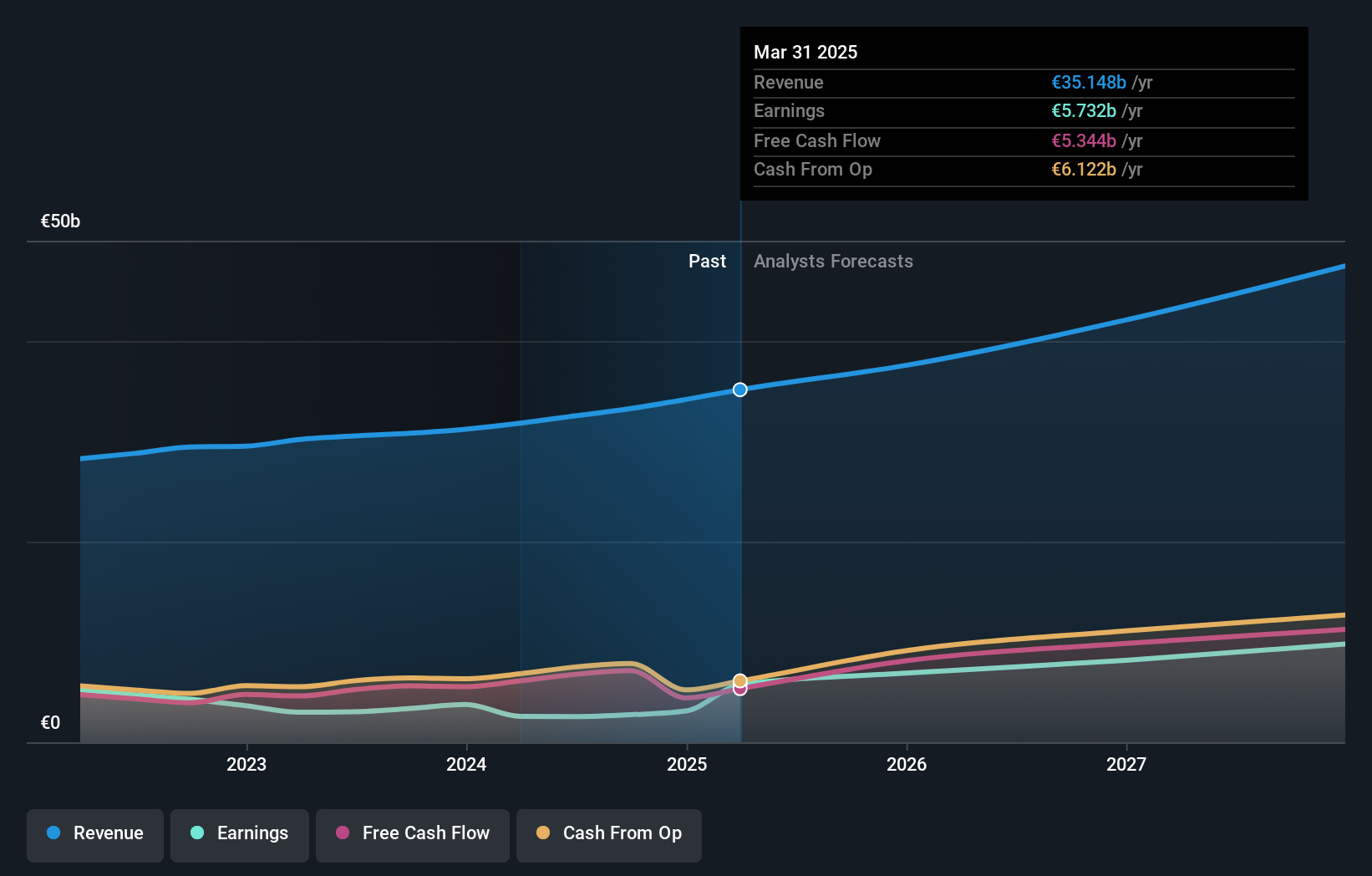

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, delivers applications, technology, and services on a global scale and has a market cap of €239.30 billion.

Operations: SAP SE generates revenue primarily from its Applications, Technology & Services segment, which brought in €32.54 billion. The company operates globally through its subsidiaries and focuses on delivering a wide range of enterprise software solutions.

SAP, a stalwart in the tech arena, recently fortified its position through a strategic partnership with BGSF Inc., enhancing its service offerings around SAP S/4HANA and SAP Cloud. This move underscores SAP's commitment to digital transformation, leveraging innovative platforms to streamline client operations—a critical factor as businesses increasingly pivot towards efficient, cloud-based solutions. In fiscal 2024, despite a challenging market environment reflected by a one-off loss of €3.3 billion impacting financials, SAP's R&D expenditure remained robust at 9.6% of revenue; this investment fuels ongoing product enhancements and technological leadership. Looking ahead, earnings are projected to surge by an impressive 37.9% annually, indicating strong future prospects driven by sustained innovation and market adaptation strategies.

- Navigate through the intricacies of SAP with our comprehensive health report here.

Evaluate SAP's historical performance by accessing our past performance report.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA provides out-of-home media and online advertising solutions in Germany and internationally, with a market cap of €3.25 billion.

Operations: Ströer SE & Co. KGaA generates revenue primarily through its Out-Of-Home Media (€922.53 million), Digital & Dialog Media (€862.76 million), and Daas & E-Commerce (€357.19 million) segments. The company focuses on providing advertising solutions across various platforms in Germany and internationally, leveraging a diverse portfolio to drive its income streams.

Ströer SE & Co. KGaA, amid a flurry of recent corporate presentations, has demonstrated robust financial health with a significant uptick in sales to €964.96 million and net income rising to €33.75 million in the first half of 2024, compared to the previous year. This performance is underscored by a promising forecast of revenue growth at 7.4% annually, outpacing the German market's 5.4%. Further bolstering its competitive edge, Ströer's R&D investments remain pivotal, aligning with its strategic focus on innovation within the digital advertising sector—a move that not only enhances its service offerings but also positions it well against industry norms where R&D as a percentage of revenue stands at 29.9%. These factors collectively signal Ströer’s potential for sustained growth and market adaptation in an evolving tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Ströer SE KGaA.

Assess Ströer SE KGaA's past performance with our detailed historical performance reports.

Seize The Opportunity

- Discover the full array of 43 German High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.